Abercrombie & Fitch 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

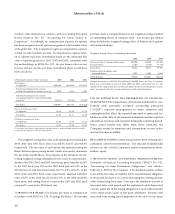

are minimal, the adoption of SFAS No. 143 had no impact on the

Company’s results of operations or its financial position.

SFAS No. 146, “Accounting for Costs Associated with Exit or

Disposal Activities,” was issued in June 2002. SFAS No. 146

addresses significant issues regarding the recognition, measurement,

and reporting of costs that are associated with the exit and disposal

activities, including restructuring activities, that are currently

accounted for pursuant to the guidance that the Emerging Issues

Task Force (“EITF”) has set forth in EITF Issue No. 94-3,

“Liability Recognition for Certain Employee Termination Benefits

and Other Costs to Exit an Activity (including Certain Costs

Incurred in a Restructuring.)” SFAS No. 146 also addresses

accounting and reporting standards for costs related to terminating

a contract that is not a capital lease and termination benefits that

employees who are involuntarily terminated receive under the

terms of a one-time benefit arrangement or an individual deferred

compensation contract. SFAS No. 146 was effective for exit or dis-

posal activities that were initiated after December 31, 2002. The

Company adopted SFAS No. 146 in first quarter of the 2003 fiscal

year and adoption did not have an impact on the Company’s

results of operations or its financial position.

SFAS No. 148, “Accounting for Stock-Based Compensation–

Transition and Disclosure–an Amendment of FASB No. 123,” was

issued on December 31, 2002. Pursuant to this standard, companies

that chose to adopt the accounting provisions of FASB Statement

No. 123, “Accounting for Stock-Based Compensation,” were per-

mitted to select from three transition methods (prospective, modified

prospective and retroactive restatement). Companies that chose

not to adopt the accounting provisions of SFAS No. 123 were

affected by the new disclosure requirements of SFAS No. 148. The

new interim disclosure provisions were effective for the first quarter

of 2003 and have been adopted by the Company (see Note 2).

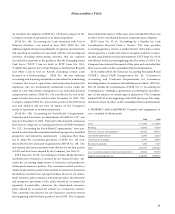

EITF Issue No. 03-08, “Accounting for Claims-Made Insurance

and Retroactive Insurance Contracts by the Insured Entity,” dis-

cusses the accounting implications of retroactive and prospective

claims-made insurance policies. The consensus reached was that a

claims-made insurance policy that contains no retroactive provisions

should be accounted for on a prospective basis. However, if a claims-

made insurance policy contains a retroactive provision, the retroactive

and prospective provisions of the policy should be accounted for

separately, if practicable; otherwise, the claims-made insurance

policy should be accounted for entirely as a retroactive contract.

This consensus was effective for new insurance contracts entered

into beginning with the third quarter of fiscal 2003. The Company

has evaluated the impact of this issue and concluded that there was

no effect to the consolidated financial statements upon adoption.

EITF Issue No. 02-16, “Accounting by a Reseller for Cash

Consideration Received From a Vendor.” The issue provides

accounting guidance on how a reseller should characterize consid-

eration given by a vendor and when to recognize and how to meas-

ure that consideration in its income statement. EITF Issue No. 02-16

was effective for fiscal years beginning after December 15, 2002. The

Company has evaluated the impact of this issue and concluded that

there was no effect on the consolidated financial statements.

In November 2002, the Financial Accounting Standards Board

(“FASB”), issued FASB Interpretation No. 45, “Guarantor’s

Accounting and Disclosure Requirements for Guarantees,

Including Indirect Guarantees of Indebtedness of Others” (FIN 45).

FIN 45 clarifies the requirements of SFAS No. 5, “Accounting for

Contingencies,” relating to a guarantor’s accounting for, and disclo-

sure of, the issuance of certain types of guarantees. The Company

adopted FIN 45 at the beginning of the 2003 fiscal year. The adop-

tion did not have an effect on the consolidated financial statements.

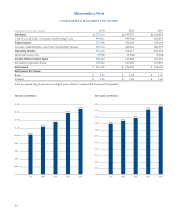

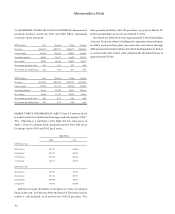

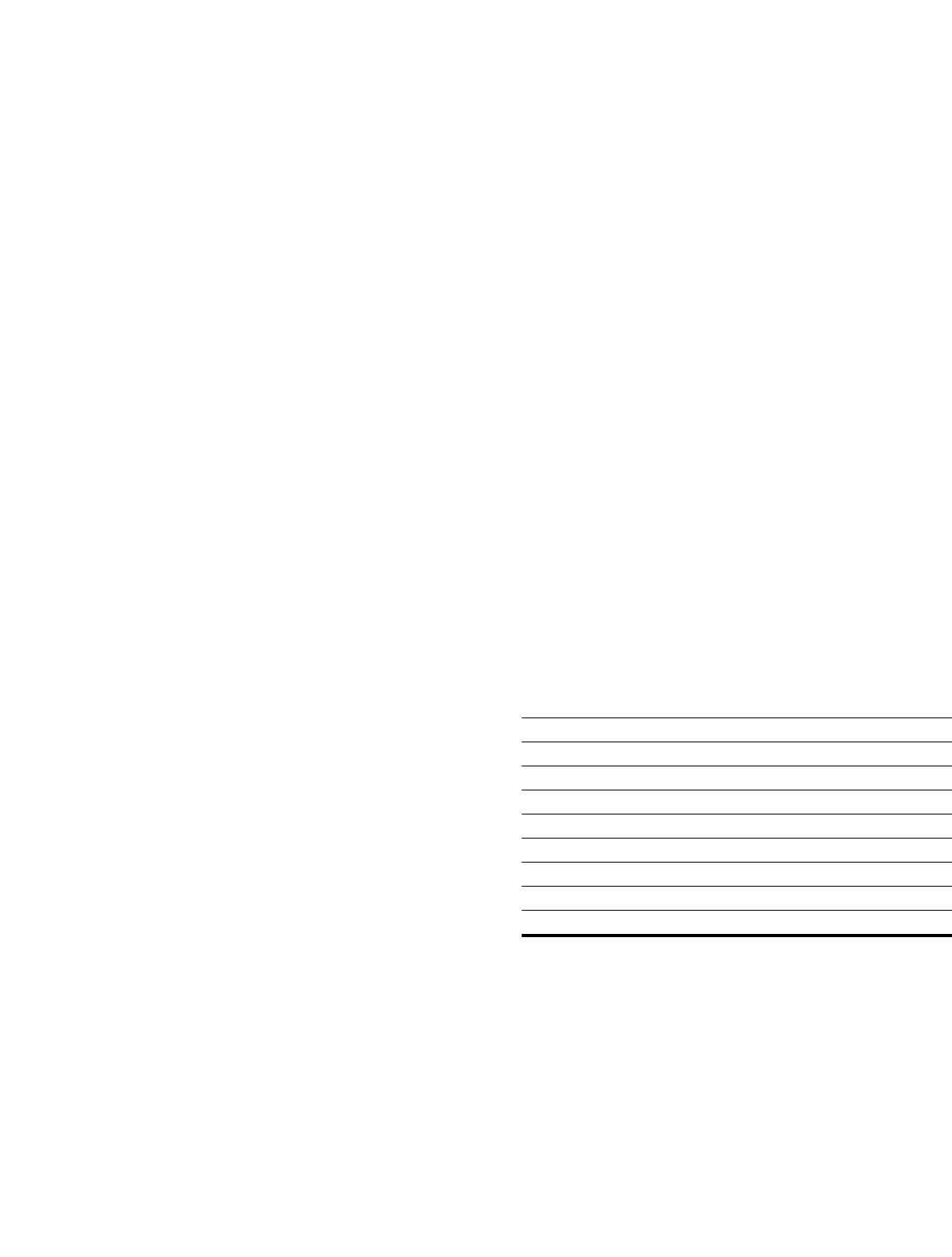

4. PROPERTY AND EQUIPMENT Property and equipment, at

cost, consisted of (thousands):

2003 2002

Land $ 15,985 $ 15,949

Building 110,726 92,680

Furniture, fixtures and equipment 469,135 394,276

Leasehold improvements 46,586 52,293

Construction in progress 27,901 23,095

Beneficial leaseholds 5,839 7,349

Total $676,172 $585,642

Less: Accumulated depreciation and amortization 230,216 192,701

Property and equipment, net $445,956 $392,941

Abercrombie &Fitch

29