Abercrombie & Fitch 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

Financing activities during the 2003, 2002 and 2001 fiscal years

consisted primarily of the repurchase of 4,401,000 shares, 1,850,000

shares, and 600,000 shares, respectively, of A&F’s Class A

Common Stock pursuant to previously authorized stock repurchase

programs.

The 2003 repurchase leaves 599,000 shares remaining as of

January 31, 2004 of the 5,000,000 share repurchase authorized by

the Board of Directors during its August 2002 Board meeting. In

addition to stock repurchases, financing activities also consisted

of stock option exercises, restricted stock issuances and overdrafts.

These overdrafts are outstanding checks reclassified from cash to

accounts payable.

Effective November 14, 2002, the Company entered into a

new $250 million syndicated unsecured credit agreement (the

“Credit Agreement”), which replaced both the then existing $150

million syndicated unsecured credit agreement and a $75 million

trade letter of credit facility. Additional details regarding the

Credit Agreement can be found in the Notes to Consolidated

Financial Statements (see Note 8).

Letters of credit totaling approximately $42.8 million and

$41.8 million were outstanding under the Credit Agreement at

January 31, 2004 and February 1, 2003, respectively. No borrow-

ings were outstanding under the Credit Agreement at January 31,

2004 or February 1, 2003.

The Company has standby letters of credit in the amount of

$4.7 million that expire during the 2004 fiscal year but automati-

cally renew for a period of one year. The beneficiary, a merchan-

dise supplier, has the right to draw upon the standby letters of

credit if the Company has authorized or filed a voluntary petition

in bankruptcy. To date, the beneficiary has not drawn upon the

standby letters of credit.

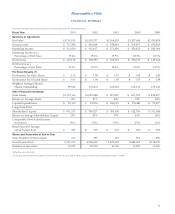

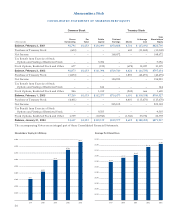

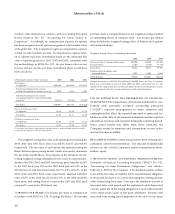

OF F-BALANCE SHEET ARRANGEMENTS AND CONTRACTUAL

OBLIGATIONS The Company does not have any off-balance sheet

arrangements or debt obligations. As of January 31, 2004, the

Company’s contractual obligations were as follows:

Contractual Less than More than

Obligations Total 1 year 1-3 years 3-5 years 5 years

Operating

Leases $1,002,720 $141,338 $278,417 $232,628 $350,337

Purchase

Obligations $ 143,600 $143,600 – – –

and Other

Total $1,146,320 $284,938 $278,417 $232,628 $350,337

The majority of the Company’s contractual obligations are

made up of operating leases for its stores (see Note 5 of the Notes to

Consolidated Financial Statements). The purchase obligations and

other category represents purchase orders for merchandise to be

delivered during Spring 2004, preventive maintenance contracts for

the 2004 fiscal year and letters of credit outstanding as of January

31, 2004 (see Note 8 of the Notes to Consolidated Financial

Statements). The Company expects to fund all of these obligations

with cash provided from operations.

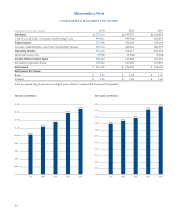

STORES AND GROSS SQUARE F EET Store count and gross

square footage by concept were as follows:

January 31, 2004 February 1, 2003

Number Gross Square Number Gross Square

of Stores Feet (millions) of Stores Feet (millions)

Abercrombie & Fitch 357 3,154 340 3,036

abercrombie 171 753 164 727

Hollister 172 1,114 93 595

Total 700 5,021 597 4,358

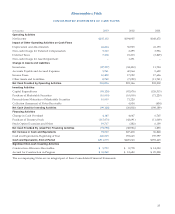

CAPITAL EXPENDIT URES Capital expenditures, net of construction

allowances, totaled $99.1 million, $93.0 million and $126.5 million for

the 2003, 2002 and 2001 fiscal years, respectively. Additionally, the non-

cash accrual for construction in progress increased $18.6 million in the

2003 fiscal year, decreased $12.7 million in the 2002 fiscal year and

increased $1.0 million the 2001 fiscal year. Capital expenditures in the

2003 fiscal year related primarily to new store construction. In addi-

tion, approximately $35.0 million of the total capital expenditures

was invested in expansion of the home office, distribution center

projects and a new point-of-sale system. Capital expenditures in the

2002 fiscal year related primarily to new store construction with

approximately $20.0 million invested in information technology and

distribution center projects. Capital expenditures in the 2001 fiscal year

related primarily to new store construction. Approximately $17.0

million of the total capital expenditure in the 2001 fiscal year related

to the construction of a new home office and distribution center. The

office and distribution center were completed in the 2001 fiscal year.

The Company anticipates spending $110.0 million to $120.0 million

in the 2004 fiscal year for capital expenditures, of which $85.0 million

to $95.0 million will be for new/remodel store construction. The bal-

ance of the capital expenditures will primarily relate to home office

and distribution center projects and other miscellaneous projects.

The Company intends to add approximately 745,000 gross square

feet in the 2004 fiscal year, which will represent a 15% increase over

18