Abercrombie & Fitch 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

EITF Issue No. 02-16, “Accounting by a Reseller for Cash

Consideration Received From a Vendor.” The issue provides

accounting guidance on how a reseller should characterize consid-

eration given by a vendor and when to recognize and how to measure

that consideration in its income statement. EITF Issue No. 02-16

was effective for fiscal years beginning after December 15, 2002. The

Company has evaluated the impact of this issue and concluded that

there was no effect on the consolidated financial statements.

In November 2002, the Financial Accounting Standards

Board (“FASB”) issued FASB Interpretation No. 45, “Guarantor’s

Accounting and Disclosure Requirements for Guarantees,

Including Indirect Guarantees of Indebtedness of Others” (“FIN

45”). FIN 45 clarifies the requirements of SFAS No. 5, “Accounting

for Contingencies,” relating to a guarantor’s accounting for, and dis-

closure of, the issuance of certain types of guarantees. The Company

adopted FIN 45 at the beginning of the 2003 fiscal year. The adop-

tion did not have an effect on the consolidated financial statements.

IMPACT OF INFLATION The Company’s results of operations

and financial condition are presented based upon historical cost.

While it is difficult to accurately measure the impact of inflation due

to the imprecise nature of the estimates required, the Company

believes that the effects of inflation, if any, on its results of operations

and financial condition have been minor.

SAFE HARBOR STATEMENT UNDER TH E PRIVATE SECURITIES

LITIGATION REF ORM ACT OF 1995 A&F cautions that any for-

ward-looking statements (as such term is defined in the Private

Securities Litigation Reform Act of 1995) contained in this Annual

Report or made by management of A&F involve risks and uncer-

tainties and are subject to change based on various important factors,

many of which may be beyond the Company’s control. Words such

as “estimate,” “project,” “plan,” “believe,” “expect,” “anticipate,”

“intend,” and similar expressions may identify forward-looking state-

ments. The following factors, in addition to those included in the

disclosure under the heading “RISK FACTORS” in “ITEM 1. BUSI-

NESS” of A&F’s Annual Report on Form 10-K for the fiscal year ended

January 31, 2004, in some cases have affected and in the future could

affect the Company’s financial performance and could cause actual

results for the 2004 fiscal year and beyond to differ materially from those

expressed or implied in any of the forward-looking statements included

in this Annual Report or otherwise made by management:

■ changes in consumer spending and consumer preferences

■the effects of political and economic events and conditions

domestically and in foreign jurisdictions in which the Company

operates, including, but not limited to, acts of terrorism or war;

■the impact of competition and pricing;

■changes in weather patterns;

■ postal rate increases and changes;

■ paper and printing costs;

■ market price of key raw materials;

■ ability to source product from its global supplier base;

■ political stability;

■currency and exchange risks and changes in existing or

potential duties, tariffs or quotas;

■ availability of suitable store locations at appropriate terms;

■ ability to develop new merchandise; and

■ ability to hire, train and retain associates.

Future economic and industry trends that could potentially

impact revenue and profitability are difficult to predict. Therefore,

there can be no assurance that the forward-looking statements

included in this Annual Report will prove to be accurate. In light

of the significant uncertainties in the forward-looking statements

included herein, the inclusion of such information should not be

regarded as a representation by the Company, or any other person,

that the objectives of the Company will be achieved. The forward-

looking statements herein are based on information presently avail-

able to the management of the Company. Except as may be required

by applicable law, the Company assumes no obligation to publicly

update or revise its forward-looking statements even if experience or

future changes make it clear that any projected results expressed or

implied therein will not be realized.

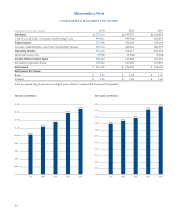

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT

MARKET RISK. The Company maintains its cash equivalents in

financial instruments with original maturities of 90 days or less. The

Company also holds marketable securities with original maturities

of less than one year. These financial instruments bear interest at

fixed rates and are subject to interest rate risk through lost income

should interest rates increase. The Company does not enter into

financial instruments for trading purposes.

As of January 31, 2004, the Company had no long-term debt

outstanding. Future borrowings would bear interest at negotiated

rates and would be subject to interest rate risk. The Company does

not believe that an adverse change in interest rates would have a

material affect on the Company’s financial condition.

Abercrombie &Fitch

21