Abercrombie & Fitch 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

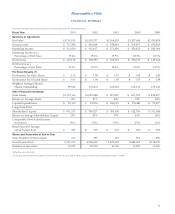

FOURTH QUARTER 2002 Net sales for the fourth quarter of the

2002 fiscal year were $534.5 million, up 15% over 2001’s fourth

quarter net sales of $466.6 million. Comparable store sales decreased

4% for the quarter.

By merchandise concept, comps for the quarter were as follows:

Abercrombie & Fitch’s comps declined 5%, with womens achieving

positive low-single digit comps and mens a mid-teen negative comp.

Comps for abercrombie declined 4%, with girls achieving a high-

single digit positive comp during the quarter and boys a negative

high-teen comp. Comps in Hollister were a positive 16%, with girls

achieving low twenties positive comps and guys a high- single digit

positive comp. By region, comps were strongest in the West and

weakest in the Midwest.

Given continued uncertainty in the economy, the Company

entered the fourth quarter of the 2002 fiscal year with an approach

designed to protect both the bottom line and the aspirational quali-

ty of the brands. The Company continued to strategically use direct

mail and bounce-back promotions, but, overall, a much less aggres-

sive approach to promotions was undertaken as compared to the

2001 fiscal year.

The pre-Christmas selling environment was very challenging

and, as expected, comps were negative for the fourth quarter prior to

Christmas. Comps improved significantly after Christmas, resulting

in a flat comp for December 2002. January 2003 comps were positive

3%, which reflected strong sales of winter clearance, and positive

results from the initial Spring assortment.

From a merchandising standpoint, womens continued to out-

perform mens. Key classifications in womens during the quarter

included woven shirts, knit tops, outerwear, pants, sweats and under-

wear. Mens continued to be difficult and there remained no solid

trend industry-wide. Knit tops and woven shirts performed well

during the quarter.

As for the kids’ business, knit tops, sweats, woven tops, pants

and outerwear performed very well in girls. In boys, denim and

sweats performed best. As in the adult men’s business, boys con-

tinued to be difficult.

In Hollister, girls continued to be more significant than guys,

representing approximately 65% of the overall business. For the

quarter, the best performing girls classifications were woven shirts,

knit tops, sweats, skirts and denim. In guys, denim, knit tops, graph-

ic t-shirts, sweatshirts and accessories performed best.

Sales in the e-commerce business grew by over 25% during

the fourth quarter of the 2002 fiscal year as compared to the fourth

quarter of the 2001 fiscal year. The direct to consumer business

(which includes the Company’s catalogue, the A&F Quarterly and

the Company’s Web sites) accounted for 5.0% of net sales in the

fourth quarter of the 2002 fiscal year as compared to 4.5% in the

2001 fiscal year.

FISCAL 2002 Net sales for the 2002 fiscal year reached $1.6 billion,

up 17% over the 2001 fiscal year. The sales increase was attributable

to the net addition of 106 stores offset by a 5% comparable store

sales decrease.

By merchandise concept, Abercrombie & Fitch comps declined

6%, abercrombie comps declined 4% and Hollister comps

increased 10%. The decline in comps was primarily due to the weak

performance in both mens and boys. Mens comps decreased in low-

double digits for the 2002 fiscal year while boys comps decreased in

the mid-teens. Overall, the women’s and girls’ businesses continued

to increase in share of the total business and accounted for approx-

imately 57% of the adult and kids’ businesses in the 2002 fiscal year.

For the year, womens comps were negative low-single digits while

girls comps were positive mid-single digits.

Hollister continued to perform well. For the 2002 fiscal year, sales

per square foot in Hollister stores were approximately 86% of the

sales per square foot of Abercrombie & Fitch stores in the same malls.

The Company’s catalogue, the A&F Quarterly and the

Company’s Web sites represented 4.7% of the 2002 fiscal year net

sales compared to 4.2% in the 2001 fiscal year.

GROSS INCOME The Company’s gross income may not be com-

parable to those of other retailers since all significant costs related to the

Company’s distribution network, excluding direct shipping costs

related to the e-commerce and catalogue sales, are included in general,

administrative and store operating expenses (see “General,

Administrative and Store Operating Expenses” section below).

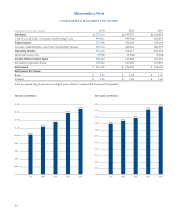

FOURTH QUARTER 2003 Gross income for the fourth quarter of the

2003 fiscal year was $261.0 million compared to $243.0 million in the

2002 fiscal year. The gross income rate (gross income divided by net

sales) for the fourth quarter of the 2003 fiscal year was 46.6%, up 110

basis points from last year’s rate of 45.5%. The increase in gross

income rate resulted largely from an increase in initial markup

(IMU), partially offset by a higher markdown rate and an increase

in buying and occupancy costs as a percent of net sales.

Continued progress in sourcing efficiency has been an impor-

tant factor in improving IMU and profit. The Company continued

to make progress increasing IMU in the Hollister and abercrombie

business, where IMU improved over 400 basis points versus the

fourth quarter of the 2002 fiscal year for both concepts. All three

14