Abercrombie & Fitch 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

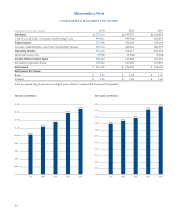

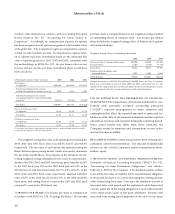

5. LEASED FACILIT IES AND COMMITMENT S Annual store rent

is comprised of a fixed minimum amount, plus contingent rent

based on a percentage of sales exceeding a stipulated amount.

Store lease terms generally require additional payments covering

taxes, common area costs and certain other expenses.

A summary of rent expense follows (thousands):

2003 2002 2001

Store rent:

Fixed minimum $121,547 $105,751 $83,608

Contingent 5,194 4,886 4,897

Total store rent $126,741 $110,637 $88,505

Buildings, equipment and other 1,219 1,133 1,566

Total rent expense $127,960 $111,770 $90,071

At January 31, 2004, the Company was committed to noncancelable

leases with remaining terms of one to thirteen years. These commit-

ments include store leases with initial terms ranging primarily from

ten to fifteen years. A summary of minimum rent commitments

under noncancelable leases follows (thousands):

2004 $141,338 2007 122,478

2005 $142,266 2008 110,150

2006 $136,151 Thereafter 350,337

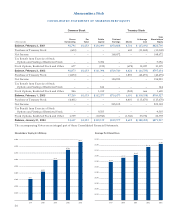

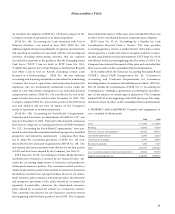

6. ACCRUED EXPENSES Accrued expenses consisted of the follow-

ing (thousands):

2003 2002

Accrual for construction in progress $31,269 $12,680

Current portion of unredeemed gift card revenue 20,417 23,454

Rent and landlord charges 17,689 18,465

Compensation and benefits 14,589 15,857

Catalogue and advertising costs 14,183 9,701

Legal 9,248 5,136

Store accruals 6,671 10,773

Other 24,166 23,460

Total $138,232 $119,526

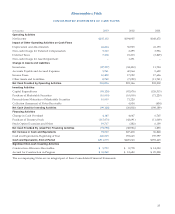

7. INCOME TAXES The provision for income taxes consisted of

(thousands):

2003 2002 2001

Currently payable:

Federal $101,692 $ 88,238 $ 79,691

State 18,248 13,865 15,002

$119,940 $102,103 $ 94,693

Deferred:

Federal $ 8,748 $ 16,727 $ 11,133

State 1,552 2,620 2,024

$10,300 $ 19,347)$ 13,157

Total provision $130,240 $121,450 $107,850

A reconciliation between the statutory Federal income tax rate and

the effective income tax rate follows:

2003 2002 2001

Federal income tax rate 35.0% 35.0% 35.0%

State income tax, net of Federal

income tax effect 3.8% 3.5% 3.9%

Other items, net 0.0% (0.1%) 0.1%

Total 38.8% 38.4% 39.0%

Income taxes payable included net current deferred tax assets of

$3.5 million and $6.5 million at January 31, 2004 and February 1,

2003, respectively.

Under a tax sharing arrangement with The Limited, which

owned 84.2% of the outstanding Common Stock through May 19,

1998, the Company was responsible for and paid to The Limited its

proportionate share of income taxes calculated upon its separate tax-

able income at the estimated annual effective tax rate for periods

prior to May 19, 1998. In 2002, a final tax sharing payment was

made to The Limited pursuant to an agreement to terminate the tax

sharing agreement. As a result, the Company has been indemnified

by The Limited for any federal, state or local taxes asserted with

respect to The Limited for all periods prior to May 19, 1998.

Amounts paid to The Limited totaled $1.4 million and $ 20 thou-

sand in 2002 and 2001, respectively.

Amounts paid directly to taxing authorities were $113.0 million,

30