Abercrombie & Fitch 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

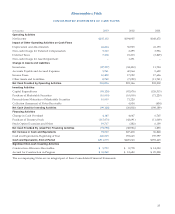

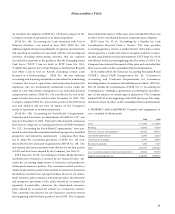

year-end 2003. It is anticipated the increase will result from the

addition of approximately 15 new Abercrombie & Fitch stores, 10

new abercrombie stores and 85 new Hollister stores. In addition, the

Company recently announced plans for a new lifestyle brand that

will target an older customer than its current brands. The Company

expects to open four test stores in August 2004. Additionally, the

Company plans to remodel 10 to 15 Abercrombie & Fitch stores.

The Company estimates that the average cost for leasehold

improvements and furniture and fixtures for Abercrombie & Fitch

stores opened during the 2004 fiscal year will approximate $550,000

per store, net of landlord allowances. In addition, initial inventory

purchases are expected to average approximately $300,000 per store.

The Company estimates that the average cost for leasehold

improvements and furniture and fixtures for abercrombie stores

opened during the 2004 fiscal year will approximate $450,000 per

store, net of landlord allowances. In addition, initial inventory pur-

chases are expected to average approximately $115,000 per store.

The Company estimates that the average cost for leasehold

improvements and furniture and fixtures for Hollister stores opened

during the 2004 fiscal year will approximate $590,000 per store, net

of landlord allowances. In addition, initial inventory purchases are

expected to average approximately $215,000 per store.

The Company expects that substantially all future capital

expenditures will be funded with cash from operations. In addition,

the Company has $250 million available (less outstanding letters

of credit) under its Credit Agreement to support operations.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES The

Company’s discussion and analysis of its financial condition and

results of operations are based upon the Company’s consolidated

financial statements, which have been prepared in accordance with

accounting principles generally accepted in the United States

(“GAAP”). The preparation of these financial statements requires

the Company to make estimates and assumptions that affect the

reported amounts of assets, liabilities, revenues and expenses. Since

actual results may differ from those estimates, the Company revises

its estimates and assumptions as new information becomes available.

The Company’s significant accounting policies can be found in

the Notes to Consolidated Financial Statements (see Note 2).

The Company believes that the following policies are most criti-

cal to the portrayal of the Company’s financial condition and

results of operations.

Revenue Recognition - The Company recognizes retail sales at

the time the customer takes possession of the merchandise and

purchases are paid for, primarily with either cash or credit card.

Catalogue and e-commerce sales are recorded upon customer receipt

of merchandise. Amounts relating to shipping and handling billed

to customers in a sale transaction are classified as revenue and the

direct shipping costs are classified as cost of goods sold. Employee

discounts are classified as a reduction of revenue. The Company

reserves for sales returns through estimates based on historical

experience and various other assumptions that management

believes to be reasonable.

Inventory Valuation - Inventories are principally valued at the

lower of average cost or market, on a first-in first-out basis, utilizing

the retail method. The retail method of inventory valuation is an

averaging technique applied to different categories of inventory.

At the Company, the averaging is determined at the stock keeping

unit (“SKU”) level by averaging all costs for each SKU. An initial

markup is applied to inventory at cost in order to establish a cost-to-

retail ratio. Permanent markdowns, when taken, reduce both the

retail and cost components of inventory on hand so as to maintain

the already established cost-to-retail relationship. The use of the

retail method and the recording of markdowns effectively values

inventory at the lower of cost or market. The Company further

reduces inventory by recording an additional markdown reserve

using the retail carrying value of inventory from the season just

passed. Markdowns on this carryover inventory represent estimat-

ed future anticipated selling price declines.

Additionally, as part of inventory valuation, an inventory shrink-

age estimate is made each period that reduces the value of invento-

ry for lost or stolen items. Inherent in the retail method calculation

are certain significant judgments and estimates including, among

others, initial markup, markdowns and shrinkage, which could sig-

nificantly impact the ending inventory valuation at cost as well as the

resulting gross margins. Management believes that this inventory

valuation method is appropriate since it preserves the cost-to-retail

relationship in ending inventory.

Property and Equipment - Depreciation and amortization of

property and equipment are computed for financial reporting pur-

poses on a straight-line basis, using service lives ranging principally

from 30 years for buildings, 10 to 15 years for leasehold improve-

ments and 3 to 10 years for other property and equipment. Beneficial

leaseholds represent the present value of the excess of fair market rent

over contractual rent of existing stores at the 1988 purchase of the

Abercrombie & Fitch business by The Limited, Inc. (now known as

Limited Brands, Inc., “The Limited”) and are being amortized over

the lives of the related leases. The cost of assets sold or retired and the

related accumulated depreciation or amortization are removed from

the accounts with any resulting gain or loss included in net income.

Abercrombie &Fitch

19