Abercrombie & Fitch 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

intrinsic value method in accordance with Accounting Principles

Board Opinion No. 25, “Accounting for Stock Issued to

Employees.” Accordingly, no compensation expense for options

has been recognized as all options are granted at fair market value

at the grant date. The Company recognizes compensation expense

related to restricted share awards. If compensation expense relat-

ed to options had been determined based on the estimated fair

value of options granted in 2003, 2002 and 2001, consistent with

the methodology in SFAS No. 123, the pro forma effect on net

income and net income per basic and diluted share would have

been as follows:

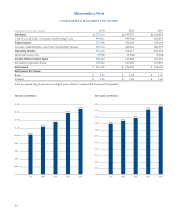

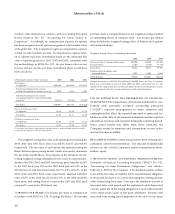

(Thousands except per share amount) 2003 2002 2001

Net Income:

As reported $205,102 $194,935 $168,672

Stock-based compensation expense

included in reported net income, net of tax 3,250 1,414 2,401

Stock-based compensation expense

determined under fair value based method,

net of tax(1) (28,261) (28,184) (22,453)

Pro forma $180,091 $168,165 $148,620

Basic net income per share:

As reported $2.12 $1.99 $1.70

Pro forma $1.86 $1.71 $1.50

Diluted net income per share:

As reported $2.06 $1.94 $1.65

Pro forma $1.83 $1.68 $1.48

(1) Includes stock-based compensation expense related to restricted share awards actually

recognized in earnings in each period presented.

The weighted-average fair value of all options granted during the

2003, 2002 and 2001 fiscal years was $14.05, $12.07 and $14.96,

respectively. The fair value of each option was estimated using the

Black-Scholes option-pricing model, which was used to determine

the pro forma results above. For purposes of the valuation, the fol-

lowing weighted-average assumptions were used: no expected divi-

dends in the 2003, 2002 and 2001 fiscal years; price volatility of 64%

in the 2003 fiscal year, 53% in the 2002 fiscal year and 54% in the

2001 fiscal year; risk-free interest rates of 2.5%, 4.3% and 4.7% in the

2003, 2002 and 2001 fiscal years, respectively; assumed forfeiture

rates of 23% in the 2003 fiscal year and 15% in the 2002 and 2001

fiscal years; and vesting lives of 4 years in the 2003 and 2002 fiscal

years and 5 years in the 2001 fiscal year.

EARNINGS PER SHARE Net income per share is computed in

accordance with SFAS No. 128, “Earnings Per Share.” Net income

per basic share is computed based on the weighted-average number

of outstanding shares of common stock. Net income per diluted

share includes the weighted-average effect of dilutive stock options

and restricted shares.

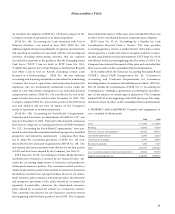

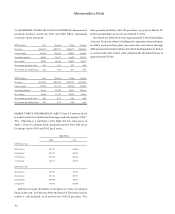

Weighted–Average Shares Outstanding (thousands):

2003 2002 2001

Shares of Class A Common stock issued 103,300 103,300 103,300

Treasury shares (6,467) (5,129) (4,198)

Basic shares 96,833 98,171 99,102

Dilutive effect of options and

restricted shares 2,747 2,460 3,422

Diluted shares 99,580 100,631 102,524

Options to purchase 6,151,000, 9,218,000 and 5,630,000 shares of Class A Common

Stock were outstanding at year-end 2003, 2002 and 2001, respectively, but were not

included in the computation of net income per diluted share because the options’ exercise

prices were greater than the average market price of the underlying shares.

USE OF ESTIMATES IN T HE PREPARAT ION OF F INANCIAL

STATEMENTS The preparation of financial statements in con-

formity with generally accepted accounting principles

(“GAAP”) requires management to make estimates and

assumptions that affect the reported amounts of assets and lia-

bilities as of the date of the financial statements and the reported

amounts of revenues and expenses during the reporting period.

Since actual results may differ from those estimates, the

Company revises its estimates and assumptions as new infor-

mation becomes available.

RECLASSIFICATIONS Certain amounts have been reclassified to

conform to current year presentation. The amounts reclassified did

not have an effect on the Company’s results of operations or share-

holders’ equity.

3. RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

Statement of Financial Accounting Standards (“SFAS”) No. 143,

“Accounting for Asset Retirement Obligations,” was effective

February 2, 2003 for the Company. The standard requires entities

to record the fair value of a liability for an asset retirement obligation

in the period in which it is a cost by increasing the carrying amount

of the related long-lived asset. Over time, the liability is accreted to

its present value each period, and the capitalized cost is depreciated

over the useful life of the related obligation for its recorded amount

or the entity incurs a gain or loss upon settlement. Because costs

associated with exiting leased properties at the end of lease terms

28