Abercrombie & Fitch 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

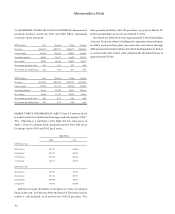

ment or whenever events or changes in circumstances indicate

that full recoverability of net assets through future cash flows is in

question. Factors used in the evaluation include, but are not limited

to, management’s plans for future operations, recent operating

results and projected cash flows.

INCOME TAXES Income taxes are calculated in accordance with

SFAS No. 109, “Accounting for Income Taxes,” which requires

the use of the liability method. Deferred tax assets and liabilities

are recognized based on the difference between the financial state-

ment carrying amounts of existing assets and liabilities and their

respective tax bases.

Deferred tax assets and liabilities are measured using enacted

tax rates in effect in the years in which those temporary differences

are expected to reverse. Under SFAS No. 109, the effect on deferred

taxes of a change in tax rates is recognized in income in the period

that includes the enactment date.

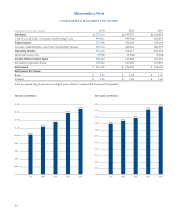

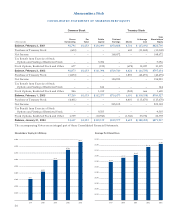

SHAREHOLDERS’ EQUIT Y At January 31, 2004 and February 1,

2003, there were 150 million shares of $.01 par value Class A

Common Stock authorized, of which 94.6 million and 97.3 million

shares were outstanding at January 31, 2004 and February 1, 2003,

respectively, and 106.4 million shares of $.01 par value Class B

Common Stock authorized, none of which were outstanding at

January 31, 2004 or February 1, 2003. In addition, 15 million shares

of $.01 par value Preferred Stock were authorized, none of which

have been issued. See Note 13 for information about Preferred

Stock Purchase Rights.

Holders of Class A Common Stock generally have identical rights

to holders of Class B Common Stock, except that holders of Class A

Common Stock are entitled to one vote per share while holders of

Class B Common Stock are entitled to three votes per share on all

matters submitted to a vote of shareholders.

REVENUE RECOGNIT ION The Company recognizes retail sales

at the time the customer takes possession of the merchandise and

purchases are paid for, primarily with either cash or credit card.

Catalogue and e-commerce sales are recorded upon customer

receipt of merchandise. Amounts relating to shipping and handling

billed to customers in a sale transaction are classified as revenue and

the related direct shipping costs are classified as cost of goods sold.

Employee discounts are classified as a reduction of revenue. The

Company reserves for sales returns through estimates based on

historical experience and various other assumptions that manage-

ment believes to be reasonable.

COST OF GOODS SOLD, OCCUPANCY AND BUYING COST S

The following expenses are included as part of Cost of Goods

Sold, Occupancy and Buying Costs: landed cost of merchandise,

freight, payroll and related costs associated with merchandise

procurement, inspection costs, store rents and other real estate

costs, store asset depreciation, inventory shrink, and catalogue

production and mailing costs.

GENERAL, ADMINIST RATIVE AND STORE OPERATING

EXPENSES General, Administrative and Store Operating Expenses

include distribution center costs including receiving and warehouse

costs, store payroll and expenses, home office payroll and expenses

(not related to merchandise procurement) and advertising.

CATALOGUE AND ADVERTISING COSTS Costs related to the

A&F Quarterly, a catalogue/magazine, primarily consist of catalogue

production and mailing costs and are expensed as incurred as a

component of “Cost of Goods Sold, Occupancy and Buying Costs.”

Advertising costs consist of in-store photographs and advertising in

selected national publications and are expensed as part of “General,

Administrative and Store Operating Expenses” when the photo-

graphs or publications first appear. Catalogue and advertising costs,

which include photo shoot costs, amounted to $33.6 million in 2003,

$33.4 million in 2002 and $30.7 million in 2001.

STORE PREOPENING EXPENSES Pre-opening expenses related

to new store openings are charged to operations as incurred.

DESIGN AND DEVELOPMENT COST S Costs to design and

develop the Company’s merchandise are expensed as incurred and

are reflected as a component of “Cost of Goods Sold, Occupancy

and Buying Costs.”

FAIR VALUE OF FINANCIAL INSTRUMENTS The recorded

values of current assets and current liabilities, including receivables,

marketable securities and accounts payable, approximate fair value

due to the short maturity and because the average interest rate

approximates current market origination rates.

STOCK-BASED COMPENSATION The Company reports stock-

based compensation through the disclosure-only requirements of

SFAS No. 123, “Accounting for Stock-Based Compensation,” as

amended by SFAS No. 148, “Accounting for Stock-Based

Compensation– Transition and Disclosure–an Amendment of FASB

No. 123,” but elects to measure compensation expense using the

Abercrombie &Fitch

27