Abercrombie & Fitch 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

digit for the fourth quarter, while guys comps were a negative

mid-single digit.

On a regional basis, comp store results across all three concepts

were strongest along the East Coast and in the West and weakest in

the Midwest. Stores located in Florida, Southern California and the

New York metropolitan area had the best comp performance.

From a promotional standpoint, the Company used direct mail

promotions during the fourth quarter of the 2003 fiscal year to drive

business between Thanksgiving and Christmas, but did not anniver-

sary the 2002 fourth quarter issuance of a bounce-back coupon.

Also, the Company did not repeat a 15% -off bag stuffer coupon that

impacted late December and January business in fiscal 2002.

Overall, the Company sought to have a less promotional look to the

stores in the 2003 fiscal year.

From a merchandising standpoint, womens continued to out-

perform mens. In Abercrombie & Fitch, womens had strong comp

store increases in the fourth quarter in knits, fleece and skirts. Weak

classifications included woven shirts and outerwear. The men's

business continued to be difficult. However, graphic t-shirts and

woven shirts were classifications that had comp increases while the

sweater and outerwear classifications had significant decreases.

In the kids’ business, for the quarter, knits, sweats and pants had

strong comp store increases in girls, which were somewhat offset by

weak business in sweaters, shirts, outerwear and gymwear. Boys

graphic tees, woven shirts and accessories had comp increases, but

these increases were not sufficient to offset other weaker performing

classifications.

In Hollister, girls also achieved stronger comps than guys. In

girls, sweats, skirts, pants and denim had significant comp store

increases during the quarter, while comps in the sweater and outer-

wear classifications declined. In guys, woven shirts, denim and

sweats had positive comp store increases. However, the sweater, knit

tops and outerwear classifications had significant declines.

Sales in the e-commerce business grew by over 42% during

the fourth quarter of the 2003 fiscal year as compared to the same

period during the 2002 fiscal year. The Company added a Hollister

e-commerce business during back-to-school 2003. The direct to con-

sumer business (which includes the Company’s catalogue, the A&F

Quarterly (a catalogue/magazine) and the Company’s Web sites)

accounted for 6.0% of net sales in the fourth quarter of the 2003 fiscal

year as compared to 5.0% in the fourth quarter of fiscal 2002.

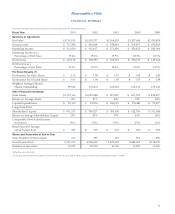

FISCAL 2003 Net sales for the 2003 fiscal year reached $1.7 billion,

up 7% over the 2002 fiscal year. The sales increase was attributable

to the net addition of 103 stores partially offset by a 9% comparable

store sales decrease.

By merchandise concept, comps for the 2003 fiscal year were

as follows: Abercrombie & Fitch’s comps declined 11% with mens

comps declining low twenties and womens comps declining mid-

single digits. abercrombie comps declined 6% with girls achieving

a mid-single digit positive comp store increase and boys a negative

comp in the high teens. Overall, the women’s and girls’ businesses

continued to increase in share of the total business and accounted

for approximately 63% of the adult and kids’ businesses in the 2003

fiscal year. Hollister comps for the 2003 fiscal year were a posi-

tive 7%, with girls comps positive in low double digits and guys

slightly negative.

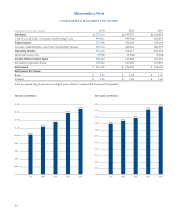

During the year, Hollister continued to gain in productivity

relative to Abercrombie & Fitch. For the 2003 fiscal year, sales per

square foot in Hollister stores were approximately 113% of the sales

per square foot of Abercrombie & Fitch stores in the same malls.

For the 2003 fiscal year, e-commerce sales grew by approximately

39% compared to the 2002 fiscal year. The Company’s catalogue,

the A&F Quarterly, and the Company’s Web sites represented

5.3% of net sales for the 2003 fiscal year compared to 4.7% in the

2002 fiscal year.

CURRENT TRENDS AND OUTLOOK The Company experienced

double digit comp store increases each year from the 1996 fiscal year

to the 1999 fiscal year, reaching sales per gross square foot of $505 in

fiscal 1999, a level significantly higher than most of its competitors.

The Company believes that the comp store decreases since then

reflect both a difficult retail environment and a normalization of

the Company’s sales per square foot relative to its competition. The

Company achieved positive comp store increases in January and

February 2004 and is encouraged by this improvement in trend.

Although the Company is confident that comps will improve in the

future, due to the uncertain competitive and economic environment,

it cannot predict whether this will occur in the 2004 fiscal year or any

subsequent year.

Driving top line revenue will be the Company’s priority in the

2004 fiscal year and the Company has made a number of organiza-

tional changes intended to strengthen the design and merchandising

groups. Additionally, changes have been made in the Company’s

marketing strategies. The A&F Quarterly has been discontinued and

the Company plans to use a variety of marketing vehicles (including

lifestyle only direct mail and national magazine advertising) in the

future. In addition to emphasizing top line growth, management

will focus on strong operational controls which have been an impor-

tant factor in the Company’s success.

Abercrombie &Fitch

13