AT&T Uverse 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 AT&T Uverse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

78

| 2007 AT&T Annual Report

NOTE 13. STOCKHOLDERS’ EQUITY

From time to time, we repurchase shares of common stock

for distribution through our employee benefit plans or in

connection with certain acquisitions. In December 2007,

the Board of Directors authorized the repurchase of up to

400 million shares of our common stock. This authorization

replaced previous authorizations and will expire on

December 31, 2009. As of December 31, 2007, we had not

repurchased any shares under this program.

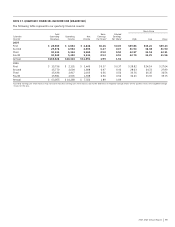

NOTE 14. ADDITIONAL FINANCIAL INFORMATION

December 31,

Balance Sheets 2007 2006

Accounts payable and accrued liabilities:

Accounts payable $ 7,059 $ 6,919

Accrued rents and other 4,321 3,957

Accrued payroll and commissions 3,419 3,974

Deferred directory revenue 2,348 1,721

Accrued interest 1,149 915

Compensated future absences 637 759

Current portion of employee

benefit obligation 249 973

Other 2,217 2,888

Total accounts payable and

accrued liabilities $21,399 $22,106

Deferred compensation (included in

Other noncurrent liabilities) $ 2,141 $ 2,064

Statements of Income 2007 2006 2005

Advertising expense $3,430 $1,530 $ 812

Interest expense incurred $3,678 $1,916 $1,492

Capitalized interest (171) (73) (36)

Total interest expense $3,507 $1,843 $1,456

Statements of Cash Flows 2007 2006 2005

Cash paid during the year for:

Interest $3,445 $1,666 $1,395

Income taxes, net of refunds 4,013 2,777 2,038

Statements of Stockholders’ Equity 2007 2006 2005

Accumulated other comprehensive

income (loss) is comprised of

the following components, net

of taxes, at December 31:

Foreign currency translation

adjustment $(469) $ (488) $(505)

Unrealized gains on securities 375 345 340

Unrealized (losses) on

cash flow hedges (226) (172) (189)

Defined benefit

postretirement plan (59) (4,999) —

Other (1) — (2)

Accumulated other

comprehensive (loss) $(380) $(5,314) $(356)

No customer accounted for more than 10% of consolidated

revenues in 2007, 2006 or 2005.

NOTE 15. TRANSACTIONS WITH AT&T MOBILITY

Prior to our December 29, 2006 acquisition of BellSouth (see

Note 2), we and BellSouth, the two owners of AT&T Mobility,

each made a subordinated loan to AT&T Mobility (shareholder

loans) and entered into a revolving credit agreement with

AT&T Mobility to provide short-term financing for operations.

Following the BellSouth acquisition both our shareholder loan

and revolving credit agreement with AT&T Mobility were

consolidated and do not appear on our consolidated balance

sheets at December 31, 2007 and 2006. The shareholder loan

carries an annual 6.0% interest rate and we earned interest

income on this loan of $246 during 2006 and $311 in 2005.

Prior to our BellSouth acquisition, we generated revenues

of $1,466 in 2006 and $869 in 2005 for services sold to AT&T

Mobility. These revenues were primarily from access and

long-distance services sold to AT&T Mobility on a wholesale

basis and commissions revenue related to customers added

through AT&T sales sources.

NOTE 16. CONTINGENT LIABILITIES

In addition to issues specifically discussed elsewhere, we are

party to numerous lawsuits, regulatory proceedings and

other matters arising in the ordinary course of business.

In accordance with Statement of Financial Accounting

Standards No. 5, “Accounting for Contingencies,” in evaluating

these matters on an ongoing basis, we take into account

amounts already accrued on the balance sheet. In our opinion,

although the outcomes of these proceedings are uncertain,

they should not have a material adverse effect on our

financial position, results of operations or cash flows.

We have contractual obligations to purchase certain

goods or services from various other parties. Our purchase

obligations are expected to be approximately $2,461 in

2008, $2,237 in total for 2009 and 2010, $1,197 in total for

2011 and 2012 and $471 in total for years thereafter.