AT&T Uverse 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 AT&T Uverse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 AT&T Annual Report

| 31

offset by a 44.8% increase in data ARPU and increased

long-distance revenue per customer. In 2006, local service

revenue per customer declined primarily due to the two

reasons discussed above as well as free mobile-to-mobile

plans that allow our wireless customers to call other

AT&T Mobility customers at no charge and, to a lesser

extent, Rollover® minutes. An increase in customers on

Rollover plans tends to lower ARPU, since unused minutes

(and associated revenue) are deferred until subsequent

months for up to one year.

The effective management of customer churn also is

critical to our ability to maximize revenue growth and to

maintain and improve margins. Customer churn is calculated

by dividing the aggregate number of wireless customers who

cancel service during each month in a period by the total

number of wireless customers at the beginning of each month

in that period. Our customer churn rate was 1.7% in 2007,

down from 1.8% in 2006 and 2.2% in 2005. The churn rate

for postpaid customers was 1.3% in 2007, down from 1.5%

in 2006 and 1.9% in 2005. The decline in postpaid churn

reflects higher network quality, more affordable rate plans

and broader network coverage as well as exclusive devices

and free mobile-to-mobile calling among our wireless

customers. Churn levels were slightly negatively impacted

by ongoing transition of customers from our older analog

and Time Division Multiple Access (TDMA) platforms to our

advanced Global System for Mobile Communication (GSM)

network. We plan to cease operating our analog and TDMA

networks in early 2008. The increasing mix of prepaid and

reseller customers in our customer base are also expected

to pressure churn rates in the future.

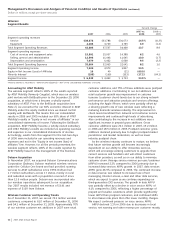

Wireless Operating Results

Our wireless segment operating income margin was 16.4%

in 2007, 12.2% in 2006 and 5.3% in 2005. The higher margin

in 2007 was primarily due to revenue growth of $5,147, which

exceeded our increase in operating expenses of $2,699.

The higher margin in 2006 was primarily due to revenue

growth of $3,069, which exceeded our increase in operating

expenses of $324.

Service revenues are comprised of local voice and data

services, roaming, long-distance and other revenue. Service

revenues increased $4,890, or 14.5%, in 2007 and $3,115,

or 10.2%, in 2006 and consisted of:

• Data revenue increases of $2,692, or 63.3%, in 2007

and $1,579, or 59.0%, in 2006. The increase in 2007 is

primarily due to the increased number of data users

and an increase in data ARPU of 46.9%, which primarily

resulted from increased use of text messaging, e-mail,

data access and media bundling services. Our significant

data growth also reflects an increased number of

subscribers using our 3G network. The increase in

2006 was related to increased use of text messaging

and Internet access services, which resulted in an

increase in data ARPU of 44.8%. Data service revenues

represented approximately 18.0% of our wireless

segment service revenues in 2007 and 12.6% in 2006.

• Voice revenue increases of $2,135, or 7.3%, in 2007

and $1,592, or 5.8%, in 2006. The increase in 2007 was

primarily due to an increase in the number of average

wireless customers of approximately 12.1%, partially

offset by a decline in voice ARPU of 4.1%. The increase

in 2006 was primarily due to an increase in the average

number of wireless customers of 11.5%, partially offset

by competitive pricing pressures and the impact of

various all-inclusive calling and prepaid plans. Included

in voice revenues for both periods were increases in

long-distance and net roaming revenue due to increased

international usage.

Equipment revenues increased $257, or 6.9%, in 2007 and

decreased $46, or 1.2%, in 2006. The increase in 2007 was

due to higher handset revenues reflecting increased gross

customer additions and customer upgrades to more advanced

handsets, partially offset by increased equipment discounts

and rebate activity. The slight decrease in 2006 was due to a

decline in handset revenues as a result of increased rebates

and equipment return credits and lower priced handsets,

mostly offset by increased sales of handset units, handset

upgrades and accessories.

Cost of services and equipment sales expenses increased

$934, or 6.2%, in 2007 and $669, or 4.6%, in 2006. The 2007

increase was primarily due to increased equipment sales

expense of $1,140 due to the overall increase in sales as well

as an increase in sales of higher-cost 3G devices, the intro-

duction of the Apple iPhone handset and an increase in the

number and per-unit cost of handset accessory sales. Total

equipment costs continue to be higher than equipment

revenues due to the sale of handsets below cost, through

direct sales sources, to customers who committed to one-year

or two-year contracts or in connection with other promotions.

Cost of services declined $206 in 2007. This decline was

due to lower interconnect, roaming and long-distance

expenses related to network and systems integration and

cost-reduction initiatives, as well as cost reductions from the

continued migration of network usage from the T-Mobile

USA (T-Mobile) network in California and Nevada to our

networks in these states. Our remaining purchase

commitment to T-Mobile for this transition period was

$51 at December 31, 2007. These decreases were partially

offset by higher network usage, with increases in total system

minutes of use (MOU) of 13.5%, and associated network

system expansion and increased network equipment costs.

Expenses increased in 2006 primarily due to increases in

network usage and associated network system expansion.

Cost of services increased $492, or 5.3%, in 2006 due to

the following:

• Increases in network usage with a total system MOU

increase of 20.6% related to the increase in customers.

Additionally, average MOUs per customer increased 8.2%.

• Higher roaming and long-distance costs, partially offset

by a decline in reseller expenses. The reseller decrease

resulted from a decrease in MOUs on the T-Mobile

network of more than 50% for 2006.

• Integration costs, primarily for network integration,

of $229.

Equipment sales expenses increased $177, or 3.5%, in 2006

due to increased handset upgrades of 11.2% and an increase

in the average cost per upgrade and accessory sold, partially

offset by a decline in the average cost per handset sold to

new customers.