AT&T Uverse 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 AT&T Uverse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

36

| 2007 AT&T Annual Report

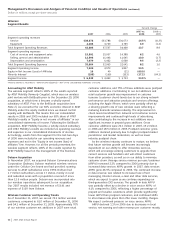

Advertising & Publishing

Segment Results

Percent Change

2007 vs. 2006 vs.

2007 2006 2005 2006 2005

Total Segment Operating Revenues $5,851 $3,685 $3,684 58.8% —

Segment operating expenses

Cost of sales 1,733 1,121 1,104 54.6 1.5

Selling, general and administrative 1,333 616 581 — 6.0

Depreciation and amortization 924 3 5 — (40.0)

Total Segment Operating Expenses 3,990 1,740 1,690 — 3.0

Segment Operating Income 1,861 1,945 1,994 (4.3) (2.5)

Equity in Net Income (Loss) of Affiliates — (17) (5) — —

Segment Income $1,861 $1,928 $1,989 (3.5)% (3.1)%

Operating revenues increased $2,166, or 58.8%, in 2007,

primarily due to the addition of BellSouth’s operating results,

which increased operating revenues approximately $2,220 in

2007. The increase was largely driven by print advertising

revenue of $1,859 and Internet advertising revenue of $200.

Operating revenues in 2006 remained relatively unchanged.

Operating expenses increased $2,250 in 2007 compared

to $50, or 3.0%, in 2006 primarily due to the addition of

BellSouth’s operating results, which increased total operating

expenses by approximately $2,110 in 2007. The increase in

2006 was primarily due to higher costs for Internet traffic,

brand advertising and employee benefits.

Cost of sales increased $612, or 54.6%, in 2007 compared

to $17, or 1.5%, in 2006, primarily due to the addition of

BellSouth’s operating results, which increased cost of sales by

approximately $550 in 2007. Publishing, commissions, paper

and printing costs represent the majority of cost of sales

expenses in 2007. The increase in 2006 was primarily due

to higher costs for Internet traffic.

Selling, general and administrative expenses increased

$717 in 2007 compared to $35, or 6.0%, in 2006 primarily

due to the addition of BellSouth’s operating results, which

increased selling, general and administrative expenses by

approximately $645 in 2007. Employee, uncollectible and

advertising-related expenses represent the majority of

selling, general and administrative expenses in 2007.

Increased expenses in 2006 were primarily due to increases

in other advertising & publishing segment costs, including

brand advertising and employee benefits of $102, partially

offset by lower bad-debt expense of $74.

Depreciation and amortization expenses increased

$921 in 2007, resulting from the amortization of customer

lists acquired as a part of the BellSouth acquisition, which

increased expenses by $915 in 2007. Depreciation and

amortization expenses in 2006 remained relatively

unchanged.

Ingenio Acquisition

In December 2007, we acquired Ingenio®, a provider of Pay

Per Call® technology. Ingenio will be integrated with YPC

and will allow us to better serve business directory and

local search customers across our entire advertising and

publishing portfolio.

Accounting Impacts From the BellSouth Acquisition

Prior to the BellSouth acquisition (see Note 2), we accounted

for our 66% economic interest in YPC under the equity

method since we shared control equally with BellSouth.

Following the BellSouth acquisition, YPC became a wholly-

owned subsidiary of AT&T and its results are reflected in

operating revenues and expenses in our consolidated

statement of income.

For segment disclosure purposes, we have carried forward

deferred revenue and deferred cost balances for BellSouth in

order to reflect how the segment is managed. This is different

from consolidated reporting purposes as under FAS 141

BellSouth deferred revenue and expenses from directories

published during the 12-month period ending with the

December 29, 2006 acquisition date are not recognized

and therefore were not included in the opening balance

sheet (see Note 4). For management reporting purposes,

we continued to amortize these balances over the life of

the directory (typically 12 months). Thus, our advertising

& publishing segment results include revenue of $964 and

expenses of $308 in 2007 related to directories published

in the Southeast region during 2006, prior to our acquisition

of BellSouth.

Operating Results

Our advertising & publishing segment operating income

margin was 31.8% in 2007, 52.8% in 2006 and 54.1% in 2005.

The decrease in the segment operating income margin in

2007 was primarily due to the addition of BellSouth’s

operating results, including the amortization of BellSouth’s

customer lists acquired as a part of the acquisition. The

decrease in the segment operating income margin in 2006

was primarily the result of increased operating expenses.