AT&T Uverse 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 AT&T Uverse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 AT&T Annual Report

| 67

and had maturities ranging from 2007 to 2097. Included in

our “Total notes and debentures” balance in the table above

was the face value of acquired debt from BellSouth and

AT&T Mobility of $25,234, which had a carrying amount of

$26,968 at December 31, 2006.

Included in the table above at December 31, 2006, was

$1,734 representing the remaining excess of the fair value

over the recorded value of debt in connection with the

acquisition of BellSouth and AT&T Mobility. The excess is

amortized over the remaining lives of the underlying debt

obligations.

We have debt instruments that may require us to repur-

chase the debt or which may alter the interest rate associated

with that debt. We have $1,000 of Puttable Reset Securities

(PURS) at 4.2% maturing in 2021 with an annual put option

by the holder. If the holders of our PURS do not require us

to repurchase the securities, the interest rate will be reset

based on current market conditions. Since these securities

can be put to us annually, the balance is included in current

maturities of long-term debt in our balance sheet.

Beginning in May 2009, our $500 zero-coupon puttable

note may be presented for redemption by the holder at

specified dates, but not more frequently than annually,

excluding 2011. If the note is held to maturity in 2022, the

redemption amount will be $1,030.

As of December 31, 2007 and 2006, we were in compliance

with all covenants and conditions of instruments governing

our debt. Substantially all of our outstanding long-term debt

is unsecured. Excluding capitalized leases and the effect of

interest rate swaps, the aggregate principal amounts of

long-term debt and the corresponding weighted-average

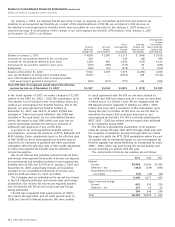

interest rate scheduled for repayment are as follows:

There-

2008 2009 2010 2011 2012 after

Debt

repayments $4,926 $5,965 $3,766 $7,534 $4,894 $32,771

Weighted-

average

interest rate 5.5% 4.9% 6.2% 7.1% 6.6% 6.4%

Financing Activities

Debt During 2007, debt repayments totaled $10,183 and

consisted of:

• $3,871 related to debt repayments with a weighted-

average interest rate of 6.1%, which included the early

redemption of debt related to a put exercise on $1,000

of our 4.2% PURS and called debt of $500 with an

interest rate of 7.0%.

• $3,411 related to repayments of commercial paper and

other short-term bank borrowings.

• $1,735 related to the early redemption of Dobson debt

acquired with a par value of $1,599 and a weighted-

average interest rate of 9.1%.

• $904 related to the early repayment of a Dobson

long-term credit facility.

• $218 related to the early redemption of a convertible

note held by Dobson.

• $44 related to scheduled principal payments on other

debt and repayments of other borrowings.

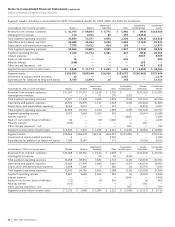

The following table is a reconciliation of our investments

in equity affiliates as presented on our consolidated balance

sheets:

2007 2006

Beginning of year $1,995 $2,031

Additional investments 8 5

Equity in net income of affiliates 692 535

Dividends received (395) (97)

Currency translation adjustments (18) (22)

Other adjustments (12) (457)

End of year $2,270 $1,995

Undistributed earnings from equity affiliates were $2,335

and $2,038 at December 31, 2007 and 2006, respectively.

The currency translation adjustment for 2007 and 2006

primarily reflects the effect of exchange rate fluctuations

on our investments in Telmex and América Móvil. “Other

adjustments” for 2006 consisted primarily of $375

representing the consolidation of Cellular Communications

of Puerto Rico, YPC and other domestic wireless investments

as wholly-owned subsidiaries of AT&T as a result of the

BellSouth acquisition and $75 representing purchase

accounting revaluation of equity investments in ATTC.

The fair value of our investment in Telmex, based on the

equivalent value of Telmex L shares at December 31, 2007,

was $3,315. The fair value of our investment in América Móvil,

based on the equivalent value of América Móvil L shares at

December 31, 2007, was $8,808.

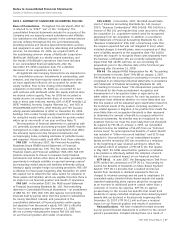

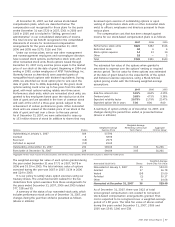

NOTE 8. DEBT

Long-term debt of AT&T and its subsidiaries, including interest

rates and maturities, is summarized as follows at December 31:

2007 2006

Notes and debentures

Interest Rates Maturities

4.03% – 5.98% 2007 – 2054 $23,324 $18,571

6.00% – 7.88% 2007 – 2097 29,282 24,685

8.00% – 9.10% 2007 – 2031 7,114 8,626

Other 136 141

Fair value of interest rate swaps 88 (80)

59,944 51,943

Unamortized premium, net of discount 2,049 2,323

Total notes and debentures 61,993 54,266

Capitalized leases 201 211

Total long-term debt, including

current maturities 62,194 54,477

Current maturities of long-term debt (4,939) (4,414)

Total long-term debt $57,255 $50,063

On December 29, 2006, we included on our balance sheet

$28,321 in long-term debt and capital leases related to our

acquisition of BellSouth (see Note 2). The debt of AT&T

Mobility was included in that amount since it is now a

subsidiary of AT&T. BellSouth’s and AT&T Mobility’s long-term

debt included both fixed and floating interest rates with a

weighted-average rate of 6.7% (ranging from 4.2% to 8.8%)