AT&T Uverse 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 AT&T Uverse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 AT&T Annual Report

| 57

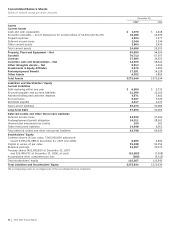

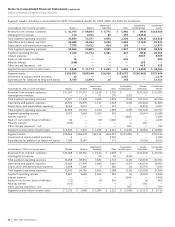

Notes to Consolidated Financial Statements

Dollars in millions except per share amounts

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation Throughout this document, AT&T Inc.

is referred to as “AT&T,” “we” or the “Company.” The

consolidated financial statements include the accounts of the

Company and our majority-owned subsidiaries and affiliates.

Our subsidiaries and affiliates operate in the communications

services industry throughout the U.S. and internationally,

providing wireless and wireline telecommunications services

and equipment as well as directory advertising and publishing

services. On December 29, 2006, we acquired 100% of

the outstanding common shares of BellSouth Corporation

(BellSouth). BellSouth is a wholly-owned subsidiary, and

the results of BellSouth’s operations have been included

in our consolidated financial statements after the

December 29, 2006 acquisition date. For a detailed

discussion of our acquisition, see Note 2.

All significant intercompany transactions are eliminated in

the consolidation process. Investments in partnerships, joint

ventures, and less-than-majority-owned subsidiaries where

we have significant influence are accounted for under the

equity method. Prior to the closing of the BellSouth

acquisition on December 29, 2006, we accounted for our

joint ventures with BellSouth under the equity method since

we shared control equally. Thus, for 2006 we recorded as

equity income our proportionate share of economic owner-

ship in these joint ventures, namely, 60% of AT&T Mobility LLC

(AT&T Mobility), formerly Cingular Wireless LLC, and 66% of

YELLOWPAGES.COM (YPC). AT&T Mobility and YPC became

wholly-owned subsidiaries of AT&T on December 29, 2006.

Earnings from certain foreign equity investments accounted

for using the equity method are included for periods ended

within up to one month of our year end (see Note 7).

The preparation of financial statements in conformity with

U.S. generally accepted accounting principles (GAAP) requires

management to make estimates and assumptions that affect

the amounts reported in the financial statements and

accompanying notes, including estimates of probable losses

and expenses. Actual results could differ from those estimates.

FAS 159 In February 2007, the Financial Accounting

Standards Board (FASB) issued Statement of Financial

Accounting Standards No. 159, “The Fair Value Option for

Financial Assets and Financial Liabilities” (FAS 159). FAS 159

permits companies to choose to measure many financial

instruments and certain other items at fair value, providing the

opportunity to mitigate volatility in reported earnings caused

by measuring related assets and liabilities differently without

having to apply complex hedge accounting provisions. FAS 159

is effective for fiscal years beginning after November 15, 2007.

We elected not to adopt the fair value option for valuation of

those assets and liabilities which are eligible, therefore there is

no impact on our financial position and results of operations.

FAS 160 In December 2007, the FASB issued Statement

of Financial Accounting Standards No. 160, “Noncontrolling

Interests in Consolidated Financial Statements – an amendment

of ARB No. 51” (FAS 160). FAS 160 requires noncontrolling

interests held by parties other than the parent in subsidiaries

be clearly identified, labeled, and presented in the

consolidated statement of financial position within equity,

but separate from the parent’s equity. FAS 160 is effective

for fiscal years beginning after December 15, 2008.

We are currently evaluating the impact FAS 160 will have

on our financial position and results of operations.

FAS 141(R) In December 2007, the FASB issued State-

ment of Financial Accounting Standards No. 141 (revised

2007), “Business Combinations” (FAS 141(R)). FAS 141(R) is a

revision of FAS 141 and requires that costs incurred to effect

the acquisition (i.e., acquisition-related costs) be recognized

separately from the acquisition. In addition, in accordance

with Statement of Financial Accounting Standards No. 141,

“Business Combinations” (FAS 141), restructuring costs that

the acquirer expected but was not obligated to incur, which

included changes to benefit plans, were recognized as if they

were a liability assumed at the acquisition date. FAS 141(R)

requires the acquirer to recognize those costs separately from

the business combination. We are currently evaluating the

impact that FAS 141(R) will have on our accounting for

acquisitions prior to the effective date of the first fiscal year

beginning after December 15, 2008.

FIN 48 We adopted FASB Interpretation No. 48, “Accounting

for Uncertainty in Income Taxes” (FIN 48) on January 1, 2007.

FIN 48 clarifies the accounting for uncertainty in income taxes

recognized in an enterprise’s financial statements in accordance

with Statement of Financial Accounting Standards No. 109,

“Accounting for Income Taxes.” The interpretation prescribes

a threshold for the financial statement recognition and

measurement of a tax position taken or expected to be

taken within an income tax return. For each tax position, the

enterprise must determine whether it is more likely than not

that the position will be sustained upon examination based on

the technical merits of the position, including resolution of

any related appeals or litigation. A tax position that meets the

more likely than not recognition threshold is then measured

to determine the amount of benefit to recognize within the

financial statements. No benefits may be recognized for tax

positions that do not meet the more likely than not threshold.

As required by FIN 48, on January 1, 2007, we reclassified

deferred income tax liabilities of $6,225 from our “Deferred

income taxes” for unrecognized tax benefits, of which $6,100

was included in “Other noncurrent liabilities” and $175 was

included in “Accrued taxes” on our consolidated balance

sheets and the remaining $50 was recorded as a reduction

to the beginning-of-year retained earnings to reflect the

cumulative effect of adoption of FIN 48 in the first quarter.

In May 2007, the FASB issued further guidance on whether

a tax position is effectively settled, the adoption of which

did not have a material impact on our financial position.

EITF 06-11 In June 2007, the Emerging Issues Task Force

(EITF) ratified the consensus on EITF 06-11, “Accounting for

Income Tax Benefits of Dividends on Share-Based Payment

Awards.” EITF 06-11 provides that a realized income tax

benefit from dividends or dividend equivalents that are

charged to retained earnings and are paid to employees for

nonvested equity-classified share-based awards and equity-

classified outstanding share options should be recognized

as an increase to additional paid-in capital rather than a

reduction of income tax expense. EITF 06-11 applies

prospectively to the income tax benefits that result from

dividends on equity-classified employee share-based payment

awards that are declared in fiscal periods beginning after

December 15, 2007. EITF 06-11 will not have a material

impact on our financial position and results of operations.

Reclassifications We have reclassified certain amounts

in prior-period financial statements to conform to the current

period’s presentation. Included among these, as a result of