AT&T Uverse 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 AT&T Uverse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

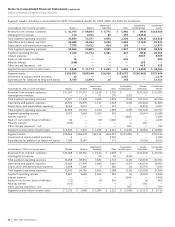

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

62

| 2007 AT&T Annual Report

Adjustments were primarily related to valuation estimates

that, due to the proximity of the merger to year-end, were

based on data from periods prior to the close of the

December 29, 2006 acquisition. Using the December 29, 2006

data, purchase price allocations decreased the opening

balance sheet values of property, plant and equipment,

trademark/names and other intangibles, offset by an

increased value of licenses and customer lists and relation-

ships acquired. Deferred tax adjustments are associated

with the above-mentioned items.

Substantially all of the licenses acquired have an indefinite

life, and accordingly, are not subject to amortization. The

majority of customer relationship intangible assets are being

amortized over a weighted-average period of 6.4 years using

the sum-of-the-months-digits method. This method best

reflects the estimated pattern in which the economic benefits

will be consumed. Other intangible assets and other

noncurrent liabilities include lease and sublease contracts,

which are amortized over the remaining terms of the

underlying leases and have a weighted-average amortization

period of 6.4 years.

AT&T Corp. In November 2005, we acquired ATTC in a

transaction accounted for under FAS 141, issuing 632 million

shares. ATTC was one of the nation’s leading business service

communications providers, offering a variety of global

communications services, including large domestic and

multinational businesses, small and medium-size businesses

and government agencies, and operated one of the leading

telecommunications networks in the U.S. ATTC also provided

domestic and international long-distance and usage-based-

communications services to consumer customers. ATTC is now

a wholly-owned subsidiary of AT&T and the results of ATTC’s

operations have been included in our consolidated financial

statements after the November 18, 2005 acquisition date.

Under the purchase method of accounting, the transaction

was valued, for accounting purposes, at $15,517 and the

assets and liabilities of ATTC were recorded at their respective

fair values as of the date of the acquisition.

Other Acquisitions During 2007, we acquired Interwise®,

a global provider of voice, Web and video conferencing

services to businesses for $122 and Ingenio®, a provider

of Pay Per Call® technology for directory and local search

business for $195, net of cash. We recorded $304 of goodwill

related to these acquisitions.

During 2006, we acquired Comergent Technologies, Nistevo

Corporation and USinternetworking, Inc., for a combined

$500, recording $333 in goodwill. The acquisitions of these

companies are designed to enhance our service offerings for

Web hosting and application management. In January 2005,

we acquired Yantra Corporation (Yantra) for $169 in cash and

recorded goodwill of $98. Yantra is a provider of distributed

order management and supply-chain fulfillment services.

Dispositions

In May 2007, we sold to Clearwire Corporation (Clearwire),

a national provider of wireless broadband Internet access,

education broadband service spectrum and broadband radio

service spectrum valued at $300. Sale of this spectrum was

required as a condition to the approval of our acquisition of

BellSouth.

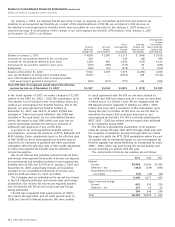

Valuation and Other Adjustments

As ATTC and BellSouth stock options that were converted

at the time of the respective acquisitions are exercised, the

tax effect on those options may further reduce goodwill.

During 2007, we recorded $9 in related goodwill reductions

for ATTC and $33 for BellSouth.

Included in the current liabilities reported on our

consolidated balance sheet are accruals established under

EITF Issue No. 95-3, “Recognition of Liabilities in Connection

with a Purchase Business Combination” (EITF 95-3). The

liabilities include accruals for severance, lease terminations

and equipment removal costs associated with our

acquisitions of ATTC and BellSouth.

Included in the liabilities valued for the December 2006

acquisition of BellSouth was accrued severance of $535 for

BellSouth employees and $44 for AT&T Mobility employees,

all of which will be paid from company cash. In addition,

we also reviewed, confirmed and developed plans affecting

the integration of retail stores, administrative space and

networks, including those acquired in AT&T Mobility’s

acquisition of AT&T Wireless Services, Inc. When these

acquisition plans were finalized during 2007, we recorded

additional accruals for severance, lease terminations and

equipment removal costs at AT&T Mobility.

Following is a summary of the accruals recorded at

December 31, 2006, cash payments made during 2007

and the purchase accounting adjustments thereto, for

the acquisitions of ATTC and BellSouth.

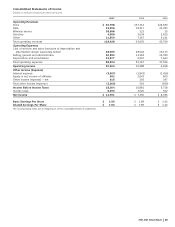

12/31/06 Cash Additional 12/31/07

Balance Payments Accruals Adjustments Balance

Severance accruals paid from:

Company funds $ 986 $(417) $ 42 $ (71) $ 540

Pension and postemployment benefit plans 183 (54) — — 129

Lease terminations 146 (149) 422 6 425

Equipment removal and other related costs 117 (125) 214 (45) 161

Total $1,432 $(745) $678 $(110) $1,255