AT&T Uverse 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 AT&T Uverse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

70

| 2007 AT&T Annual Report

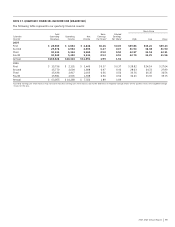

On January 1, 2007, we adopted FIN 48 (see Note 1) and, as required, we reclassified $6,225 from net deferred tax

liabilities to unrecognized tax benefits. As a result of the implementation of FIN 48, we recognized a $50 increase in

the liability for unrecognized tax benefits, which was accounted for as a reduction to the January 1, 2007 balance of

retained earnings. A reconciliation of the change in our unrecognized tax benefits (UTB) balance from January 1, 2007

to December 31, 2007, is as follows:

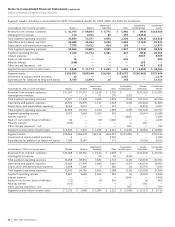

Unrecognized

Income

Gross Deferred Tax Benefits,

Federal, Accrued Unrecognized Federal and Net of Deferred

State and Interest Income State Income Federal and

Foreign Tax and Penalties Tax Benefits Tax Benefits State Benefits

Balance at January 1, 2007 $ 4,895 $ 1,380 $ 6,275 $ (846) $ 5,429

Increases for tax positions related to the current year 429 — 429 (30) 399

Increases for tax positions related to prior years 1,324 606 1,930 (315) 1,615

Decreases for tax positions related to prior years (478) (298) (776) 93 (683)

Settlements (269) (10) (279) 17 (262)

Balance at December 31, 2007 5,901 1,678 7,579 (1,081) 6,498

Less: tax attributable to timing items included above (3,911) — (3,911) 189 (3,722)

Less: UTB included above that relate to acquired entities

that would impact goodwill if recognized (623) (174) (797) 216 (581)

Total UTB that, if recognized, would impact the effective

income tax rate as of December 31, 2007 $ 1,367 $1,504 $ 2,871 $ (676) $ 2,195

In the fourth quarter of 2007, we made a deposit of $1,000

related to the AT&T Inc. 2000 – 2002 IRS examination cycle.

This deposit is not included in the reconciliation above but

reduces our unrecognized tax benefits balance. Net of this

deposit, our unrecognized tax benefits balance at

December 31, 2007, was $6,579, of which $5,894 was

included in “Other noncurrent liabilities” and $685 was

included in “Accrued taxes” on our consolidated balance

sheets. We expect to pay $685 within one year, but we

cannot reasonably estimate the timing or amounts of

additional cash payments, if any, at this time.

A portion of our unrecognized tax benefits relates to

pre-acquisition uncertain tax positions of ATTC, BellSouth and

AT&T Mobility. Future adjustments (prior to the effective date

of FAS 141(R)) to these unrecognized tax benefits may be

required to be allocated to goodwill and other purchased

intangibles. After the effective date of FAS 141(R), adjustment

of these unrecognized tax benefits may be reflected in

income tax expense.

We record interest and penalties related to federal, state

and foreign unrecognized tax benefits in income tax expense.

Accrued interest and penalties included in unrecognized tax

benefits were $1,380 and $1,678 as of January 1, 2007 and

December 31, 2007, respectively. Interest and penalties

included in our consolidated statements of income were

$303 for both December 31, 2007 and 2006.

The Company and our subsidiaries file income tax returns

in the U.S. federal jurisdiction and various state and foreign

jurisdictions. Our income tax returns are regularly audited

and reviewed by the IRS as well as by state and foreign

taxing authorities.

The IRS has completed field examinations of AT&T’s

tax returns through 2002, and all audit periods prior to

1998 are closed for federal purposes. We were unable

to reach agreement with the IRS on one issue related to

our 1998 and 1999 tax returns and, as a result, we have filed

a refund suit in U.S. District Court. We are engaged with the

IRS Appeals Division (Appeals) in settling our 2000 – 2002

returns and may reach a resolution of this examination cycle

during the next 12 months. At this time, we are not able to

determine the impact that resolution may have on our

unrecognized tax benefits. The IRS is currently examining the

AT&T 2003 – 2005 tax returns, and we expect their fieldwork

to be completed during 2008.

The IRS has completed the examination of all acquired

entity tax returns through 2003 (ATTC through 2004) and, with

the exception of BellSouth, all years through 2001 are closed.

We expect to settle the ATTC 2005 examination within the next

12 months with an immaterial impact on our unrecognized tax

benefits. Appeals has issued BellSouth an assessment for years

1999 – 2001, which was paid during the second quarter, and

we are reviewing our options with this case.

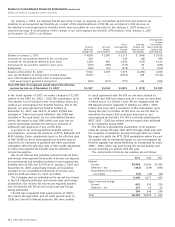

The components of income tax expense are as follows:

2007 2006 2005

Federal:

Current $5,903 $3,344 $1,385

Deferred – net (413) (139) (681)

Amortization of investment

tax credits (31) (28) (21)

5,459 3,177 683

State, local and foreign:

Current 621 295 226

Deferred – net 173 53 23

794 348 249

Total $6,253 $3,525 $ 932