AT&T Uverse 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 AT&T Uverse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 AT&T Annual Report

| 65

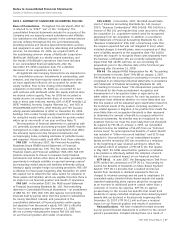

NOTE 5. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment is summarized as follows at

December 31:

Lives

(years) 2007 2006

Land — $ 1,860 $ 1,925

Buildings 35-45 23,670 23,481

Central office equipment 3-10 70,632 63,997

Cable, wiring and conduit 10-50 68,676 64,483

Other equipment 5-15 32,606 33,448

Software 3-5 9,298 11,678

Under construction — 3,776 3,137

210,518 202,149

Accumulated depreciation

and amortization 114,628 107,553

Property, plant and

equipment – net $ 95,890 $ 94,596

Our depreciation expense was $15,625 in 2007, $8,874 in

2006 and $7,372 in 2005.

Certain facilities and equipment used in operations are

leased under operating or capital leases. Rental expenses

under operating leases were $2,566 for 2007, $869 for 2006,

and $473 for 2005. The future minimum rental payments

under noncancelable operating leases for the years 2008

through 2012 are $2,088, $1,850, $1,629, $1,399 and

$1,223, with $6,958 due thereafter. Capital leases are

not significant.

American Tower Corp. Agreement

In August 2000, we reached an agreement with American

Tower Corp. (American Tower) under which we granted

American Tower the exclusive rights to lease space on a

number of our communications towers. In exchange, we

received a combination of cash and equity instruments as

complete prepayment of rent with the closing of each leasing

agreement. The value of the prepayments was recorded as

deferred revenue and recognized in income as revenue over

the life of the leases. The balance of deferred revenue was

$539 in 2007, $568 in 2006, and $598 in 2005.

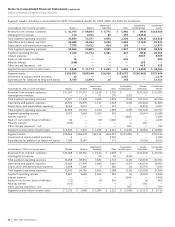

NOTE 6. GOODWILL AND OTHER INTANGIBLE ASSETS

Changes in the carrying amounts of goodwill, by segment, for the years ended December 31, 2007 and 2006, are as follows:

Advertising

Wireless Wireline & Publishing Other Total

Balance as of January 1, 2006 $ — $ 12,795 $ 8 $1,252 $ 14,055

Goodwill acquired:

BellSouth acquisition 27,429 20,939 5,528 — 53,896

Other — 197 128 139 464

Goodwill adjustment related to ATTC acquisition — (989) — — (989)

Other 681 — — (450) 231

Balance as of December 31, 2006 28,110 32,942 5,664 941 67,657

Goodwill acquired 2,623 133 171 — 2,927

Goodwill adjustment related to BellSouth acquisition 1,989 (1,554) — — 435

Settlement of IRS audit — (123) — — (123)

Goodwill adjustments for prior-year acquisitions and FIN 48 — (44) (51) (32) (127)

Other (9) (53) 4 2 (56)

Balance as of December 31, 2007 $32,713 $31,301 $5,788 $ 911 $70,713

Goodwill is tested annually for impairment, with any impairments being expensed in that period’s income statement. Due to the

proximity of our acquisition of BellSouth to year-end 2006, we originally recorded all BellSouth assets, including goodwill, in our

other segment. In 2007, in conjunction with our segment realignment (see Note 4) we moved the initial BellSouth goodwill to our

wireline and advertising & publishing segments. During our allocation period, we completed purchase accounting adjustments to

the AT&T Mobility and BellSouth goodwill (see Note 2). Other changes to goodwill include adjustments totaling $42 for the tax

effect of stock options exercised.