Xcel Energy 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

market value exercise price. Instead, equity-based compensation arrangements will be measured and recognized based on the grant-

date fair value using an option-pricing model (such as Black-Scholes or Binomial) that considers at least six factors identified in SFAS

No. 123R. An expense related to the difference between the grant-date fair value and the purchase price would be recognized over the

vesting period of the options. Under previous guidance, companies were allowed to initially estimate forfeitures or recognize them as

they actually occurred. SFAS No. 123R requires companies to estimate forfeitures on the date of grant and to adjust that estimate

when information becomes available that suggests actual forfeitures will differ from previous estimates. Revisions to forfeiture

estimates will be recorded as a cumulative effect of a change in accounting estimate in the period in which the revision occurs.

Previous accounting guidance allowed for compensation expense related to share-based payment awards to be reversed if the target

was not met. However, under SFAS No. 123R, compensation expense for share-based payment awards that expire unexercised due to

the company’s failure to reach a certain target stock price cannot be reversed. Any accruals made for Xcel Energy’s restricted stock

unit award that was granted in 2004 and is based on a total shareholder return (TSR) cannot be reversed if the target is not met. As

required, Xcel Energy adopted the provisions in the first quarter of 2006 using the modified prospective application. Since stock

options had vested and other awards were recorded at their fair values prior to implementation of SFAS No. 123R, implementation did

not have a material impact on net income or earnings per share. Pro forma net income under SFAS No. 123R for the quarter and

twelve months ended Dec. 31, 2006 would not have been materially different than what was recorded.

Since the vesting of the 2004 restricted stock units is predicated on the achievement of a market condition, the achievement of a TSR,

the fair value used to calculate the expense related to this award is based on the stock price on the date of grant adjusted for the

uncertainty surrounding the achievement of the TSR. Since the vesting of the 2005 and 2006 restricted stock units is predicated on the

achievement of a performance condition, the achievement of an earnings per share or environmental measures target, fair values used

to calculate the expense on these plans are based on the amount of the award calculated as a percentage of salaries and approved by

Xcel Energy’s board of directors. The performance share plan awards have been historically settled partially in cash and therefore do

not qualify as an equity award, but are accounted for as a liability award. As a liability award, the fair value on which expense is based

is remeasured each period based on the current stock price, and final expense is based on the market value of the shares on the date the

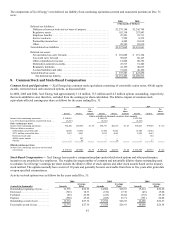

award is settled. Compensation expense related to share-based awards of approximately $47 million and $33 million was recorded in

2006 and 2005, respectively. As of Dec. 31, 2006, there was approximately $19 million of total unrecognized compensation cost

related to non-vested share-based compensation awards. Total unrecognized compensation expense will be adjusted for future changes

in estimated forfeitures. We expect to recognize that cost over a weighted-average period of 1.7 years. The amount of cash used to

settle these awards was $11 million and $4 million for 2006 and 2005, respectively.

Prior to 2006, Xcel Energy applied Accounting Principles Board Opinion No. 25 — “Accounting for Stock Issued to Employees” in

accounting for stock-based compensation and, accordingly, no compensation cost was recognized for the issuance of stock options, as

the exercise price of the options equaled the fair-market value of Xcel Energy’s common stock at the date of grant. In December 2002,

the FASB issued SFAS No. 148 — “Accounting for Stock-Based Compensation — Transition and Disclosure,” amending SFAS

No. 123 to provide alternative methods of transition for a voluntary change to the fair-value-based method of accounting for stock-

based employee compensation, and requiring disclosure in both annual and interim Consolidated Financial Statements about the

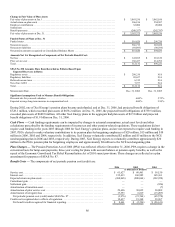

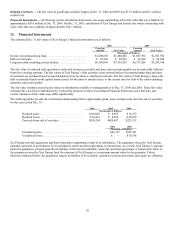

method used and the effect of the method used on results. The pro forma impact of applying SFAS No. 148 was as follows at Dec. 31:

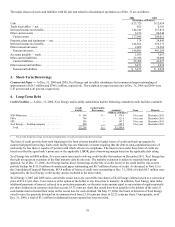

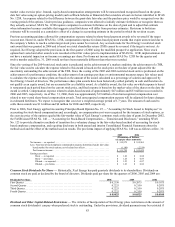

2005 2004

(Thousands of Dollars,

except per share amounts)

Net income — as reported............................................. $ 512,972 $ 355,961

Less: Total stock-based employee compensation expense determined under fair-value-

based method for stock options, net of related tax effects .................... (1,180) (2,339)

Pro forma net income .............................................. $ 511,792 $ 353,622

Earnings per share:

Basic — as reported ............................................. $ 1.26 $ 0.88

Basic — pro forma.............................................. $ 1.26 $ 0.87

Diluted — as reported............................................ $ 1.23 $ 0.87

Diluted — pro forma............................................. $ 1.23 $ 0.86

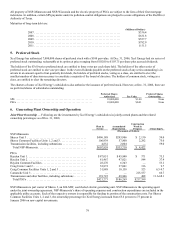

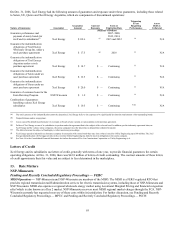

Common Stock Dividends Per Share — Historically, Xcel Energy has paid quarterly dividends to its shareholders. Dividends on

common stock are paid as declared by the board of directors. Dividends paid per share for the quarters of 2006, 2005 and 2004 are:

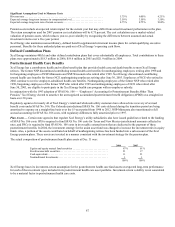

Dividends Per Share 2006 2005 2004

First Quarter .................................................... $ 0.2150 $ 0.2075 $ 0.1875

Second Quarter .................................................. 0.2225 0.2150 0.2075

Third Quarter.................................................... 0.2225 0.2150 0.2075

Fourth Quarter................................................... 0.2225 0.2150 0.2075

$ 0.8825 $ 0.8525 $ 0.8100

Dividend and Other Capital-Related Restrictions — The Articles of Incorporation of Xcel Energy place restrictions on the amount of

common stock dividends it can pay when preferred stock is outstanding. Under the provisions, dividend payments may be restricted if