Xcel Energy 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

defendants opposed. On Sept. 30, 2005, the U.S. District Court granted plaintiffs’ motion for class certification. On Oct. 17, 2005,

defendants filed a petition with the Second Circuit Court of Appeals challenging the class certification. On Dec. 5, 2005, e prime

reached a tentative settlement with the plaintiffs that received final court approval in May 2006. The settlement was paid by e prime

and it did not have a material financial impact on Xcel Energy.

Department of Labor Audit — In 2001, Xcel Energy received notice from the U.S. DOL Employee Benefit Security Administration

that it intended to audit the Xcel Energy pension plan. After multiple on-site meetings and interviews with Xcel Energy personnel, the

DOL indicated on Sept. 18, 2003, that it was prepared to take the position that Xcel Energy, as plan sponsor and through its delegate,

the Pension Trust Administration Committee, breached its fiduciary duties under ERISA with respect to certain investments made in

limited partnerships and hedge funds in 1997 and 1998. The DOL has offered to conclude the audit if Xcel Energy is willing to

contribute to the plan the full amount of losses from the questioned investments, or approximately $7 million. On July 19, 2004, Xcel

Energy formally responded with a letter to the DOL that asserted no fiduciary violations have occurred and extended an offer to meet

to discuss the matter further. In 2005, and again in January 2006, the DOL submitted two additional requests for information related to

the investigation, and Xcel Energy submitted timely responses to each request.

On June 12, 2006, the DOL issued a letter to the Xcel Energy Pension Trust Administration Committee indicating that, although there

may have been a breach of the Committee’s fiduciary obligations under ERISA, the DOL will not pursue any action against the

Committee or the pension plan with respect to these alleged breaches due, in part, to the steps the Committee has taken in outsourcing

certain investment management and administration functions to third parties.

NewMech vs. Northern States Power Company — On May 16, 2006, NewMech served and filed a complaint against NSP-

Minnesota, Southern Minnesota Municipal Power Agency (SMMPA), and Benson Engineering in the Minnesota State District Court,

Sherburne County, alleging entitlement to payment in the amount of approximately $4.2 million for unpaid costs allegedly associated

with construction work done by NewMech at NSP-Minnesota and SMMPA’s jointly owned Sherco 3 generating plant in 2005.

NewMech had previously served a mechanic’s lien, and sought, through this action, foreclosure of the lien and sale of the property.

NewMech additionally sought the claimed damages as a result of an alleged breach of contract by NSP-Minnesota. NSP-Minnesota,

SMMPA and Benson filed answers denying NewMech’s allegations. Additionally, NSP-Minnesota and SMMPA counterclaimed for

damages in excess of $7 million for breach of contract, delay in contract performance, misrepresentation and fraudulent inducement to

enter into the contract and slander of title. A confidential settlement of the dispute was reached on Sept. 29, 2006 and it did not have a

material financial impact on Xcel Energy.

Additional Information

For more discussion of legal claims and environmental proceedings, see Note 14 to the Consolidated Financial Statements under Item

8, incorporated by reference. For a discussion of proceedings involving utility rates and other regulatory matters, see Pending and

Recently Concluded Regulatory Proceedings under Item 1, Management’s Discussion and Analysis under Item 7, and Note 13 to the

Consolidated Financial Statements under Item 8, incorporated by reference.

Item 4 — Submission of Matters to a Vote of Security Holders

No issues were submitted for a vote during the fourth quarter of 2006.

PART II

Item 5 — Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities

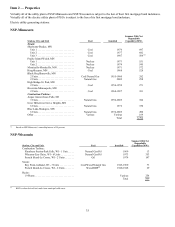

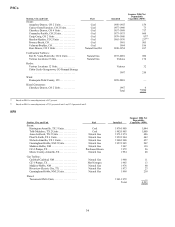

Quarterly Stock Data

Xcel Energy’s common stock is listed on the New York Stock Exchange (NYSE). The trading symbol is XEL. The following are the

reported high and low sales prices based on the NYSE Composite Transactions for the quarters of 2006 and 2005 and the dividends

declared per share during those quarters.

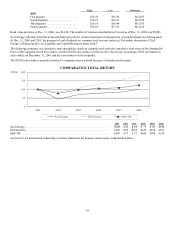

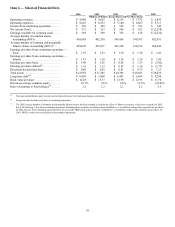

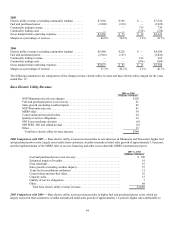

High Low Dividends

2006

First Quarter........................ $19.61 $17.91 $0.2150

Second Quarter...................... $19.76 $17.80 $0.2225

Third Quarter....................... $21.05 $18.96 $0.2225

Fourth Quarter...................... $23.63 $20.56 $0.2225