Xcel Energy 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76

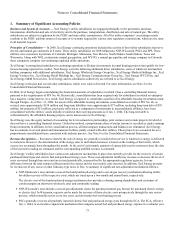

If restructuring or other changes in the regulatory environment occur, our regulated utility subsidiaries may no longer be eligible to

apply this accounting treatment, and may be required to eliminate such regulatory assets and liabilities from their balance sheets. Such

changes could have a material effect on Xcel Energy’s results of operations in the period the write-offs are recorded. See more

discussion of regulatory assets and liabilities at Note 16 to the Consolidated Financial Statements.

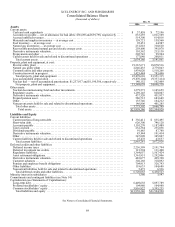

Deferred Financing Costs — Other assets included deferred financing costs, net of amortization, of approximately $47 million and

$42 million at Dec. 31, 2006 and 2005, respectively. Xcel Energy is amortizing these financing costs over the remaining maturity

periods of the related debt.

Accounts Receivable and Allowance for Uncollectibles — Accounts receivable are stated at the actual billed amount net of write-offs

and allowance for uncollectibles. Xcel Energy establishes an allowance for uncollectibles based on a reserve policy that reflects its

expected exposure to the credit risk of customers.

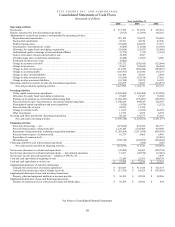

Emission Allowances — Emission allowances are recorded at cost, including the annual SO2 and NOx emission allowance

entitlement received at no cost from the Federal EPA. Xcel Energy follows the inventory model for all allowances. The sales of

allowances are reported in the Operating Activities section of the Consolidated Statements of Cash Flows. The net margin on sales of

emission allowances is included in Electric Utility Operations Revenue as it is integral to the production process of energy and our

revenue optimization strategy for our utility operations.

Reclassifications — The balance sheet and the statements of cash flows have been reclassified from prior-period presentation to

conform to the 2006 presentation. These reclassifications had no effect on net income or earnings per share. The reclassifications were

related to the presentation of regulatory assets and liabilities for ARO and decommissioning activities on a net basis. These

reclassifications did not affect total operating, investing or financing within the statements of cash flows.

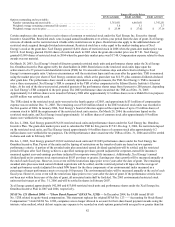

FASB Interpretation No. 48 (FIN 48) — In July 2006, the FASB issued FIN 48, “Accounting for Uncertainty in Income Taxes — an

interpretation of FASB Statement No. 109.” FIN 48 prescribes how a company should recognize, measure, present and disclose

uncertain tax positions that the company has taken or expects to take in its income tax returns. FIN 48 requires that only income tax

benefits that meet the “more likely than not” recognition threshold be recognized or continue to be recognized on its effective date.

Initial derecognition amounts would be reported as a cumulative effect of a change in accounting principle. Following

implementation, the ongoing recognition of changes in the measurement of uncertain tax positions would be reflected as a component

of income tax expense.

FIN 48 is effective for fiscal years beginning after Dec. 15, 2006. Xcel Energy has substantially completed its analysis and does not

expect the cumulative effect of the adoption to be material.

Fair Value Measurements (SFAS No. 157) — In September 2006, the FASB issued SFAS No. 157, which provides a single

definition of fair value, together with a framework for measuring it, and requires additional disclosure about the use of fair value to

measure assets and liabilities. SFAS No. 157 also emphasizes that fair value is a market-based measurement, and sets out a fair value

hierarchy with the highest priority being quoted prices in active markets. Fair value measurements are disclosed by level within that

hierarchy. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after Nov. 15, 2007. Xcel Energy is

evaluating the impact of SFAS No. 157 on its financial condition and results of operations and does not expect the impact of

implementation to be material.

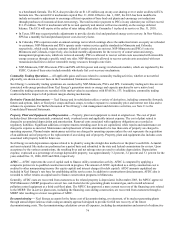

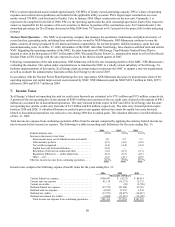

2. Discontinued Operations

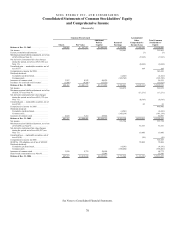

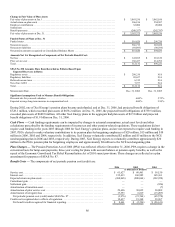

Xcel Energy classified and accounted for certain assets as held for sale at Dec. 31, 2006 and 2005. Assets held for sale are valued on

an asset-by-asset basis at the lower of carrying amount or fair value less costs to sell. In applying those provisions, management

considered cash flow analyses, bids and offers related to those assets and businesses. Assets held for sale are not depreciated.

Results of operations for divested businesses and the results of businesses held for sale are reported for all periods presented on a net

basis as discontinued operations. In addition, the assets and liabilities of the businesses divested and held for sale in 2006 and 2005

have been reclassified to assets and liabilities held for sale in the accompanying Balance Sheet.

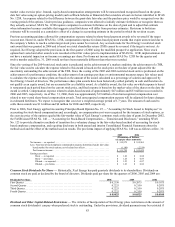

Regulated Utility Subsidiaries

In 2005, Black Hills Corp. purchased all the common stock of Cheyenne, including the assumption of outstanding debt of

approximately $25 million, for approximately $90 million, plus a working capital adjustment finalized in 2005. The sale resulted in an

after-tax loss of approximately $13 million, or 3 cents per share.