Xcel Energy 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

• Xcel Energy is participating in a voluntary carbon management program and has established goals to reduce its volume of

carbon dioxide emissions by 12 million tons by 2009, and to reduce carbon intensity by 7 percent by 2012.

• In certain regulatory jurisdictions, Xcel Energy uses an evaluation process for future generating resources that incorporates the

risk of future carbon limits through the use of a carbon cost adder or externality costs.

• PSCo is in the process of developing an IGCC plant that generates electricity using gasified coal and will be the first plant of

its kind to capture and sequester a portion of the carbon dioxide generated by the plant.

• Xcel Energy is the largest retail provider of wind generated energy in the nation and continues to grow its wind portfolio.

• Xcel Energy is involved in initiatives to manage carbon dioxide, including the use of biosequestration and the study of

geological sequestration.

• Xcel Energy continues to develop and expand its customer conservation and demand side management programs.

• Xcel Energy is working with public policy makers to support the development of a national climate policy to require the

deployment of electric generation technology that emits little or no carbon dioxide.

Xcel Energy believes that it is well positioned for a variety of possible outcomes.

Impact of Nonregulated Investments

In the past, Xcel Energy’s investments in nonregulated operations had a significant impact on its results of operations. As a result of

the divestiture of NRG and other nonregulated operations, Xcel Energy does not expect that its investments in nonregulated operations

will continue to have a significant impact on its results.

Inflation

Inflation at its current level is not expected to materially affect Xcel Energy’s prices or returns to shareholders.

Critical Accounting Policies and Estimates

Preparation of the Consolidated Financial Statements and related disclosures in compliance with GAAP requires the application of

accounting rules and guidance, as well as the use of estimates. The application of these policies necessarily involves judgments

regarding future events, including the likelihood of success of particular projects, legal and regulatory challenges and anticipated

recovery of costs. These judgments could materially impact the Consolidated Financial Statements and disclosures, based on varying

assumptions. In addition, the financial and operating environment also may have a significant effect on the operation of the business

and on the results reported even if the nature of the accounting policies applied have not changed. The following is a list of accounting

policies that are most significant to the portrayal of Xcel Energy’s financial condition and results, and that require management’s most

difficult, subjective or complex judgments. Each of these has a higher potential likelihood of resulting in materially different reported

amounts under different conditions or using different assumptions. Each critical accounting policy has been discussed with the audit

committee of the Xcel Energy board of directors.

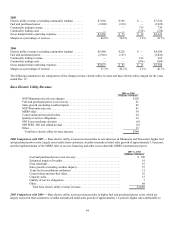

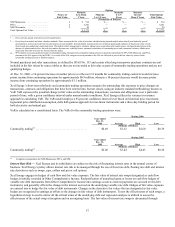

Accounting

Policy

Judgments/Uncertainties

Affecting Application See Additional Discussion At

Regulatory Mechanisms and

Cost Recovery

• Anticipated future regulatory decisions and their

impact

• External regulatory decisions, requirements and

regulatory environment

• Impact of deregulation and competition on

ratemaking process and ability to recover costs

Management’s Discussion and Analysis: Factors Affecting

Results of Continuing Operations

• Regulation

Notes to Consolidated Financial Statements

• Notes 1, 12, 13, 14 and 16

Nuclear Plant

Decommissioning and Cost

Recovery

• Costs of future decommissioning

• Availability of facilities for waste disposal

• Approved methods for waste disposal

• Useful lives of nuclear power plants

• Future recovery of plant investment and

decommissioning costs

• Re-licensing of nuclear plants impact on

decommissioning costs

Notes to Consolidated Financial Statements

• Notes 1, 14 and 15