Xcel Energy 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.105

published phase II of the rule, which applies to existing cooling water intakes at steam-electric power plants. Several lawsuits were

filed against the EPA in the United States Court of Appeals for the Second Circuit challenging the phase II rulemaking. On Jan. 25,

2007, the court issued its decision and remanded virtually every aspect of the rule to the EPA for reconsideration. It is unclear whether

the EPA will stay the deadlines in the rule until the remanded rulemaking is finished. As a result, the rule’s compliance requirements

and associated deadlines are currently unknown. It is not possible to provide an accurate estimate of the overall cost of this rulemaking

at this time due to the many uncertainties involved.

PSCo Notice of Violation — On July 1, 2002, PSCo received a Notice of Violation (NOV) from the EPA alleging violations of the

New Source Review (NSR) requirements of the Clean Air Act (CAA) at the Comanche and Pawnee plants in Colorado. The NOV

specifically alleges that various maintenance, repair and replacement projects undertaken at the plants in the mid- to late-1990s should

have required a permit under the NSR process. PSCo believes it has acted in full compliance with the CAA and NSR process. It

believes that the projects identified in the NOV fit within the routine maintenance, repair and replacement exemption contained within

the NSR regulations or are otherwise not subject to the NSR requirements. PSCo also believes that the projects would be expressly

authorized under the EPA’s NSR equipment replacement rulemaking promulgated in October 2003. PSCo disagrees with the

assertions contained in the NOV and intends to vigorously defend its position. As required by the CAA, the EPA met with Xcel

Energy in September 2002 to discuss the NOV.

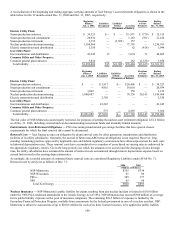

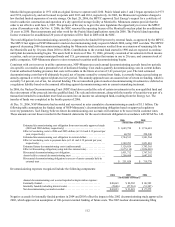

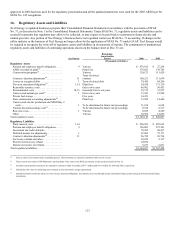

Asset Retirement Obligations

Xcel Energy records future plant removal obligations as a liability at fair value with a corresponding increase to the carrying values of

the related long-lived assets in accordance with SFAS No. 143 — “Accounting for Asset Retirement Obligations” (SFAS No. 143).

This liability will be increased over time by applying the interest method of accretion to the liability, and the capitalized costs will be

depreciated over the useful life of the related long-lived assets. The recording of the obligation for regulated operations has no income

statement impact due to the deferral of the adjustments through the establishment of a regulatory asset pursuant to SFAS No. 71.

Recorded ARO — Asset retirement obligations have been recorded for plant related to nuclear production, steam production, electric

transmission and distribution, natural gas transmission and distribution and office buildings. The steam production obligation includes

asbestos, ash-containment facilities and decommissioning. The asbestos recognition associated with the steam production includes

certain plants at NSP-Minnesota, PSCo and SPS. NSP-Minnesota also recorded asbestos recognition for its general office building.

Generally, this asbestos abatement removal obligation originated in 1973 with the CAA, which applied to the demolition of buildings

or removal of equipment containing asbestos that can become airborne on removal. Asset retirement obligations also have been

recorded for NSP-Minnesota, PSCo and SPS steam production related to ash-containment facilities such as bottom ash ponds,

evaporation ponds and solid waste landfills. The origination date on the ARO recognition for ash-containment facilities at steam plants

was the in-service date of various facilities.

Xcel Energy recognized an ARO for the retirement costs of natural gas mains at NSP-Minnesota, NSP- Wisconsin and PSCo. In

addition, an ARO was recognized for the removal of electric transmission and distribution equipment at NSP-Minnesota, NSP-

Wisconsin, PSCo and SPS. The electric transmission and distribution ARO consists of many small potential obligations associated

with polychlorinated biphenyls (PCBs), mineral oil, storage tanks, treated poles, lithium batteries, mercury and street lighting lamps.

These electric and natural gas assets have many in-service dates for which it is difficult to assign the obligation to a particular year.

Therefore, the obligation was measured using an average service life.

For the nuclear assets, the ARO associated with the decommissioning of two NSP-Minnesota nuclear generating plants, Monticello

and Prairie Island, originates with the in-service date of the facility. Monticello began operation in 1971. Prairie Island units 1 and 2

began operation in 1973 and 1974, respectively. See Note 15 to the Consolidated Financial Statements for further discussion of

nuclear obligations.

If Xcel Energy had implemented FIN No. 47 at Jan. 1, 2005, the liability for asset retirement obligations would have increased by

$55.2 million.