Xcel Energy 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.90

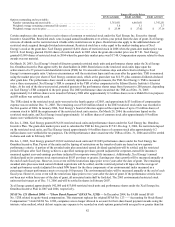

policy allows it to manage market price risk within each rate-regulated operation to the extent such exposure exists, as allowed by

regulations.

Short-Term Wholesale and Commodity Trading Risk — Xcel Energy’s utility subsidiaries conduct various short-term wholesale and

commodity trading activities, including the purchase and sale of electric capacity, energy and other energy-related instruments. Xcel

Energy’s risk-management policy allows management to conduct the marketing activity within guidelines and limitations as approved

by our risk-management committee, which is made up of management personnel not directly involved in the activities governed by

this policy.

Interest Rate Risk — Xcel Energy and its subsidiaries are subject to the risk of fluctuating interest rates in the normal course of

business. Xcel Energy’s risk-management policy allows interest rate risk to be managed through the use of fixed-rate debt, floating-

rate debt and interest rate derivatives such as swaps, caps, collars and put or call options.

Types of and Accounting for Derivative Instruments

Xcel Energy and its subsidiaries use derivative instruments in connection with its utility commodity price, interest rate, short-term

wholesale and commodity trading activities, including forward contracts, futures, swaps and options. All derivative instruments not

qualifying for the normal purchases and normal sales exception, as defined by SFAS No. 133, are recorded at fair value. The

classification of the fair value for these derivative instruments is dependent on the designation of a qualifying hedging relationship.

The adjustment to fair value of derivative instruments not designated in a qualifying hedging relationship is reflected in current

earnings or as a regulatory balance. This classification is dependent on the applicability of specific regulation. This includes certain

instruments used to mitigate market risk for the utility operations and all instruments related to the commodity trading operations. The

designation of a cash flow hedge permits the classification of fair value to be recorded within Other Comprehensive Income, to the

extent effective. The designation of a fair value hedge permits a derivative instrument’s gains or losses to offset the related results of

the hedged item in the Consolidated Statements of Income.

SFAS No. 133 requires that the hedging relationship be highly effective and that a company formally designate a hedging relationship

to apply hedge accounting. Xcel Energy and its subsidiaries formally document hedging relationships, including, among other factors,

the identification of the hedging instrument and the hedged transaction, as well as the risk-management objectives and strategies for

undertaking the hedged transaction. Xcel Energy and its subsidiaries also formally assess, both at inception and on an ongoing basis, if

required, whether the derivative instruments being used are highly effective in offsetting changes in either the fair value or cash flows

of the hedged items.

Gains or losses on hedging transactions for the sales of energy or energy-related products are primarily recorded as a component of

revenue; hedging transactions for fuel used in energy generation are recorded as a component of fuel costs; hedging transactions for

natural gas purchased for resale are recorded as a component of natural gas costs; and interest rate hedging transactions are recorded

as a component of interest expense. Certain utility subsidiaries are allowed to recover in electric or natural gas rates the costs of

certain financial instruments purchased to reduce commodity cost volatility.

Qualifying hedging relationships are designated as either a hedge of a forecasted transaction or future cash flow (cash flow hedge), or

a hedge of a recognized asset, liability or firm commitment (fair value hedge). The types of qualifying hedging transactions that Xcel

Energy and its subsidiaries are currently engaged in are discussed below.

Cash Flow Hedges

The effective portion of the change in the fair value of a derivative instrument qualifying as a cash flow hedge is recorded as a

component of Other Comprehensive Income or deferred as a regulatory asset or liability, and reclassified into earnings in the same

period or periods during which the hedged transaction affects earnings. The ineffective portion of a derivative instrument’s change in

fair value is recognized in current earnings.

Commodity Cash Flow Hedges — Xcel Energy’s utility subsidiaries enter into derivative instruments to manage variability of future

cash flows from changes in commodity prices. These derivative instruments are designated as cash flow hedges for accounting

purposes. At Dec. 31, 2006, Xcel Energy had various commodity-related contracts classified as cash flow hedges extending through

December 2009. The fair value of these cash flow hedges is recorded in either Other Comprehensive Income or deferred as a

regulatory asset or liability. This classification is based on the regulatory recovery mechanisms in place. Amounts deferred in these

accounts are recorded in earnings as the hedged purchase or sales transaction is settled. This could include the purchase or sale of

energy or energy-related products, the use of natural gas to generate electric energy or gas purchased for resale.

As of Dec. 31, 2006, Xcel Energy had no amounts in Accumulated Other Comprehensive Income related to commodity cash flow

hedge contracts that are expected to be recognized in earnings during the next 12 months as the hedged transactions settle.

Xcel Energy had immaterial ineffectiveness related to commodity cash flow hedges during the year ended Dec. 31, 2006 and no

ineffectiveness during the year ended Dec. 31, 2005.