XM Radio 2000 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

XM SATELLiTE RADiO 2000 Annual Report

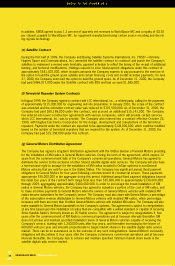

(h) Joint Development Agreement

On January 12, 1999, Sirius Radio the other holder of an FCC satellite radio license, commenced an action against

the Company in the United States District Court for the Southern District of New York, alleging that the Company

was infringing or would infringe three patents assigned to Sirius Radio. In its complaint, Sirius Radio sought money

damages to the extent the Company manufactured, used or sold any product or method claimed in their patents and

injunctive relief. On February 16, 2000, this suit was resolved in accordance with the terms of a joint development

agreement between the Company and Sirius Radio and both companies agreed to cross-license their respective

property. Each party is obligated to fund one half of the development cost for a unified standard for satellite

radios. Each party will be entitled to license fees or a credit towards its one half of the cost based upon the

validity, value, use, importance and available alternatives of the technology it contributes. The amounts for these

fees or credits will be determined over time by agreement of the parties or by arbitration. The parties have yet

to agree on the validity, value, use, importance and available alternatives of their respective technologies. If the

parties fail to reach agreement, the fees or credits may be determined through binding arbitration. However, if

this agreement is terminated before the value of the license has been determined due to the Company’s failure

to perform a material covenant or obligation, then this suit could be refiled.

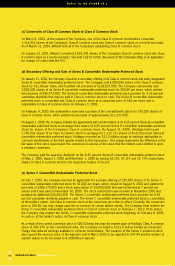

(i) Sony Warrant

In February 2000, the Company issued a warrant to Sony exercisable for shares of the Company’s Class A common

stock. The warrant will vest at the time that it attains its millionth customer, and the number of shares underlying

the warrant will be determined by the percentage of XM Radios that have a Sony brand name as of the vesting

date. If Sony achieves its maximum performance target, it will receive 2 percent of the total number of shares of

the Company’s Class A common stock on a fully-diluted basis upon exercise of the warrant. The exercise price of

the Sony warrant will equal 105 percent of fair market value of the Class A common stock on the vesting date,

determined based upon the 20-day trailing average.

(j) Approval of Change of Control

On July 14, 2000, the Company filed an application with the FCC to allow the Company to transfer its control

from Motient to a diffuse group of owners, none of whom will have controlling interest. On December 22, 2000,

the application was approved by the FCC. As discussed in note 5(c), Motient converted 2,652,243 shares of the

Company’s Class B common stock to Class A common stock on January 12, 2001. Through February 9, 2001,

Motient has sold 2,000,000 shares of Class A common stock, which reduced its voting interest to 48.7 percent

of the shares outstanding.

(k) Sales, Marketing and Distribution Agreements

The Company has entered into various joint sales, marketing and distribution agreements. Under the terms of these

agreements, the Company is obligated to provide incentives, subsidies and commissions to other companies that

may include fixed payments, per-unit subscriber amounts and revenue sharing arrangements. The amount of

these operational, promotional, subscriber acquisition, joint development, and manufacturing costs related to

these agreements cannot be estimated, but are expected to be substantial future costs.

FiNANCiALS 2000

47