XM Radio 2000 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

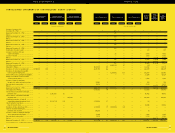

CONSOLiDATED STATEMENTS OF CASH FLOWS

(In thousands)

Cash flows from operating activities:

Net loss .................................................................................. $ (16,167) $ (36,896) $ (51,873) $ (106,595)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization .......................................... 57 1,478 3,369 4,936

Amortization of deferred financing fees .............................. —509 — 509

Non-cash stock compensation .......................................... —4,210 2,743 6,953

Non-cash charge for beneficial conversion

feature of note issued to Parent .................................... —5,520 —5,520

Changes in operating assets and liabilities:

Increase in prepaid and other current assets .......................... (212) (905) (7,738) (8,815)

Increase (decrease) in other assets........................................ — 43 — (641)

Increase in accounts payable and accrued expenses .............. 1,701 7,519 16,051 32,733

Increase (decrease) in amounts due to related parties ............ 13,322 (1,316) 1 63

Increase (decrease) in accrued interest .................................. (2) 3,053 ——

Net cash used in operating activities.............................. (1,301) (16,785) (37,447) (65,337)

Cash flows from investing activities:

Purchase of property and equipment ........................................ (506) (2,008) (51,378) (53,974)

Additions to system under construction...................................... (43,406) (159,510) (414,889) (711,173)

Net purchase/maturity of short-term investments ...................... — (69,472) 69,472 —

Net purchase/maturity of restricted investments ........................ — — (106,338) (106,338)

Other investing activities .......................................................... —(3,422) (56,268) (56,268)

Net cash used in investing activities .............................. (43,912) (234,412) (559,401) (927,753)

Cash flows from financing activities:

Proceeds from sale of common stock and capital contribution ...... —114,428 133,235 256,816

Proceeds from issuance of Series B convertible

redeemable preferred stock .................................................. — — 96,472 96,472

Proceeds from issuance of senior

secured notes and warrants .................................................. — — 322,889 322,889

Proceeds from issuance of Series C convertible

redeemable preferred stock .................................................. —— 226,822 226,822

Proceeds from issuance of subordinated

convertible notes to related parties........................................ 45,920 22,966 — 157,866

Proceeds from the issuance of options ...................................... — — — 1,500

Proceeds from issuance of convertible notes .......................... — 250,000 — 250,000

Repayment of loan payable .................................................... — (75,000) — (75,000)

Payments for deferred financing costs .................................... (393) (10,725) (8,365) (19,372)

Other net financing activities .................................................. (5) (84) ——

Net cash provided by financing activities...................... 45,522 301,585 771,053 1,217,993

Net increase in cash and cash equivalents .................................. 309 50,388 174,205 224,903

Cash and cash equivalents at beginning of period ........................ 1 310 50,698 —

Cash and cash equivalents at end of period ................................ $ 310 $ 50,698 $ 224,903 $ 224,903

Supplemental cash flow disclosure:

Increase in FCC license, goodwill and intangibles .................... $ —$ 51,624 $ —$ 51,624

Liabilities exchanged for new convertible note to related parties...... —81,676 —81,676

Non-cash interest capitalized .................................................. 11,824 15,162 16,302 45,274

Interest converted into principal note balance .......................... 9,157 4,601 ——

Accrued expenses transferred to loan balance ........................ —7,405 — —

Accrued system milestone payments ...................................... 21,867 15,500 30,192 30,192

Property acquired through capital leases ................................ —470 1,688 2,075

Conversion of debt to equity .................................................. —353,315 —353,315

Use of deposit for terrestrial repeater contract ........................ ——3,422 —

See accompanying notes to consolidated financial statements.

December

15, 1992

(Date of

Inception) to

December 31,

2000

200019991998

RADiO TO THE POWER OF X

32 XM SATELLiTE RADiO 2000 Annual Report