XM Radio 2000 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

XM SATELLiTE RADiO 2000 Annual Report

SFAS No. 138 require that all derivative instruments be recorded on the balance sheet at their respective fair values.

SFAS No. 133 and SFAS No. 138 are effective for all fiscal quarters of all fiscal years beginning after 2000. The

Company will adopt SFAS No. 133 and SFAS No. 138 on January 1, 2001. The Company has reviewed its contracts

and has determined that it has no derivative instruments and does not engage in hedging activities.

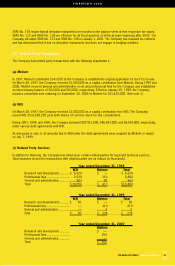

(2) Related Party Transactions

The Company had related party transactions with the following shareholders:

(a) Motient

In 1997, Motient contributed $143,000 to the Company to establish the original application for the FCC license.

On March 28, 1997, the Company received $1,500,000 as a capital contribution from Motient. During 1999 and

2000, Motient incurred general and administrative costs and professional fees for the Company and established

an intercompany balance of $62,000 and $63,000, respectively. Effective January 15, 1999, the Company

issued a convertible note maturing on September 30, 2006 to Motient for $21,419,000. (See note 3).

(b) WSI

On March 28, 1997, the Company received $1,500,000 as a capital contribution from WSI. The Company

issued WSI 25 (6,689,250 post split) shares of common stock for this consideration.

During 1997, 1998, and 1999, the Company borrowed $87,911,000, $45,583,000, and $8,953,000, respectively,

under various debt agreements with WSI.

As discussed in note 3, all amounts due to WSI under the debt agreements were acquired by Motient or repaid

on July 7, 1999.

(c) Related Party Services

In addition to financing, the Company has relied upon certain related parties for legal and technical services.

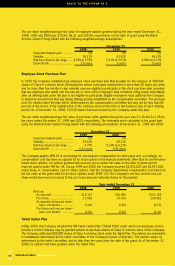

Total expenses incurred in transactions with related parties are as follows (in thousands):

Year ended December 31, 1998

WSI Motient Total

Research and development............$ 6,624 $ —$ 6,624

Professional fees........................... 2,529 353 2,882

General and administrative............. 903 60 963

Total $ 10,056 $ 413 $10,469

Year ended December 31, 1999

WSI Motient Total

Research and development............ $ 50 $ —$ 50

Professional fees........................... —219 219

General and administrative............. — 5 5

Total $ 50 $ 224 $ 274

Year ended December 31, 2000

Motient

Research and development............ $ —

Professional fees........................... 252

General and administrative............. —

Total $ 252

FiNANCiALS 2000

37