XM Radio 2000 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FiNANCiALS 2000

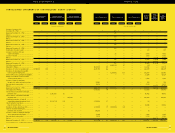

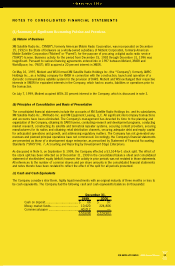

CONSOLiDATED STATEMENTS OF STOCKHOLDERS’ EQUiTY (DEFiCiT)

(In thousands, except share data) (In thousands, except share data)

Issuance of common stock

(December 15, 1992) .................................... — $ — — $ — — $ — — $ — 100 $ — — $ — $ — $ — $ —

Balance at December 31, 1992 ...................... — — — — — — — — 100 — — — — — —

Net loss ........................................................ — — — — — — — — — — — — — — —

Balance at December 31, 1993 ...................... — — — — — — — — 100 — — — — — —

Net loss ........................................................ — — — — — — — — — — — — — — —

Balance at December 31, 1994 ...................... — — — — — — — — 100 — — — — — —

Net loss ........................................................ — — — — — — — — — — — — — — —

Balance at December 31, 1995 ...................... — — — — — — — — 100 — — — — — —

Net loss ........................................................ — — — — — — — — — — — — — — —

Balance at December 31, 1996 ...................... — — — — — — — — 100 — — — — — —

Contributions to paid-in capital ........................ — — — — — — — — — — — — 143 — 143

Issuance of common stock and

capital contributions.................................... — — — — — — — — 25 — — — 9,000 — 9,000

Issuance of options ........................................ — — — — — — — — — — — — 1,500 — 1,500

Net loss ........................................................ — — — — — — — — — — — — — (1,659) (1,659)

Balance at December 31, 1997 ...................... — — — — — — — — 125 — — — 10,643 (1,659) 8,984

Net loss ........................................................ — — — — — — — — — — — — — (16,167) (16,167)

Balance at December 31, 1998 ...................... — — — — — — — — 125 — — — 10,643 (17,826) (7,183)

53,514-for-one stock split .............................. — — — — — — — — 6,689,125 67 — — (67) — —

Initial public offering ........................................ — — — — — — 10,241,000 102 — — — — 114,032 — 114,134

Conversion of Series A convertible debt .......... 10,786,504 108 — — — — 16,179,755 162 — — — — 246,079 — 246,349

Conversion of subordinated convertible

notes payable to related party .................... — — — — — — — — 11,182,926 112 — — 106,843 — 106,955

Increase in FCC license, goodwill and intangibles .. — — — — — — — — — — — — 51,624 — 51,624

Charge for beneficial conversion feature

of note issued to Parent.............................. — — — — — — — — — — — — 5,520 — 5,520

Issuance of shares to employees

through stock option and purchase plans .... — — — — — — 29,862 1 — — — — 303 — 304

Non-cash stock compensation ........................ — — — — — — 14,716 — — — — — 4,210 — 4,210

Net loss ........................................................ — — — — — — — — — — — — — (36,896) (36,896)

Balance at December 31, 1999 ...................... 10,786,504 108 — — — — 26,465,333 265 17,872,176 179 — — 539,187 (54,722) 485,017

Secondary public offering................................ — — — — — — 4,370,000 44 — — — — 132,026 — 132,070

Sale of Series B convertible redeemable ..........

preferred stock .......................................... — — 2,000,000 20 — — — — — — — — 96,452 — 96,472

Sale of Series C convertible redeemable

preferred stock .......................................... — — — — 235,000 2 — — — — — — 226,820 — 226,822

Incentivized conversion of Series B ................

convertible redeemable preferred stock ...... — — (1,132,711) (11) — — 1,700,016 17 — — — — (6) — —

Sale of warrants to purchase ..........................

Class A common stock .............................. — — — — — — — — — — — — 63,536 — 63,536

Conversion of Class B common stock .............. — — — — — — 1,314,914 13 (1,314,914) (13) — — — — —

Series B convertible redeemable......................

preferred stock dividends ............................ — — — — — — 145,166 1 — — — — (1) — —

Issuance of shares to employees through

stock option and purchase plans.................. — — — — — — 73,565 1 — — — — 1,164 — 1,165

Non-cash stock compensation ........................ — — — — — — 5,000 — — — — — 2,743 — 2,743

Net loss ........................................................ — — — — — — — — — — — — — (51,873) (51,873)

Balance at December 31, 2000 ...................... 10,786,504 $ 108 867,289 $ 9 235,000 $ 2 34,073,994 $ 341 16,557,262 $ 166 — $ — $1,061,921 $ (106,595) $ 955,952

See accompanying notes to consolidated financial statements.

Series B Convertible

Redeemable Preferred Stock

Series C Convertible

Redeemable Preferred Stock

Series A Convertible

Preferred Stock

Shares Amount Shares Amount Shares AmountShares Amount

Class A Common Stock Class B Common Stock

Shares Amount Shares Amount

Class C Common Stock

Additional

Paid-in

Capital

Deficit

Accumulated

During

Development

Stage

Total

Stockholders’

Equity

(Deficit)

XM SATELLiTE RADiO 2000 Annual Report 31

RADiO TO THE POWER OF X

30 XM SATELLiTE RADiO 2000 Annual Report