XM Radio 2000 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

XM SATELLiTE RADiO 2000 Annual Report

The following discussion and analysis provides information that we believe is relevant to an assessment and

understanding of our financial condition and consolidated results of operations. This discussion should be read

together with our consolidated financial statements and related notes.

Introduction

Overview

XM Satellite Radio Inc. was incorporated in Delaware in 1992 as a wholly-owned subsidiary of Motient

Corporation, formerly American Mobile Satellite Corporation. XM Satellite Radio Holdings Inc. became a holding

company for XM Satellite Radio Inc. in early 1997.

We are in the development stage. Since our inception in December 1992, we have devoted our efforts to

establishing and commercializing the XM Radio system. Our activities were fairly limited until 1997, when we

pursued and obtained regulatory approval from the FCC to provide satellite radio service. Our principal activities

to date have included:

•designing and developing the XM Radio system;

•negotiating contracts with satellite and launch vehicle operators, specialty programmers,

radio manufacturers and car manufacturers;

•developing technical standards and specifications;

•conducting market research; and

•securing financing for working capital and capital expenditures.

We have raised $1.3 billion to date, which is described under the heading ‘‘Liquidity and Capital Resources—

Funds Raised for Period Through Commencement of Commercial Operations.’’ We have incurred substantial losses

to date and expect to continue to incur significant losses for the foreseeable future as we continue to design,

develop and deploy the XM Radio system and for some period following our commencement of commercial operations.

We intend to capitalize all costs related to our satellite contract and our FCC license, including all applicable interest.

These capitalized costs will be depreciated over the estimated useful lives of the satellites and ground control

stations. Depreciation of our satellites will commence upon in-orbit delivery. Depreciation of our satellite control

facilities and terrestrial repeaters and the amortization of our FCC license will commence upon commercial operations.

After we begin commercial operations, which we are targeting for the summer of 2001, we anticipate that our

revenues will consist primarily of customers’ subscription fees and advertising revenues.

Results of Operations

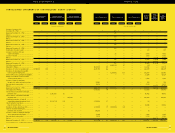

Year Ended December 31, 2000 Compared to Year Ended December 31, 1999

Research and Development. Research and development expenses increased to approximately $7.4 million in

2000, compared with approximately $4.3 million in 1999. The increase in the research and development

expenses primarily resulted from increased activity relating to our system technology development, including

chipset design and uplink technology, in 2000.

Professional Fees. Professional fees increased to approximately $22.8 million in 2000, compared with $10.0

million in 1999. The increase primarily reflects additional services of consultants, including incurring $11.3 million

for software selection and workflow process development. We expect the professional fees to trend upward as

we continue to develop marketing strategies.

General and Administrative. General and administrative expenses increased to $49.2 million in 2000, compared

with $16.4 million in 1999. The increase reflects increased headcount, facilities and sales and marketing expenses.

We have granted certain key executives stock options and incurred a non-cash compensation charge of

approximately $1.5 million in 2000 primarily for performance-based stock options. We also recorded non-cash

compensation charges of approximately $1.2 million during 2000 relating to options repriced in 1999. We also

continued the amortization of goodwill and other intangibles during 2000. We anticipate general and administrative

expenses to continue to increase through commercial operations.

FiNANCiALS 2000

21

MANAGEMENT’S DiSCUSSiON AND ANALYSiS

OF FiNANCiAL CONDiTiON AND RESULTS OF OPERATiONS