XM Radio 2000 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADiO TO THE POWER OF X

XM SATELLiTE RADiO 2000 Annual Report

With the WorldSpace Transaction, which is discussed in note 3, on July 7, 1999, WSI ceased to be a related

party; therefore, the expenses reflected for WSI are representative of the period from January 1, 1999

through July 7, 1999.

(3) Debt

(a) Loans Payable Due to Related Parties

In March 1997, XMSR entered into a series of agreements (the ‘‘Participation Agreement’’) with Motient and WSI

in which both companies provided various equity and debt funding commitments to XMSR for the purpose of

financing the activities of XMSR in connection with the establishment of a DARS satellite system in the United

States. The Participation Agreement, as well as other agreements subsequently reached between the Company,

Motient and WSI, served as the basis for several rounds of financing in the form of loans and notes with either

conversion features or options for the Company’s common stock through July 7, 1999. The Company had raised

$142,447,000 in the form of loans and convertible notes from WSI and $21,419,000 in convertible notes from

Motient through July 7, 1999.

On July 7, 1999, Motient acquired WSI’s remaining debt and equity interests in the Company in exchange for

approximately 8.6 million shares of Motient’s common stock (termed the ‘‘Worldspace Transaction’’).

Additionally, the Company issued an aggregate $250.0 million of Series A subordinated convertible notes (see

note 3(b)) to several new investors and used $75.0 million of the proceeds it received from the issuance of

these notes to redeem certain outstanding loan obligations owed to WSI. As a result of these transactions, as of

July 7, 1999, Motient owned all of the issued and outstanding stock of the Company. Concurrent with Motient’s

acquisition of the remaining interest in the Company, the Company recognized goodwill and intangibles of

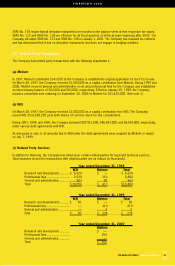

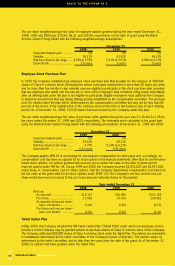

$51,624,000, which has been allocated as follows (in thousands):

FCC License.....................................$ 25,024

Goodwill........................................... 13,738

Programming agreements................. 8,000

Receiver agreements........................ 4,600

Other intangibles.............................. 262

$ 51,624

On January 15, 1999, the Company issued a convertible note to Motient for $21,419,000. This convertible note

bore interest at LIBOR plus five percent per annum and was due on December 31, 2004. The principal and interest

balances were convertible at prices of $16.35 and $9.52, respectively, per Class B common share.

Following the WorldSpace Transaction, the Company issued a convertible note maturing December 31, 2004 to

Motient for $81,676,000 in exchange for the $54,536,000 subordinated convertible notes payable,

$6,889,000 in demand notes, $20,251,000 in accrued interest and all of WSI’s outstanding options to acquire the

Company’s common stock. This note bore interest at LIBOR plus five percent per annum. The note was convertible

at Motient’s option at $8.65 per Class B common share. The Company took a one-time $5,520,000 charge to

interest due to the beneficial conversion feature of this note.

These Motient convertible notes, along with $3,870,000 of accrued interest, were converted into 11,182,926

shares of Class B common stock upon the initial public offering.

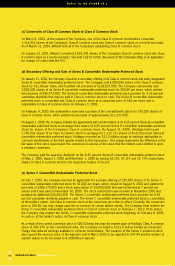

(b) Issuance of Series A Subordinated Convertible Notes of the Company to New Investors

At the closing of the WorldSpace Transaction, the Company issued an aggregate $250.0 million of Series A

subordinated convertible notes to six new investors—General Motors Corporation, $50.0 million; Clear Channel

Investments, Inc., $75.0 million; DIRECTV Enterprises, Inc., $50.0 million; and Columbia Capital, Telcom

Ventures, L.L.C. and Madison Dearborn Partners, $75.0 million. The Series A subordinated convertible notes

issued by the Company were convertible into shares of the Company’s Series A convertible preferred stock (in

the case of notes held by General Motors Corporation and DIRECTV) or Class A common stock (in the case of

notes held by the other investors) at the election of the holders or upon the occurrence of certain events, including

an initial public offering of a prescribed size. The conversion price was $9.52 aggregate principal amount of

38