XM Radio 2000 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

XM SATELLiTE RADiO 2000 Annual Report

notes for each share of the Company’s stock. These notes, along with $6,849,000 of accrued interest, were

converted into 16,179,755 shares of Class A common stock and 10,786,504 shares of Series A preferred

stock upon the initial public offering.

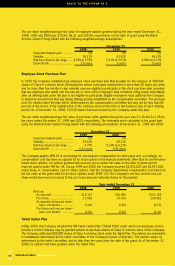

(c) Private Units Offering

On March 15, 2000 the Company closed a private placement of 325,000 units, each unit consisting of $1,000

principal amount of 14 percent Senior Secured Notes due 2010 of its subsidiary XM Satellite Radio Inc. and one

warrant to purchase 8.024815 shares of the Company’s Class A common stock at a price of $49.50 per share.

The Company realized net proceeds of $191.5 million, excluding $123.0 million used to acquire securities which

will be used to pay interest payments due under the notes for the first three years. The $325,000,000 face

value of the notes was offset by a discount of $65,746,000 associated with the fair value of the warrants sold.

The Company had amortized $2,044,000 of the discount through December 31, 2000. See note 5(e) for further

discussion regarding adjustments to the warrants sold.

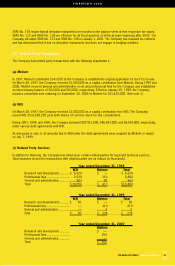

(4) Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, short-term investments, accounts payable, accrued expenses

and royalty payable approximate their fair market value because of the relatively short duration of these instruments

as of December 31, 1999 and 2000, in accordance with SFAS No. 107, Disclosures about Fair Value of

Financial Instruments. At December 31, 2000, the carrying amount and fair value of the 14 percent Senior Secured

Notes due 2010 were $261,298,000 and $179,563,000, respectively, based on the quoted market price.

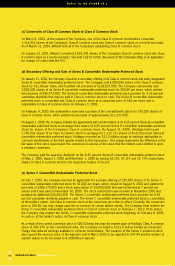

(5) Equity

(a) Recapitalization

Concurrent with the WorldSpace Transaction discussed in note 3, the Company’s capital structure was reorganized.

The Company’s common stock was converted into the newly authorized Class B common stock, which has three

votes per share. The Company also has authorized Class A common stock, which is entitled to one vote per

share and non-voting Class C common stock. The Class B common stock is convertible into Class A common

stock on a one for one basis, as follows: (1) at any time at the discretion of Motient, (2) following the Company’s

initial public offering, at the direction of the holders of a majority of the then outstanding shares of Class A common

stock (which majority must include at least 20 percent of the public holders of Class A common stock), and (3)

on or after January 1, 2002, at the direction of the holders of a majority of the then outstanding shares of the

Company’s Class A common stock. Such conversion will be effected only upon receipt of FCC approval of

Motient’s transfer of control of the Company to a diffuse group of shareholders.

The Company also authorized 60,000,000 shares of preferred stock, of which 15,000,000 shares are designated

Series A convertible preferred stock, par value $0.01 per share. The Series A convertible preferred stock is

convertible into Class A common stock at the option of the holder. The Series A preferred stock is non-voting

and receives dividends, if declared, ratably with the common stock.

On September 9, 1999, the board of directors of the Company effected a stock split providing 53,514 shares

of stock for each share owned.

(b) Initial Public Offering

On October 8, 1999, the Company completed an initial public offering of 10,000,000 shares of Class A common

stock at $12.00 per share. The offering yielded net proceeds of $111,437,000.

On October 17, 1999, the underwriters of the Company’s initial public offering exercised the over-allotment

option for an additional 241,000 shares of Class A common stock at $12.00 per share. This exercise yielded

net proceeds of $2,697,000.

FiNANCiALS 2000

39