XM Radio 2000 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADiO TO THE POWER OF X

XM SATELLiTE RADiO 2000 Annual Report

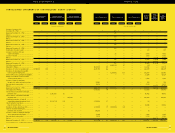

Interest Income. Interest income increased to $27.6 million in 2000, compared with $2.9 million in 1999. The

increase was the result of higher average balances of cash and cash equivalents in 2000, due to the proceeds

from the private placement of 14% senior secured notes and warrants, the public offerings of Class A common

stock and Series B convertible redeemable preferred stock and the private placement of Series C convertible

redeemable preferred stock, all in the first nine months of 2000, which exceeded expenditures for satellite and

launch vehicle construction, other capital expenditures and operating expenses.

Interest Expense. We incurred interest costs of $39.1 and $24.4 million in 2000 and 1999, respectively. We

capitalized interest costs of $39.1 million and $15.3 million associated with our FCC license and the XM Radio

system in 2000 and 1999, respectively. The increase in interest costs was the result of the incurrence of new

debt during the first quarter of 2000, which exceeded the reduction in interest due to the conversion of all debt

into equity in the fourth quarter of 1999. Further, the interest capitalization threshold was exceeded in 1999.

Net Loss. The net loss for 2000 and 1999 was $51.9 million and $36.9 million, respectively. The increase in net

losses in 2000 compared with 1999 reflects increases in research and development and professional fees expenses,

and additional general and administration expenses, primarily due to increased headcount, facility, and sales and

marketing expenses in preparation for commercial operations and the amortization of goodwill and intangibles.

Year Ended December 31, 1999 Compared to Year Ended December 31, 1998

Research and Development. Research and development expenses decreased to $4.3 million in 1999, compared

with $6.9 million in 1998. The decrease in research and development expenses resulted from the completion of

the development of some of our system technology during 1998.

Professional Fees. Professional fees increased to approximately $10.0 million in 1999, compared with $5.2

million in 1998. The increase primarily reflects additional legal, regulatory and marketing expenses.

General and Administrative. General and administrative expenses increased to $16.4 million in 1999, compared

with $4.0 million in 1998. The increase primarily reflects increased headcount and facility expenses to begin program

management and operations. We also commenced the amortization of our goodwill and intangibles resulting

from Motient’s acquisition of a former investor’s interest in us during 1999. We have granted certain key executives

stock options and incurred a non-cash compensation charge of approximately $4.1 million in the fourth quarter

of 1999 primarily for performance-based stock options. We will continue to incur quarterly non-cash compensation

charges over the vesting period depending on the market value of our Class A common stock.

Interest Income. Interest income increased to $2.9 million in 1999, compared with 1998, which was insignificant.

The increase was the result of higher average balances of cash and short-term investments during 1999 due to the

proceeds from the issuance of Series A convertible notes in the third quarter of 1999 exceeding the amounts of

expenditures for satellite and launch vehicle construction, other capital expenditures and operating expenses.

Interest Expense. As of December 31, 1999 and 1998, we owed $0 and $140.2 million, respectively, including

accrued interest, under various debt agreements which we entered into for the purpose of financing the XM Radio

system. Our capitalized interest costs were $15.3 million and $11.8 million associated with our FCC license and

the XM Radio system during 1999 and 1998, respectively. We expensed interest costs of $9.1 million and $0 during

1999 and 1998, respectively. We incurred a one-time $5.5 million charge to interest due to the beneficial

conversion feature of the new Motient note. We also exceeded our interest capitalization threshold by $3.6 million.

Net Loss. The net loss for 1999 and 1998 was $36.9 million and $16.2 million, respectively. The increase in net

losses for 1999, compared with 1998, primarily reflects an increase in net interest expense as discussed above

and additional general and administration expenses, primarily due to increased headcount and facility expenses, in

preparation for commercial operations and the commencement of amortization of goodwill and intangibles.

22