XM Radio 1999 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 1999 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 XM RADiO

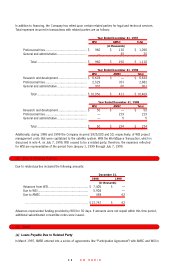

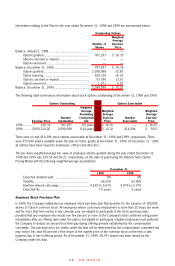

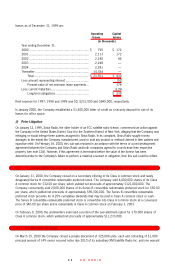

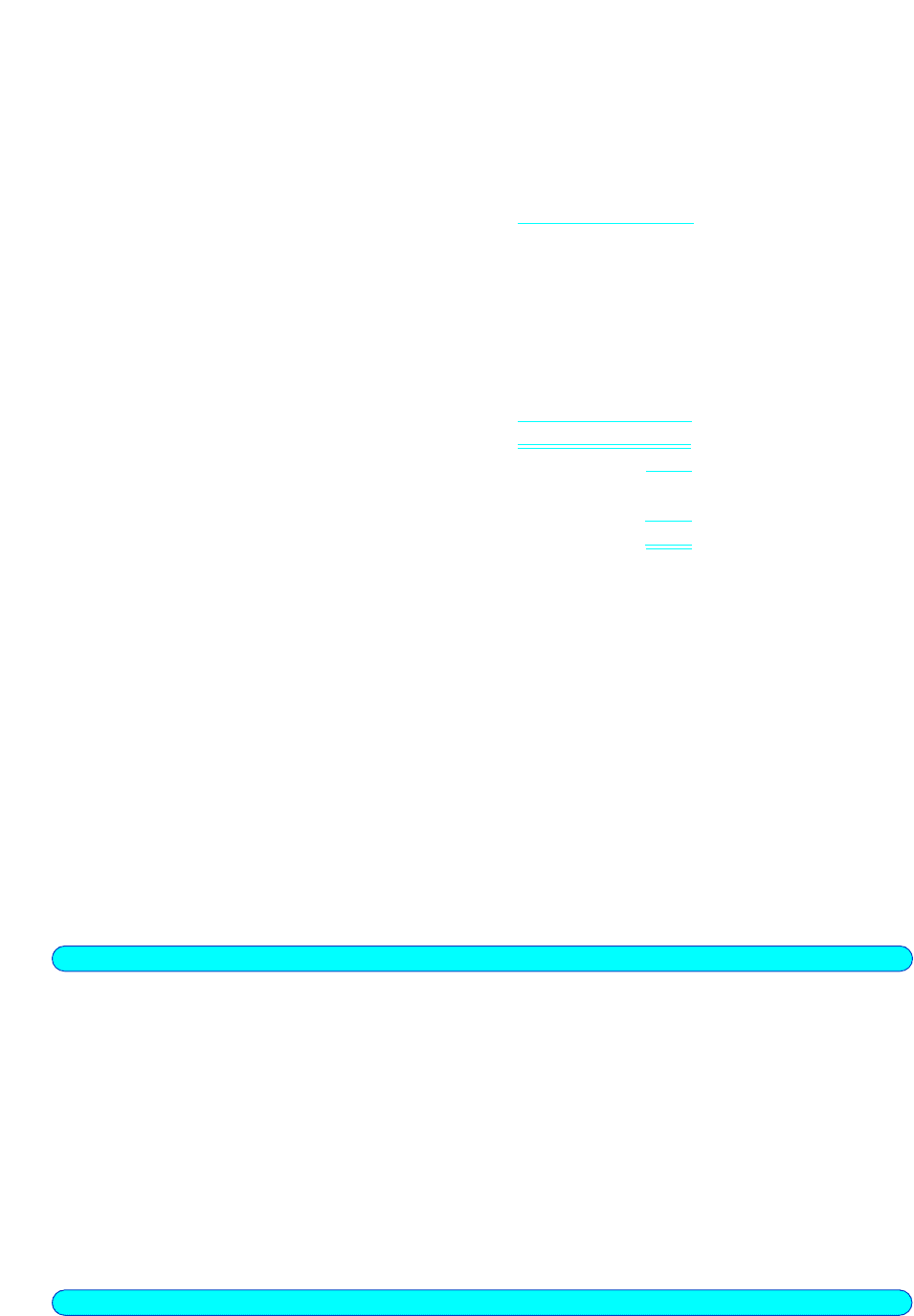

leases as of December 31, 1999 are:

Operating Capital

leases leases

(in thousands)

Year ending December 31:

2000 ..................................................................... $ 755 $ 172

2001 ..................................................................... 2,113 172

2002 ..................................................................... 2,180 86

2003 ..................................................................... 2,248 —

2004 ..................................................................... 2,281 —

Thereafter .............................................................. 14,354 —

Total................................................................ $ 23,931 $ 430

Less amount representing interest ........................... (52)

Present value of net minimum lease payments... 378

Less current maturities............................................ (139)

Long-term obligations....................................... $ 239

Rent expense for 1997, 1998 and 1999 was $0, $231,000 and $649,000, respectively.

In January 2000, the Company established a $3,400,000 letter of credit as a security deposit for one of its

leases for office space.

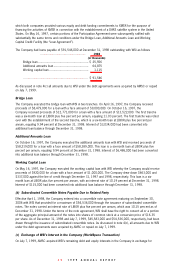

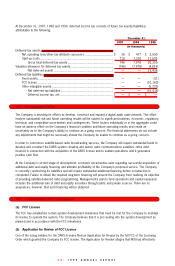

(l) Prior Litigation

On January 12, 1999, Sirius Radio, the other holder of an FCC satellite radio license, commenced an action against

the Company in the United States District Court for the Southern District of New York, alleging that the Company was

infringing or would infringe three patents assigned to Sirius Radio. In its complaint, Sirius Radio sought money

damages to the extent the Company manufactured, used or sold any product or method claimed in their patents and

injunctive relief. On February 16, 2000, this suit was resolved in accordance with the terms of a joint development

agreement between the Company and Sirius Radio and both companies agreed to cross-license their respective

property (see note 12(i)). However, if this agreement is terminated before the value of the license has been

determined due to the Company’s failure to perform a material covenant or obligation, then this suit could be refiled.

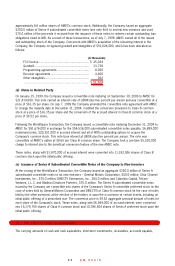

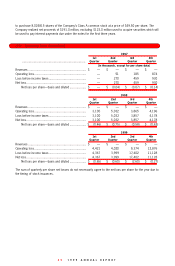

(13) Secondary Offering and Sale of Series B Convertible Redeemable Preferred Stock

On January 31, 2000, the Company closed on a secondary offering of its Class A common stock and newly

designated Series B convertible redeemable preferred stock. The Company sold 4,000,000 shares of its Class

A common stock for $32.00 per share, which yielded net proceeds of approximately $121,000,000. The

Company concurrently sold 2,000,000 shares of its Series B convertible redeemable preferred stock for $50.00

per share, which yielded net proceeds of approximately $96,300,000. The Series B convertible redeemable

preferred stock provides for 8.25% cumulative dividends that may be paid in Class A common stock or cash.

The Series B convertible redeemable preferred stock is convertible into Class A common stock at a conversion

price of $40.00 per share and is redeemable in Class A common stock on February 3, 2003.

On February 9, 2000, the underwriters exercised a portion of the over-allotment option for 370,000 shares of

Class A common stock, which yielded net proceeds of approximately $11,233,000.

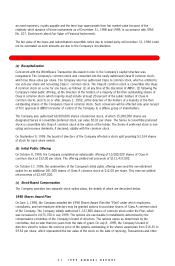

(14) Private Units Offering

On March 15, 2000 the Company closed a private placement of 325,000 units, each unit consisting of $1,000

principal amount of 14% senior secured notes due 2010 of its subsidiary XM Satellite Radio Inc. and one warrant