XM Radio 1999 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 1999 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39 1999 ANNUAL REPORT

which both companies provided various equity and debt funding commitments to XMSR for the purpose of

financing the activities of XMSR in connection with the establishment of a DARS satellite system in the United

States. On May 16, 1997, certain portions of the Participation Agreement were subsequently ratified with

substantially the same terms and conditions under the Bridge Loan, Additional Amounts Loan and Working

Capital Credit Facility (the “Loan Agreement”).

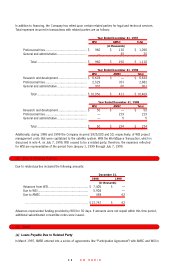

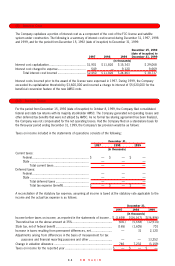

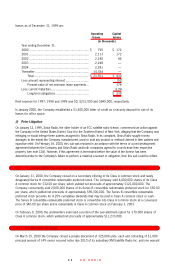

The Company had loans payable of $91,546,000 at December 31, 1998 outstanding with WSI as follows

.................................................... 1998

(in thousands)

Bridge loan .......................................................... $ 25,556

Additional amounts loan ........................................ 64,875

Working capital loan ............................................. 1,115

.......................................................................... $ 91,546

As discussed in note 4(c) all amounts due to WSI under the debt agreements were acquired by AMSC or repaid

on July 7, 1999.

Bridge Loan

The Company executed the bridge loan with WSI in two tranches. On April 16, 1997, the Company received

proceeds of $8,479,000 for a loan with a face amount of $9,000,000. On October 16, 1997, the

Company received proceeds of $12,771,000 for a loan with a face amount of $13,522,000. The first tranche

was a six-month loan at LIBOR plus five percent per annum, equaling 11.03 percent. The first tranche was rolled

over with the establishment of the second tranche, which is a six-month loan at LIBOR plus five percent per

annum, equaling 9.94 percent at December 31, 1998. Interest of $3,034,000 had been converted into

additional loan balance through December 31, 1998.

Additional Amounts Loan

On October 16, 1997, the Company executed the additional amounts loan with WSI and received proceeds of

$58,219,000 for a loan with a face amount of $58,389,000. This loan is a six-month loan at LIBOR plus five

percent per annum, equaling 9.94 percent at December 31, 1998. Interest of $6,486,000 had been converted

into additional loan balance through December 31, 1998.

Working Capital Loan

On May 16, 1997, the Company executed the working capital loan with WSI whereby the Company would receive

proceeds of $920,000 for a loan with a face amount of $1,000,000. The Company drew down $663,000 and

$337,000 against the line of credit through December 31, 1997 and 1998, respectively. This loan is a six-

month loan at LIBOR plus five percent per annum, with an interest rate of 10.19 percent at December 31, 1998.

Interest of $115,000 had been converted into additional loan balance through December 31, 1998.

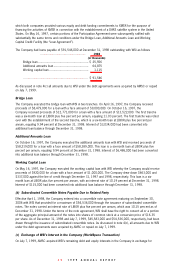

(b) Subordinated Convertible Notes Payable Due to Related Party

Effective April 1, 1998, the Company entered into a convertible note agreement maturing on September 30,

2006 with WSI that provided for a maximum of $54,536,000 through the issuance of subordinated convertible

notes. The notes carried an interest rate of LIBOR plus five percent per annum, which was 10.15 percent as of

December 31, 1998. Under the terms of the note agreement, WSI shall have the right to convert all or a portion

of the aggregate principal amount of the notes into shares of common stock at a conversion price of $16.35

per share. As of December 31, 1998 and July 7, 1999, $45,583,000 and $54,536,000, respectively, had been

drawn through the issuance of subordinated convertible notes. As discussed in note 4(c), all amounts due to WSI

under the debt agreements were acquired by AMSC or repaid on July 7, 1999.

(c) Exchange of WSI’s Interest in the Company (WorldSpace Transaction)

On July 7, 1999, AMSC acquired WSI’s remaining debt and equity interests in the Company in exchange for