XM Radio 1999 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 1999 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43 1999 ANNUAL REPORT

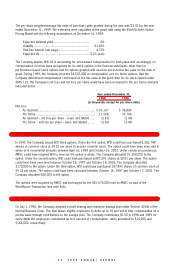

The per share weighted-average fair value of purchase rights granted during the year was $3.30 for the year

ended December 31, 1999. The estimates were calculated at the grant date using the Black-Scholes Option

Pricing Model with the following assumptions at December 31, 1999:

Expected dividend yield ......................................... 0%

Volatility................................................................ 63.92%

Risk-free interest rate range ................................... 4.73%

Expected life......................................................... 0.23 years

The Company applies APB 25 in accounting for stock-based compensation for both plans and, accordingly, no

compensation cost has been recognized for its stock options in the financial statements other than for

performance based stock options and for options granted with exercise prices below fair value on the date of

grant. During 1999, the Company incurred $4,070,000 in compensation cost for these options. Had the

Company determined compensation cost based on the fair value at the grant date for its stock options under

SFAS 123, the Company’s net loss and net loss per share would have been increased to the pro forma amounts

indicated below:

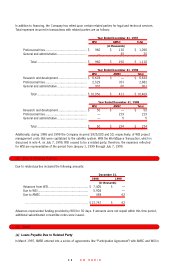

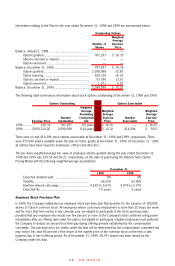

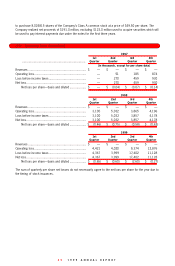

Year ended December 31,

1998 1999

(in thousands, except for per share data)

Net loss:

As reported.................................................................. $ 16,167 $ 36,896

Pro forma .................................................................... 17,508 37,706

As reported – net loss per share – basic and diluted...... (2.42) (2.40)

Pro forma – net loss per share – basic and diluted ........ (2.62) (2.46)

(7) WSI Options

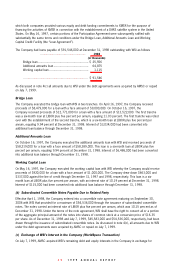

In 1997, the Company issued WSI three options. Under the first option, WSI could have purchased 5,202,748

shares of common stock at $4.52 per share to acquire common stock. The option could have been exercised in

whole or in incremental amounts between April 16, 1998 and October 16, 2002. Under certain circumstances,

AMSC could have required WSI to exercise the option in whole. The Company allocated $1,250,000 to the

option. Under the second option, WSI could have purchased 6,897,291 shares at $8.91 per share. The option

could have been exercised between October 16, 1997 and October 16, 2003. The Company allocated

$170,000 to the option. Under the third option, WSI could have purchased 187,893 shares of common stock at

$5.32 per share. The option could have been exercised between October 16, 1997 and October 17, 2002. The

Company allocated $80,000 to the option.

The options were acquired by AMSC and exchanged for the $81,676,000 note to AMSC as part of the

WorldSpace Transaction (see note 4(d)).

(8) Profit Sharing and Employee Savings Plan

On July 1, 1998, the Company adopted a profit sharing and employee savings plan under Section 401(k) of the

Internal Revenue Code. This plan allows eligible employees to defer up to 15 percent of their compensation on a

pre-tax basis through contributions to the savings plan. The Company contributed $0.50 in 1998 and 1999 for

every dollar the employees contributed up to 6 percent of compensation, which amounted to $14,000 and

$164,000, respectively.