XM Radio 1999 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 1999 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 XM RADiO

• $132.2 million in net proceeds from a Class A common stock offering in the first quarter of 2000.

• $96.3 million in net proceeds from a Series B convertible preferred stock offering in the first quarter of 2000.

• $191.0 million in net proceeds from a private placement on March 15, 2000, of 325,000 units, each unit

consisting of $1,000 principal amount of 14% senior secured notes due 2010 and one warrant to purchase

8.024815 shares of Class A common stock at $49.50 per share, excluding $123.0 million for an interest

reserve.

• $0.4 million in proceeds from the sale of stock under the employee stock purchase plan and the exercise

of stock options.

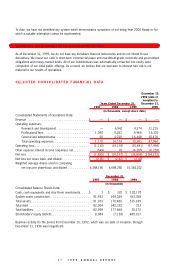

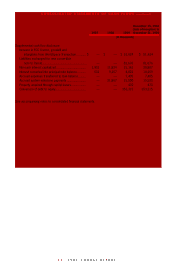

The use of funds for satellites and launch in the chart above includes $472.6 million for satellites, launch and

long-lead items, including certain financing costs associated with the satellites, and for an option to complete the

ground spare satellite under our satellite contract with Hughes. As of December 31, 1999, $183.9 million has

been paid under the satellite contract.

The anticipated $65.9 million in costs for ground segment are intended to cover the satellite control facilities,

programming production studios and various other equipment and facilities. As of December 31, 1999, we had

incurred $7.6 million in costs in deploying the ground segment.

Other operating expenses and working capital requirements in the chart above include cumulative historical

operating losses through December 31, 1999 of $54.7 million.

Sources of Funds. To date, we have raised approximately $865.0 million of equity proceeds, net of expenses,

interest reserve and repayment of debt. These funds have been used to acquire our FCC license, make required

payments under our satellite contract with Hughes, and for working capital and operating expenses. Of the

$865.0 million raised to date, approximately $167.0 million, excluding the Class A common stock acquired as

part of our initial public offering, has been raised through the issuance of equity to, and receipt of loans from,

our current stockholder, American Mobile, and a former stockholder. Of this amount, approximately $90.7 million

and $46.0 million was raised in 1997 and 1998, respectively, and $30.3 million was raised in January 1999.

In July 1999, we issued $250.0 million of Series A subordinated convertible notes to six strategic and financial

investors—General Motors, $50.0 million; Clear Channel Communications, $75.0 million; DIRECTV, $50.0

million; and Columbia Capital, Telcom Ventures, L.L.C. and Madison Dearborn Partners, $75.0 million in the

aggregate. Using part of the proceeds from the issuance of the Series A subordinated convertible notes, we

paid a former stockholder $75.0 million in July 1999 to redeem an outstanding loan. We incurred fees and

expenses totalling $11.3 million in connection with these transactions.

In October 1999, we raised $114.1 million from the issuance of 10.2 million shares of Class A common stock

at a price of $12.00 per share less $8.8 million in underwriting discounts and commissions and estimated

expenses. The Series A convertible notes, together with related accrued interest, automatically converted into

16,179,755 shares of our Class A common stock and 10,786,504 shares of our Series A preferred stock. Also,

the American Mobile notes, together with related accrued interest, automatically converted into 11,182,926

shares of our Class B common stock. As a result of these transactions, substantially all of our indebtedness

converted into equity.

In the first quarter of 2000, we completed a follow-on offering of 4,370,000 shares of Class A common stock,

yielding net proceeds of $132.2 million. At the same time, we completed an offering of 2,000,000 shares of our

Series B convertible redeemable preferred stock, which yielded net proceeds of $96.3 million. We also

completed a private placement on March 15, 2000 of 325,000 units, each unit consisting of $1,000 principal

amount of 14% senior secured notes due 2010 and one warrant to purchase 8.024815 shares of Class A

common stock at $49.50 per share that provided net proceeds of $191.0 million, excluding $123.0 million for

an interest reserve.

Uses of Funds. Of the approximately $1.1 billion of funds to be used through commencement of commercial

operations, an estimated $569.4 million are expected to be incurred under contracts presently in place and for

our FCC license, which has already been paid for in full. Total capital expenditures from our inception to

December 31, 1999, totaled $295.5 million.