XM Radio 1999 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1999 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47 1999 ANNUAL REPORT

fixed payment obligations to General Motors for four years following commencement of commercial service.

These payments approximate $35,000,000 in the aggregate during this period. Additional annual fixed

payment obligations beyond the initial four years of the contract term range from less than $35,000,000 to

approximately $130,000,000 through 2009, aggregating approximately $400,000,000. In order to encourage

the broad installation of XM radios in General Motors vehicles, the Company has agreed to subsidize a portion

of the cost of XM radios, and to make incentive payments to General Motors when the owners of General

Motors vehicles with installed XM radios become subscribers for the Company’s service. The Company must

also share with General Motors a percentage of the subscription revenue attributable to General Motors

vehicles with installed XM radios, which percentage increases until there are more than 8 million General

Motors vehicles with installed XM radios. The Company will also make available to General Motors bandwidth

on the Company’s systems. The agreement is subject to renegotiations at any time based upon the installation

of radios that are compatible with a unified standard or capable of receiving Sirius Satellite Radio’s (formerly

known as CD Radio) service. The agreement is subject to renegotiations if, four years after the commencement

of XM Radio’s commercial operations and at two-year intervals thereafter GM does not achieve and maintain

specified installation levels of General Motors vehicles capable of receiving the Company’s service, starting

with 1,240,000 units after four years, and thereafter increasing by the lesser of 600,000 units per year and

amounts proportionate to target market shares in the satellite digital radio service market. There can be no

assurances as to the outcome of any such renegotiations. General Motors’ exclusivity obligations will

discontinue if, four years after the Company commences commercial operations and at two-year intervals

thereafter, the Company fails to achieve and maintain specified minimum market share levels in the satellite

digital radio service market.

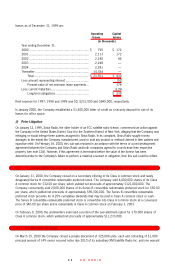

(h) Terrestrial Repeater Contract

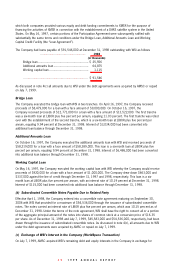

In February 2000, the Company entered into a contract with Hughes Electronics Corporation, a related party, for

the design, development and purchase of terrestrial repeater equipment. The total contract value is

$128,000,000 and the Company incurred and paid $3,500,000 under a letter agreement in anticipation of this

contract through December 31, 1999.

(i) Joint Development Agreement

On February 16, 2000, the Company signed an agreement with Sirius Satellite Radio Inc. (“Sirius Radio”), a

competitor of the Company, to develop a unified standard for satellite radios to facilitate the ability of consumers

to purchase one radio capable of receiving both the Company’s and Sirius Radio’s services. The technology

relating to the unified standard will be jointly developed, funded and owned by the two companies. As part of the

agreement, each company has licensed to the other its intellectual property relating to its system; the value of

this license will be considered part of its contribution toward the joint development. In addition, each company

has agreed to license its non-core technology, including non-essential features of its system, to the other at

commercially reasonable rates.

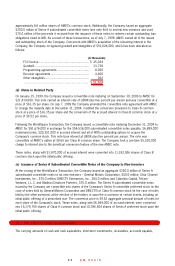

(j) Sony Warrant

In February 2000, the Company issued a warrant to Sony exercisable for shares of the Company’s Class A

common stock. The warrant will vest at the time that we attain our millionth customer, and the number of shares

underlying the warrant will be determined by the percentage of XM Radios that have a Sony brand name as of

the vesting date. If Sony achieves its maximum performance target, it will receive 2 percent of the total number

of shares of the Company’s Class A common stock on a fully-diluted basis upon exercise of the warrant. The

exercise price of the Sony warrant will equal 105% of fair market value of the Class A common stock on the

vesting date, determined based upon the 20-day trailing average.

(k) Leases

The Company has three noncancelable operating leases for office space and two noncancelable capital leases

for equipment that expire over the next ten years. The future minimum lease payments under noncancelable