XM Radio 1999 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 1999 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 XM RADiO

NOTES TO CONSOLiDATED FiNANCiAL STATEMENTS

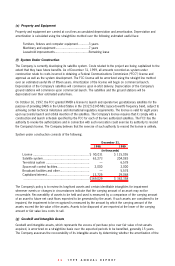

(1) Summary of Significant Accounting Policies and Practices

(a) Nature of Business

XM Satellite Radio Inc. (“XMSR”), formerly American Mobile Radio Corporation, was incorporated on December

15, 1992 in the State of Delaware as a wholly owned subsidiary of American Mobile Satellite Corporation

(“AMSC” or “Parent”) for the purpose of procuring a digital audio radio service (“DARS”) license. Business activity

for the period from December 15, 1992 through December 31, 1996 was insignificant. Pursuant to various

financing agreements entered into in 1997 between AMSC, XMSR and WorldSpace, Inc. (“WSI”), WSI acquired a

20 percent interest in XMSR.

On May 16, 1997, AMSC and WSI formed XM Satellite Radio Holdings Inc. (the “Company”), formerly AMRC

Holdings Inc., as a holding company for XMSR in connection with the construction, launch and operation of a

domestic communications satellite system for the provision of DARS. AMSC and WSI exchanged their respective

interests in XMSR for equivalent interests in the Company, which had no assets, liabilities or operations prior to

the transaction.

On July 7, 1999, AMSC acquired WSI’s 20 percent interest in the Company, which is discussed in note 4.

(b) Principles of Consolidation and Basis of Presentation

The consolidated financial statements include the accounts of XM Satellite Radio Holdings Inc. and its

subsidiaries, XM Satellite Radio Inc. and XM Radio Inc. All significant intercompany transactions and accounts

have been eliminated. The Company’s management has devoted substantially all of its time to the planning and

organization of the Company, obtaining its DARS license, and to the process of addressing regulatory matters,

initiating research and development programs, conducting market research, initiating construction of the satellite

system, securing content providers, and securing adequate debt and equity capital for anticipated operations

and growth. The Company has not generated any revenues and planned principal operations have not

commenced. Accordingly, the Company’s financial statements are presented as those of a development stage

enterprise, as prescribed by Statement of Financial Accounting Standards (“SFAS”) No. 7, Accounting and

Reporting by Development Stage Enterprises.

As discussed in Note 6, on September 9, 1999, the Company effected a 53,514-for-1 stock split. The effect of

the stock split has been reflected as of December 31, 1999 in the consolidated balance sheet and consolidated

statement of stockholders’ equity (deficit); however, the activity in prior periods was not restated in those

statements. All references to the number of common shares and per share amounts in the consolidated financial

statements and notes thereto have been restated to reflect the effect of the split for all periods presented.

(c) Cash and Cash Equivalents

The Company considers short-term, highly liquid investments with an original maturity of three months or less to

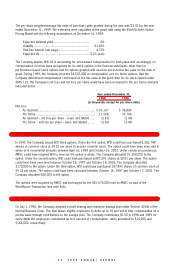

be cash equivalents. The Company had the following cash and cash equivalents balances:

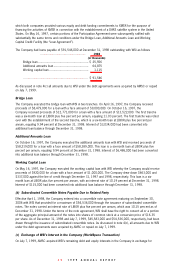

December 31,

1998 1999

(in thousands)

Cash on deposit $ 28 $ 66

Money market funds 282 10,620

Commercial paper — 40,012

$ 310 $ 50,698

(d) Short-term Investments

The Company holds commercial paper with maturity dates of less than one year that is stated at amortized cost,

which approximates fair value.