XM Radio 1999 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1999 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23 1999 ANNUAL REPORT

by the FCC of a change in control. In return, Holdings has agreed not to issue new voting securities, other than

the units issued on March 15, 2000 and other than up to 2,000,000 shares of Class A common stock (except

upon conversion or exercise of existing securities or under our employee stock plans), if it would make these

holders unable to convert any of their non-voting securities. We have filed an application with the FCC to permit

American Mobile’s voting power of Holdings to be reduced to 40% after giving effect to the conversion of all of

Holdings’ outstanding common stock equivalents. We may not, however, be able to obtain approval of our

application from the FCC or it may take a long period of time to obtain such approval and there may be

conditions imposed in connection with such approval which may be unfavorable to us. The inability to raise

capital opportunistically, or at all, could adversely affect our business plan.

We may not be able to raise any funds or obtain loans on favorable terms or at all. Our ability to obtain the

required financing depends on several factors, including future market conditions; our success or lack of success

in developing, implementing and marketing our satellite radio service; our future creditworthiness; and restrictions

contained in agreements with our investors or lenders. If we fail to obtain any necessary financing on a timely

basis, a number of adverse effects could occur. Our satellite construction and launch and other events necessary

to our business could be materially delayed or their costs could materially increase. We could default on our

commitments to our satellite construction or launch contractors, creditors or others, leading to termination of

construction or inability to launch our satellites. Finally, we may not be able to launch our satellite radio service as

planned and may have to discontinue operations or seek a purchaser for our business or assets.

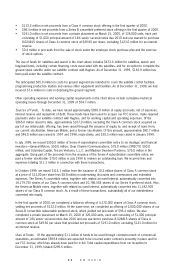

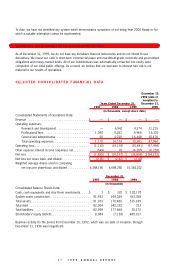

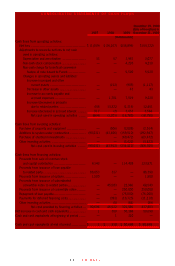

Our expected sources and uses of funds through commencement of commercial operations are as follows:

Inception Through Commercial Launch

(in millions)

Sources of Funds

Total funds raised to date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 865.0

Future capital requirements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 235.0

Total sources. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,100.0

Uses of Funds

Satellites and launch. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 472.6

Launch insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50.0

Terrestrial repeater system . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 263.3

Ground segment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65.9

Total system . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 851.8

FCC license. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90.0

Operating expenses and working capital requirements . . . . . . . . . . . 158.2

Total uses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,100.0

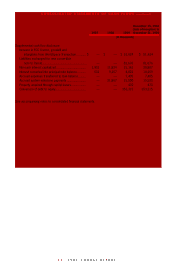

The sources and uses chart for inception through commercial launch assumes that we will commence full

commercial operations in the second quarter of 2001 and does not include net interest income or expense of

any future offerings or other financings. We anticipate that we will need substantial further funding after

commencement of operations to cover our cash requirements before we generate positive cash flow from

operations. Many factors, including our ability to generate significant revenues, could affect this estimate.

Total funds raised to date in the chart above include proceeds of

• $9.2 million in equity contributions and an additional $157.8 million in equity from converted debt

instruments funded by American Mobile and by a former investor who sold its investment to American Mobile.

• $238.7 million in net proceeds from convertible notes which were converted to Class A common stock

and Series A convertible preferred stock on October 8, 1999 as a result of our initial public offering. $75.0

million of these proceeds were used to repay outstanding debt.

• $114.1 million in net proceeds from our initial public offering.