XM Radio 1999 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 1999 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 XM RADiO

goodwill and intangible assets balance over its remaining life can be recovered through undiscounted future

operating cash flows. The amount of goodwill and intangible assets impairment, if any, is measured based on

projected discounted future operating cash flows using a discount rate reflecting the Company’s average cost of

funds. The assessment of the recoverability of goodwill will be impacted if estimated future operating cash flows

are not achieved.

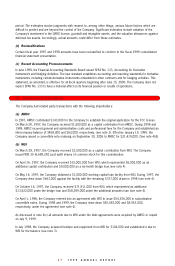

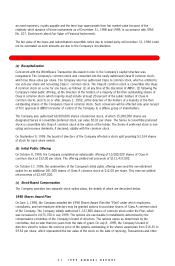

(h) Stock-Based Compensation

The Company accounts for stock-based compensation arrangements in accordance with the provisions of

Accounting Principle Board (“APB”) Opinion No. 25, Accounting for Stock Issued to Employees (APB 25), and

related interpretations, and complies with the disclosure provisions of SFAS No. 123, Accounting for Stock-

Based Compensation. Under APB 25, compensation expense is based upon the difference, if any, on the date of

grant, between the fair value of the Company’s stock and the exercise price. All stock-based awards to non-

employees are accounted for at their fair value in accordance with SFAS No. 123.

(i) Research and Development

Research and development costs are expensed as incurred.

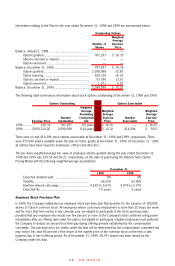

(j) Net Income (Loss) Per Share

The Company computes net income (loss) per share in accordance with SFAS No. 128, Earnings Per Share and

SEC Staff Accounting Bulletin No. 98 (“SAB 98”). Under the provisions of SFAS No. 128 and SAB 98, basic net

income (loss) per share is computer by dividing the net income (loss) available to common stockholders (after

deducting preferred dividend requirements) for the period by the weighted average number of common shares

outstanding during the period. Diluted net income (loss) available per share is computed by dividing the net

income (loss) available to common stockholders for the period by the weighted average number of common and

dilutive common equivalent shares outstanding during the period. The Company has presented historical basic

and diluted net income (loss) per share in accordance with SFAS No. 128. As the Company had a net loss in

each of the periods presented, basic and diluted net income (loss) per share is the same.

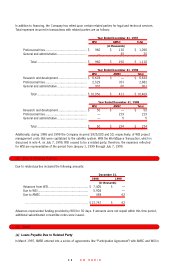

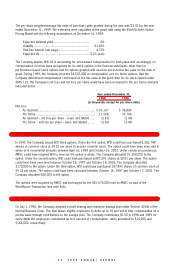

(k) Income Taxes

The Company accounts for income taxes in accordance with SFAS No. 109, Accounting for Income Taxes.

Deferred income taxes are recognized for the tax consequences in future years of differences between the tax

bases of assets and liabilities and the financial reporting amounts at each year-end, based on enacted tax laws

and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income.

Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to

be realized. Income tax expense is the sum of tax payable for the period and the change during the period in

deferred tax assets and liabilities.

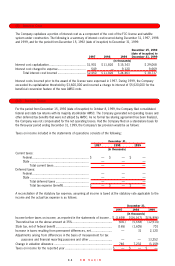

(l) Comprehensive Income

In December 1998, the Company adopted SFAS No. 130, Reporting Comprehensive Income (SFAS 130). This

statement establishes standards for reporting and displaying comprehensive income and its components in the

financial statements. This statement is effective for all interim and annual periods with the year ended December

31, 1998. The Company has evaluated the provisions of SFAS 130 and has determined that there were no

transactions that have taken place during the years ended December 31, 1997, 1998 and 1999 that would be

classified as other comprehensive income.

(m) Accounting Estimates

The preparation of the Company’s financial statements in conformity with generally accepted accounting

principles requires management to make estimates and assumptions that affect the reported amounts of assets

and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting