XM Radio 1999 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 1999 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35 1999 ANNUAL REPORT

(e) Property and Equipment

Property and equipment are carried at cost less accumulated depreciation and amortization. Depreciation and

amortization is calculated using the straight-line method over the following estimated useful lives:

Furniture, fixtures and computer equipment ............3 years

Machinery and equipment......................................7 years

Leasehold improvements.......................................Remaining lease

(f) System Under Construction

The Company is currently developing its satellite system. Costs related to the project are being capitalized to the

extent that they have future benefits. As of December 31, 1999, all amounts recorded as system under

construction relate to costs incurred in obtaining a Federal Communications Commission (“FCC”) license and

approval as well as the system development. The FCC license will be amortized using the straight line method

over an estimated useful life of fifteen years. Amortization of the license will begin on commercial launch.

Depreciation of the Company’s satellites will commence upon in-orbit delivery. Depreciation of the Company’s

ground stations will commence upon commercial launch. The satellites and the ground stations will be

depreciated over their estimated useful lives.

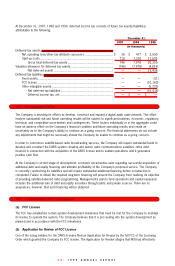

On October 16, 1997, the FCC granted XMSR a license to launch and operate two geostationary satellites for the

purpose of providing DARS in the United States in the 2332.5-2345 Mhz (space-to-earth) frequency band, subject to

achieving certain technical milestones and international regulatory requirements. The license is valid for eight years

upon successful launch and orbital insertion of the satellites. The Company’s license requires that it comply with a

construction and launch schedule specified by the FCC for each of the two authorized satellites. The FCC has the

authority to revoke the authorizations and in connection with such revocation could exercise its authority to rescind

the Company’s license. The Company believes that the exercise of such authority to rescind the license is unlikely.

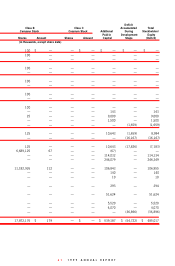

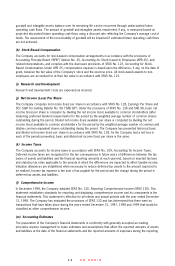

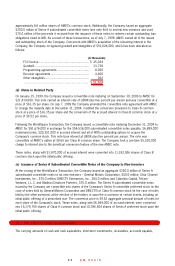

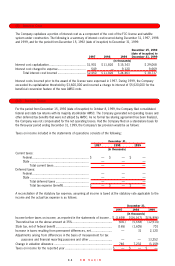

System under construction consists of the following:

December 31,

1998 1999

(in thousands)

License ................................................................ $ 90,031 $ 115,055

Satellite system ..................................................... 63,273 204,083

Terrestrial system .................................................. — 6,578

Spacecraft control facilities..................................... 2,000 2,000

Broadcast facilities and other.................................. — 5,574

Capitalized interest................................................. 13,725 29,068

........................................................................... $169,029 $ 362,358

The Company’s policy is to review its long-lived assets and certain identifiable intangibles for impairment

whenever events or changes in circumstances indicate that the carrying amount of an asset may not be

recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount

of an asset to future net cash flows expected to be generated by the asset. If such assets are considered to be

impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the

assets exceed the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying

amount or fair value less costs to sell.

(g) Goodwill and Intangible Assets

Goodwill and intangible assets, which represents the excess of purchase price over fair value of net assets

acquired, is amortized on a straight-line basis over the expected periods to be benefited, generally 15 years.

The Company assesses the recoverability of its intangible assets by determining whether the amortization of the