XM Radio 1999 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 1999 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37 1999 ANNUAL REPORT

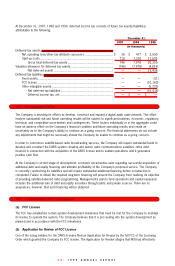

period. The estimates involve judgments with respect to, among other things, various future factors which are

difficult to predict and are beyond the control of the Company. Significant estimates include valuation of the

Company’s investment in the DARS license, goodwill and intangible assets, and the valuation allowances against

deferred tax assets. Accordingly, actual amounts could differ from these estimates.

(n) Reclassifications

Certain fiscal year 1997 and 1998 amounts have been reclassified to conform to the fiscal 1999 consolidated

financial statement presentation.

(o) Recent Accounting Pronouncements

In June 1998, the Financial Accounting Standards Board issued SFAS No. 133, Accounting for Derivative

Instruments and Hedging Activities. The new standard establishes accounting and reporting standards for derivative

instruments, including certain derivative instruments embedded in other contracts and for hedging activities. This

statement, as amended, is effective for all fiscal quarters beginning after June 15, 2000. The Company does not

expect SFAS No. 133 to have a material affect on its financial position or results of operations.

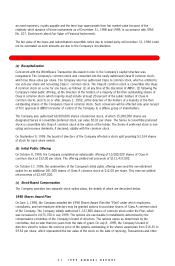

(2) Related Party Transactions

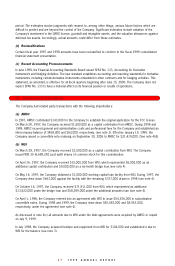

The Company had related party transactions with the following shareholders:

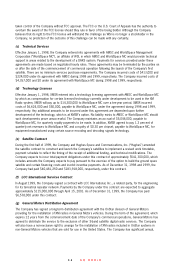

(a) AMSC

In 1997, AMSC contributed $143,000 for the Company to establish the original application for the FCC license.

On March 28, 1997, the Company received $1,500,000 as a capital contribution from AMSC. During 1998 and

1999, AMSC incurred general and administrative costs and professional fees for the Company and established an

intercompany balance of $458,000 and $62,000, respectively, (see note 3). Effective January 15, 1999, the

Company issued a convertible note maturing on September 30, 2006 to AMSC for $21,419,000. (See note 4(d)).

(b) WSI

On March 28, 1997, the Company received $1,500,000 as a capital contribution from WSI. The Company

issued WSI 25 (6,689,250 post split) shares of common stock for this consideration.

On April 16, 1997, the Company received $15,000,000 from WSI, which represented $6,000,000 as an

additional capital contribution and $9,000,000 as a six-month bridge loan (see note 4).

On May 16, 1997, the Company obtained a $1,000,000 working capital loan facility from WSI. During 1997, the

Company drew down $663,000 against the facility with the remaining $337,000 drawn in 1998 (see note 4).

On October 16, 1997, the Company received $71,911,000 from WSI, which represented an additional

$13,522,000 under the bridge loan and $58,389,000 under the additional amounts loan (see note 4).

On April 1, 1998, the Company entered into an agreement with WSI to issue $54,536,000 in subordinated

convertible notes. During 1998 and 1999, the Company drew down $45,583,000 and $8,953,000,

respectively, under the agreement (see note 4).

As discussed in note 4(c) all amounts due to WSI under the debt agreements were acquired by AMSC or repaid

on July 9, 1999.

In July 1998, the Company acquired furniture and equipment from WSI for $104,000 and established a due to

WSI for the balance (see note 3).