Westjet 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2008 Annual Report 91

notes to consolidated

fi nancial statements

For the years ended December 31, 2008 and 2007

(Stated in thousands of Canadian dollars, except share and per share data)

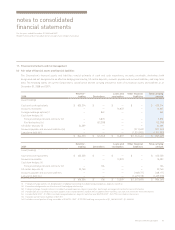

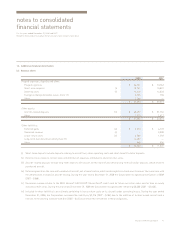

(i) Short-term deposits include deposits relating to aircraft fuel, other operating costs and short-term US-dollar deposits.

(ii) Deferred costs relate to certain sales and distribution expenses attributed to advance ticket sales.

(iii) Aircraft-related deposits include long-term deposits with lessors for the lease of aircraft and long-term US-dollar deposits, which relate to

purchased aircraft.

(iv) Deferred gains from the sale and leaseback of aircraft, net of amortization, which are being deferred and amortized over the lease term with

the amortization included in aircraft leasing. During the year ended December 31, 2008 the Corporation recognized amortization of $869

(2007 – $868).

(v) Unearned revenue relates to the BMO Mosaik® AIR MILES® MasterCard® credit card for future net retail sales and for fees on newly

activated credit cards. During the year ended December 31, 2008 the Corporation recognized the remaining $3,000 (2007 - $3,000).

(vi) Included in other liabilities is an estimate pertaining to lease return costs on its aircraft under operating leases. During the year ended

December 31, 2008, the Corporation increased the liability by $2,216 (2007 – $185) due to the addition of further leased aircraft and a

revision to the existing estimate with $nil (2007 – $nil) incurred on the settlement of these obligations.

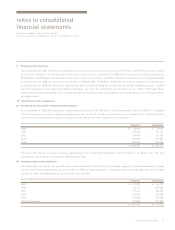

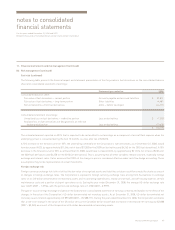

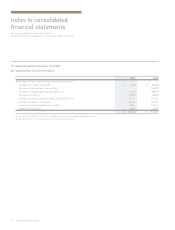

12. Additional fi nancial information

(a) Balance sheet

2008 2007

Prepaid expenses, deposits and other:

Prepaid expenses $ 26,521 $ 13,763

Short-term deposits (i) 18,761 10,827

Deferred costs (ii) 14,410 14,323

Foreign exchange derivative assets (note 11) 6,735 106

Other 1,266 —

$ 67,693 $ 39,019

Other assets:

Aircraft-related deposits (iii) $ 68,492 $ 51,754

Other 2,513 1,617

$ 71,005 $ 53,371

Other liabilities:

Deferred gains (iv) $ 5,270 $ 6,139

Unearned revenue (v) — 3,000

Lease return costs (vi) 3,508 1,292

Long-term fuel derivative liability (note 11) 14,487 —

Other 968 906

$ 24,233 $ 11,337