Westjet 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 WestJet 2008 Annual Report

current assets over current liabilities, improved to 1.25 as

compared to 1.22 as at December 31, 2007, and our adjusted

debt-to-equity ratio decreased to 1.78 from 2.07 as at

December 31, 2007. Please refer to page 50 of this MD&A

for a reconciliation of our adjusted debt-to-equity ratio,

a non-GAAP measure, to the nearest measure under

Canadian GAAP. Our strong fi nancial results have allowed

us to generate positive cash fl ow from operations to fund

our working capital requirements, make our debt payments

and fund the construction of our Campus during the year

without requiring external fi nancing.

During the year, we assumed delivery of two leased

737-700s, three owned 737-700s and one leased 737-800,

increasing our total registered fl eet to 76 aircraft. We

originally expected to take delivery of seven aircraft during

2008; however, the aircraft previously scheduled for delivery

in November 2008 was delayed as a result of a Boeing

labour strike. In 2008, we signed an agreement with Boeing

to purchase four new aircraft, bringing our total committed

fl eet to 120 by 2013. The additional capacity is aligned

with the continued commercialization of our domestic

schedule, an increase in scheduled service to the U.S. and

the introduction of new destinations into the Caribbean and

Mexican markets. We continue to operate one of the youngest

fl eets of any large North American commercial airline, with

an average age of 4.0 years.

Recently, we announced the addition of four new seasonal

destinations as part of our enhanced 2009 summer

schedule: Yellowknife, Northwest Territories; Sydney,

Nova Scotia; and San Francisco and San Diego, California.

During 2008, we began service to the following destinations:

Kamloops; Quebec City; Kona; New York City (via Newark);

Bridgetown, Barbados; La Romana, Dominican Republic;

as well as the Mexican destinations of Cancun and Puerto

Vallarta. The four new destinations announced in the fourth

quarter of 2008 will expand our network to 55 cities across

Canada, the United States, Mexico and the Caribbean.

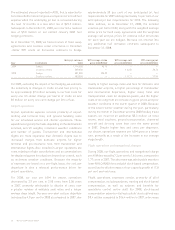

Our focus on strong cost control remained a core strategy

during 2008 and is critical to our success, especially in light

of unpredictable fuel prices. For 2008, our CASM increased

by 6.7 per cent to 13.17 cents from 12.34 cents in 2007,

attributable primarily to signifi cantly higher fuel costs year

over year. Excluding fuel and employee profi t share, our

CASM decreased to 8.28 cents from 8.55 cents in 2007, an

improvement of 3.2 per cent. This decrease was achieved

mainly through a longer average stage length, increased

aircraft utilization and cost dilution over a greater number

of available seat miles.

We maintained a strong balance sheet during 2008, as

evidenced by our signifi cant cash balance of $820.2 million

as at December 31, 2008, an increase of 25.5 per cent from

December 31, 2007. Similarly, our current ratio, defi ned as

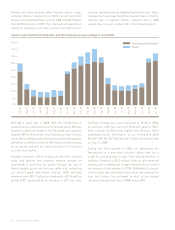

Quarterly load factor

85%

80%

75%

70%

2007 Q1 2007 Q2 2007 Q3 2007 Q4 2008 Q1 2008 Q2 2008 Q3 2008 Q4