Westjet 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 WestJet 2008 Annual Report

is booked to completion of the fl ight.

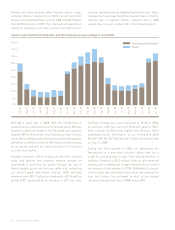

Key operational performance indicators

On-time performance and completion rates are calculated

based on the U.S. Department of Transportation’s standards

of measurement for the North American airline industry.

Our bag ratio represents the number of delayed or lost

baggage claims made per 1,000 guests.

reduction of future income tax expense recognized in the

fourth quarter of 2007, which was in addition to a $2.3 million

recovery recorded in the second quarter of 2007.

Guest experience

As an airline, we are focused on meeting the needs of our

guests while maintaining the highest safety standards. We

are committed to delivering a positive guest experience

during every aspect of our service, from the time the fl ight

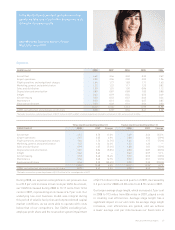

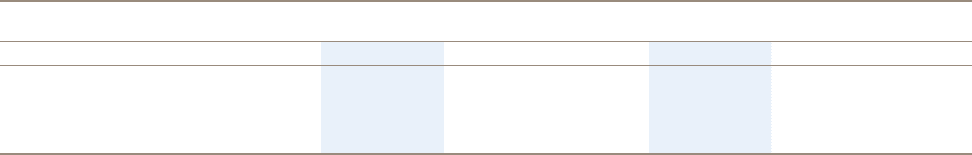

Three months ended December 31 Twelve months ended December 31

2008 2007 Change 2008 2007 Change

On-time performance 68.9% 77.8% (8.9 pts) 77.0% 82.6% (5.6 pts)

Completion rate 98.1% 99.0% (0.9 pts) 98.7% 99.2% (0.5 pts)

Bag ratio 4.68 4.32 (8.3%) 4.12 4.26 3.3%

On-time performance is a key factor in measuring our

guest experience. Severe weather patterns, particularly

during the fourth quarter, negatively impacted our on-time

performance during 2008 as compared to 2007. In December,

a record number of delayed fl ights due to harsh winter

weather contributed to the decline in our on-time

performance. During 2008, 77.0 per cent of all our

fl ights arrived within 15 minutes of their scheduled time,

compared to 82.6 per cent for 2007.

Our completion rate was down slightly for 2008 at

98.7 per cent versus 99.2 per cent in 2007, due to inclement

weather and resulting fl ight cancellations, particularly

during December. This indicator represents the percentage

of fl ights completed from fl ights originally scheduled.

We continued to see our bag ratio improve by 3.3 per cent

for the full year of 2008 as compared to 2007. We were

pleased with this result, given our year-over-year increase

in segment guests.

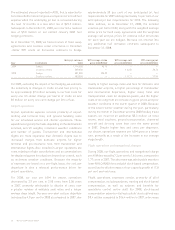

LIQUIDITY AND CAPITAL RESOURCES

The strength of our balance sheet is critical in withstanding

this period of economic downturn and uncertainty. Despite

the current unstable state of the fi nancial and credit

markets, we continue to execute our strategic plan. Our

cautious fi nancial management, substantial cash balance

and the continued generation of positive cash fl ows

signifi cantly mitigate the need to obtain external fi nancing

in the foreseeable future. Additionally, our positive liquidity

and leverage ratios refl ect our fi nancial health and stability.

As a result, we continue to persevere and grow despite

unprecedented volatility in fuel prices, unpredictable market

conditions, tightening credit markets and an overall

weakening economic outlook.

We realized signifi cant growth in our cash position in 2008,

completing the year with a healthy cash balance of $820.2

million compared to $653.6 million at December 31, 2007.

Part of this cash balance relates to cash collected with

respect to advance ticket sales, for which the balance at

December 31, 2008 was $251.4 million, as compared to

$194.9 million at December 31, 2007. Typically, we have

cash and cash equivalents on hand to have suffi cient

liquidity to meet our liabilities when due, under both

normal and stressed conditions. As at December 31, 2008,

we had cash on hand of 3.26 times (2007 – 3.35 times) the

advance ticket sales balance. Additionally, the increase in

our working capital ratio of 1.25 from 1.22 as at December

31, 2007, further demonstrates our fi nancial stability and

strong fi nancial position. As at and for the three and twelve

months ended December 31, 2008, we did not have any

investments in asset-backed commercial paper.

We monitor capital on a number of measures, including

adjusted debt-to-equity and adjusted net debt to Earnings

Before Interest, Taxes, Depreciation, Aircraft Rent and other

items (EBITDAR). Our adjusted debt-to-equity ratio was

1.78 at December 31, 2008, which included $645.4 million

in off-balance-sheet aircraft operating leases. This compared

favourably to our adjusted debt-to-equity ratio of 2.07

at December 31, 2007, attributable to the increase in net

earnings more than offsetting the addition of new aircraft

fi nancing during the year. As at December 31, 2008, our

adjusted net debt to EBITDAR ratio was 2.29, an improvement

of 8.8 per cent compared to 2.51 as at December 31,

2007, resulting primarily from increased cash and cash

equivalents more than offsetting the slight decrease in

EBITDAR. Both of these ratios met our internal targets for

December 31, 2008 and 2007 of an adjusted debt-to-equity

measure and an adjusted net debt to EBITDAR ratio of no

more than 3.00.