Westjet 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2008 Annual Report 37

following table as the lease agreement has not yet been

signed; however, if included, our future deliveries would be

121 aircraft by 2013.

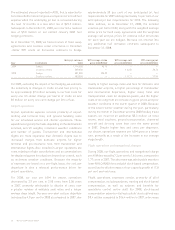

As at December 31, 2008, we had existing commitments to

take delivery of an additional 44 aircraft as summarized below:

delayed, and, based on our new fl eet schedule, we expect

delivery of nine leased aircraft in 2009.

On February 29, 2008, we signed a Letter of Intent to lease

an additional 737-800 aircraft scheduled for delivery in

2011. This has not been refl ected as a commitment in the

Series

600s 700s 800s Total fl eet

Leased Owned Total Leased Owned Total Leased Owned Total Leased Owned Total

Fleet at December 31, 2007 — 13

13 16 35

51 5 1

6 21 49

70

Fleet at December 31, 2008 — 13

13 18 38

56 6 1

7 24 52

76

Commitments:

2009 — —

— 6 —

6 3 —

3 9 —

9

2010 — —

— 5 2* 7 2 —

2 7 2

9

2011 — —

— 3 2* 5 — —

— 3 2

5

2012 — —

— 1 12* 13 — —

— 1 12

13

2013 — —

— — 8* 8 — —

— — 8

8

Total commitments — — — 15 24

39 5 —

5 20 24

44

Committed fl eet as of 2013 — 13 13 33 62

95 11 1

12 44 76

120

*We have an option to convert any of these future aircraft to 737-800s.

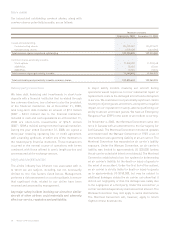

As at December 31, 2008, our total purchased aircraft

commitment, including amounts to be paid for live satellite

television systems on purchased and leased aircraft, was

$1,266.5 million (US $1,039.8 million). Additionally, our

commitment relating to aircraft operating leases was

$1,543.4 million (US $1,267.2 million) as at December

31, 2008, to be funded through our operating cash fl ow.

Amounts relating to the previously mentioned unsigned

lease have not been included in these commitments.

During the year ended December 31, 2008, we signed

a three-year revolving operating line of credit with a

syndicate of three Canadian banks. The line of credit is

available for up to a maximum of $85 million commencing

May 1, 2009, is subject to various customary conditions

precedent being satisfi ed, and will be secured by our new

Campus facility. The line of credit will bear interest at prime

plus 0.50 per cent per annum or a bankers acceptance rate

at 2.0 per cent annual stamping fee, and will be available

for general corporate expenses and working capital

purposes. We are required to pay a standby fee of 15 basis

points, based on the average unused portion of the line

of credit for the previous quarter, payable quarterly and

commencing on August 1, 2009. As at December 31, 2008,

no amounts were drawn on this facility.

Contingencies

We are party to certain legal proceedings that arise

during the ordinary course of business. It is the opinion of

management that the ultimate outcome of these matters

will not have a material effect upon our fi nancial position,

results of operations or cash fl ows.

Normal course issuer bid

On March 12, 2008, we fi led a notice with the Toronto Stock

Exchange (TSX) to make a normal course issuer bid to purchase

outstanding shares on the open market. As approved by the

TSX, we are authorized to purchase up to 2,500,000 shares

(representing approximately 1.9 per cent of our issued and

outstanding shares at the time of the bid) during the period

of March 17, 2008 to March 16, 2009, or until such earlier

time as the bid is completed or terminated at our option.

Any shares we purchase under this bid will be purchased

on the open market through the facilities of the TSX at

the prevailing market price at the time of the transaction.

Shares acquired under this bid will be cancelled.

During the year ended December 31, 2008, we purchased

2,005,084 shares under the bid for total consideration

of $29.4 million. The average book value of the shares

repurchased of $7.1 million was charged to share capital

with the $22.3 million excess of the market price over the

average book value charged to retained earnings.

During the year ended December 31, 2007, we purchased

1,263,500 shares under our previous normal course issuer

bid, which expired on February 27, 2008, for total consideration

of $21.3 million. The average book value for the shares

repurchased of $4.3 million was charged to share capital

with the $17.0 million excess of the market price over the

average book value charged to retained earnings.