Westjet 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2008 Annual Report 77

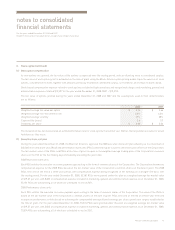

notes to consolidated

fi nancial statements

For the years ended December 31, 2008 and 2007

(Stated in thousands of Canadian dollars, except share and per share data)

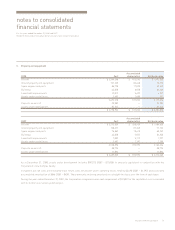

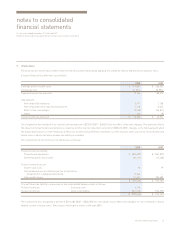

8. Share capital (continued)

(b) Issued and outstanding

As at December 31, 2008, the number of common voting shares outstanding was 124,291,677 (2007 – 122,884,662) and the number of variable

voting shares was 3,621,903 (2007 – 6,686,908).

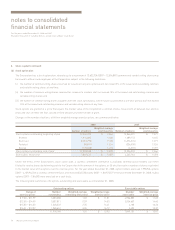

On March 12, 2008, the Corporation fi led a notice with the Toronto Stock Exchange (TSX) to make a normal course issuer bid to purchase

outstanding shares on the open market. As approved by the TSX, WestJet is authorized to purchase up to 2,500,000 shares (representing

approximately 1.9% of its issued and outstanding shares at the time of the bid) during the period of March 17, 2008 to March 16, 2009, or until

such earlier time as the bid is completed or terminated at the option of the Corporation. Any shares the Corporation purchases under this bid

will be purchased on the open market through the facilities of the TSX at the prevailing market price at the time of the transaction. Shares

acquired under this bid will be cancelled.

During the year ended December 31, 2008, the Corporation purchased 2,005,084 shares under the bid for total consideration of $29,420.

The average book value of the shares repurchased of $7,091 was charged to share capital with the $22,329 excess of the market price over the

average book value charged to retained earnings.

During the year ended December 31, 2007, the Corporation purchased 1,263,500 shares under its previous normal course issuer bid, which

expired on February 27, 2008, for total consideration of $21,250. The average book value for the shares repurchased of $4,271 was charged to

share capital with the $16,979 excess of the market price over the average book value charged to retained earnings.

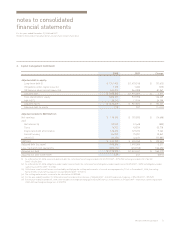

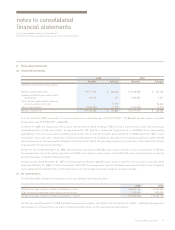

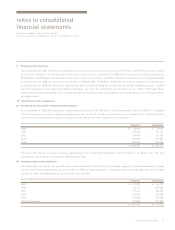

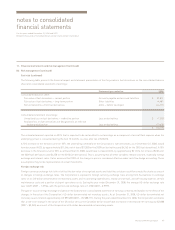

(c) Per share amounts

The following table summarizes the shares used in calculating net earnings per share:

2008 2007

Number Amount Number Amount

Common and variable voting shares:

Balance, beginning of year 129,571,570 $ 448,568 129,648,688 $ 431,248

Issuance of shares pursuant to stock

option plans 347,094 227 1,186,382 1,551

Stock-based compensation expense

on stock options exercised — 11,181 — 20,040

Shares repurchased (2,005,084) (7,091) (1,263,500) (4,271)

Balance, end of year 127,913,580 $ 452,885 129,571,570 $ 448,568

2008 2007

Weighted average number of shares outstanding – basic 128,690,146 129,709,329

Effect of dilutive employee stock options and unit plans 1,285,094 1,900,850

Weighted average number of shares outstanding – diluted 129,975,240 131,610,179

For the year ended December 31, 2008, 5,918,948 employee stock options, and 48,527 restricted share units, (2007 – 1,584,520 employee stock

options) were not included in the calculation of dilutive potential shares as the result would be anti-dilutive.