Westjet 2008 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2008 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 WestJet 2008 Annual Report

OVERVIEW

2008 was a very successful year for WestJet. In particular,

the fi rst half of the year produced very strong fi nancial

results, and the second half of the year was signifi cantly

impacted by unprecedented conditions in the fi nancial and

credit markets, and exceptionally high and volatile fuel

prices. Despite the unfavourable economic environment,

we continued to produce consistent and strong fi nancial

results, as evidenced by one of the best earnings before tax

(EBT) margins of any large North American airline, positive

cash fl ows from operations, a signifi cant cash position and

a healthy balance sheet. Amid the turmoil in the economy,

execution of our strategy was key as we added new

destinations and routes, and increased capacity and RPMs

while driving down our CASM, excluding fuel and employee

profi t share. Our code-sharing agreement with Southwest

Airlines, signed in 2008, is an important step forward in the

continued execution of our strategic plan to become one

of the top fi ve airlines in the world by 2016. Our dedicated

and enthusiastic WestJetters continued to deliver a

world-class guest experience, contributing to the success

of our airline.

2008 Highlights

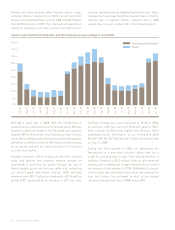

• Increased total revenues to $2,549.5 million, an increase

of 19.9 per cent over 2007.

• Recorded RASM of 14.88 cents, an increase of 1.8 per

cent over 2007, while growing capacity by 17.8 per cent

year over year.

•

Maintained strong cost controls by reducing CASM,

excluding fuel and employee profi t share, to 8.28 cents

from 8.55 cents in 2007, a decrease of 3.2 per cent.

• Recorded an EBT margin of 10.0 per cent in 2008, down

1.1 points from 2007.

• Realized net earnings of $178.1 million, a decrease of 7.6

per cent from 2007.

• Diluted earnings per share were $1.37, a decrease of 6.8

per cent compared to 2007.

• Adjusted for the reservation system impairment and

favourable income tax rate reduction in 2007, net earnings

decreased by 1.8 per cent to $178.1 million in 2008 from

$181.3 million in 2007, and diluted earnings per share

decreased to $1.37 from $1.39 in 2007, representing a

change of 1.4 per cent.

• Generated cash fl ows from operations of $460.6 million,

a decrease from $541.1 million in 2007.

Please refer to page 50 of this MD&A for a reconciliation

of the non-GAAP measures listed above, including CASM,

excluding fuel and employee profi t share, net earnings and

diluted earnings per share adjusted for the impact of the

reservation system impairment and favourable income

tax rate reduction in 2007, to the nearest measure under

Canadian GAAP.

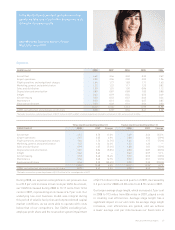

Our guests come fi rst. So it’s going to take a lot

more than the worst winter weather in 40 years to

stop from us from doing what’s right for them.

Kerry Leandre, Customer Service Shift Lead, Airports

WestJetter since 2002