Westjet 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2008 Annual Report 61

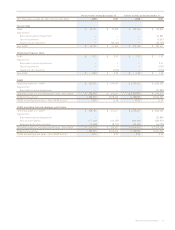

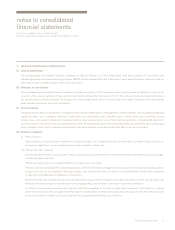

notes to consolidated

fi nancial statements

For the years ended December 31, 2008 and 2007

(Stated in thousands of Canadian dollars, except share and per share data)

1. Summary of signifi cant accounting policies

(a) Basis of presentation

The accompanying consolidated fi nancial statements of WestJet Airlines Ltd. (the Corporation) have been prepared in accordance with

Canadian generally accepted accounting principles (GAAP). Amounts presented in the Corporation’s consolidated fi nancial statements and the

notes thereto are in Canadian dollars unless otherwise stated.

(b) Principles of consolidation

The accompanying consolidated fi nancial statements include the accounts of the Corporation and its wholly owned subsidiaries, as well as the

accounts of fi ve special-purpose entities, which are utilized to facilitate the fi nancing of aircraft. The Corporation has no equity ownership in

the special-purpose entities; however, the Corporation is the primary benefi ciary of the special-purpose entities’ operations. All intercompany

balances and transactions have been eliminated.

(c) Use of estimates

The preparation of fi nancial statements in conformity with Canadian GAAP requires management to make estimates and assumptions regarding

signifi cant items such as amounts relating to depreciation and amortization, non-refundable guest credits, lease return conditions, future

income taxes, stock-based compensation expense, deferred sales and distribution costs, impairment assessments of property and equipment,

and the valuation of derivative fi nancial instruments that affect the amounts reported in the consolidated fi nancial statements and accompanying

notes. Changes in facts and circumstances may result in revised estimates, and actual results may differ from these estimates.

(d) Revenue recognition

(i) Guest revenues

Guest revenues, including the air component of vacation packages, are recognized when air transportation is provided. Tickets sold but not

yet used are reported in the consolidated balance sheet as advance ticket sales.

(ii) Charter and other revenues

Charter and other revenues include charter revenue, cargo revenue, net revenues from the sale of the land component of vacation packages,

ancillary revenues and other.

Charter and cargo revenue is recognized when air transportation is provided.

Revenue from the land component of vacation packages is generated from providing agency services equal to the amount paid by the guest for

products and services less payment to the travel supplier, and are reported at the net amounts received. Revenue from the land component

is deferred and recognized on completion of the vacation.

Ancillary revenues are recognized as the services and products are provided to the guests. Included in ancillary revenues are fees associated

with guest itinerary changes or cancellations, excess baggage fees, buy-on-board sales and pre-reserved seating fees.

Included in other revenue is revenue from expired credit fi les recognized at the time of expiry. Also included in other revenue is revenue

under the tri-branded credit card agreement that expired in 2008, where net retail sales revenue was recognized at the time the transaction

occurred and revenue related to account activations was recognized immediately upon activation.