Westjet 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 WestJet 2008 Annual Report

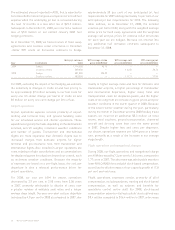

total operating costs for 2008, up from 28 per cent in 2007.

During the month of July 2008, jet fuel prices peaked at

approximately US $180 per barrel, setting an all-time

record high. The average market price for jet fuel was

US $125.02 per barrel in 2008 versus US $91.05 per barrel

in 2007, representing an increase of 37.3 per cent. On a

total dollar basis, fuel expense increased by $299.4 million

in 2008 over the prior year, of which approximately

$220 million related to the increase in jet fuel prices.

The increase in fuel prices increased our fuel cost per

ASM to 4.69 cents for 2008 compared to 3.46 cents in 2007,

representing a 35.5 per cent increase in our fuel cost per

ASM for 2008.

operations are allocated over an increasing number of miles

fl own. Likewise, longer-haul routes typically achieve higher

fuel economy, as we are able to absorb the higher costs of

fuel for take-offs and landings over a longer trip length.

We increased capacity to 17.1 billion ASMs during 2008, as

compared to 14.5 billion ASMs in 2007. The dilution of costs

over a greater number of available seat miles contributed

to the reduction of our CASM, excluding fuel and employee

profi t share, during the year.

Aircraft fuel

Fuel prices continued to negatively impact our CASM

during 2008, representing approximately 36 per cent of

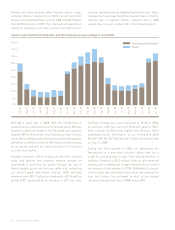

Average market price of jet fuel

180

160

140

120

100

80

60

40

2007 Q4 2008 Q1 2008 Q2 2008 Q3 2008 Q4

$ per barrel

WTI (USD)

Jet (USD)

Jet (CAD)

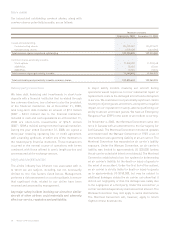

Sure, high fuel costs have been tough on everyone.

But to us it’s just another reason to stay true to how

we run our business – calm and steady.

Frederick Arends, Aircraft Material Coordinator

Maintenance

WestJetter since 2003

During the year ended December 31, 2008, we began a more

extensive fuel hedging program under a revised policy as

approved by our Board of Directors. Our current objective

is to hedge a portion of our anticipated jet fuel purchases

in order to provide management with reasonable foresight

and predictability into operations and future cash fl ows.

As jet fuel is not traded on an organized futures exchange,

there are limited opportunities to hedge directly in jet fuel;

however, fi nancial derivatives in other commodities, such

as crude oil and heating oil, are useful in decreasing the

risk of volatile fuel prices.

Upon proper qualifi cation, we account for our fuel derivatives

as cash fl ow hedges. Under cash fl ow hedge accounting,

the effective portion of the change in fair value of the

hedging instrument is recognized in accumulated other

comprehensive loss (AOCL), while the ineffective portion

is recognized in non-operating income (expense). Upon

maturity, the effective gains or losses previously recognized