Westjet 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 WestJet 2008 Annual Report

aircraft deliveries, partially offset by $13.8 million received

on the sale of two engines.

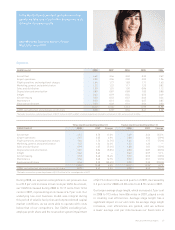

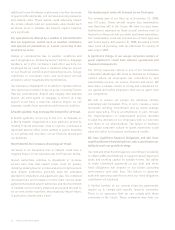

Contractual obligations and commitments

Our contractual obligations for each of the next fi ve years,

which do not include commitments for goods and services

required in the ordinary course of business, are indicated

in the table below:

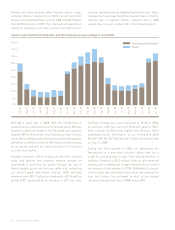

Investing cash fl ow

Cash used in investing activities for 2008 totalled $199.7

million compared to $200.3 million in 2007. During 2008,

our investing activities consisted of $114.5 million in aircraft

additions, largely related to expenditures for three new

purchased aircraft, as well as $68.9 million in spending

towards our new offi ce space adjacent to the Calgary

hangar, known as the Campus. In 2007, we added four new

aircraft and paid Boeing deposits towards 23 future owned

It’s defi nitely rewarding offering unique vacations

experiences to our guests. It’s also pretty amazing

to feel like I am contributing to our bottom line.

Kristi Sheldan, Sales Agent, WestJet Vacations

WestJetter since 2005

($ in thousands) Total 2009 2010 2011 2012 2013 Thereafter

Long-term debt repayments $ 1,351,903 $ 165,721 $ 165,034 $ 177,557 $ 163,279 $ 162,740 $ 517,572

Capital lease obligations(1) 1,179 444 698 37 — — —

Operating leases and commitments(2) 1,736,950 165,777 201,458 220,324 226,104 212,758 710,529

Purchase obligations(3) 1,266,452 62,019 131,144 151,542 561,555 360,192 —

Total contractual obligations $ 4,356,484 $ 393,961 $ 498,334 $ 549,460 $ 950,938 $ 735,690 $ 1,228,101

(1) Includes weighted average imputed interest at 5.29 per cent totaling $71.

(2) Included in operating leases are US-dollar operating leases primarily related to aircraft. The obligations of these operating leases in US dollars are: 2009 – $121,909;

2010 – $156,114; 2011 – $175,610; 2012 – $181,594; 2013 – $171,008; 2014 and thereafter $547,870.

(3) Relates to purchases of aircraft, live satellite television systems and winglets. These purchase obligations in US dollars are: 2009 – $50,919; 2010 – $107,672;

2011 – $124,419; 2012 – $461,047; 2013 – $295,724.

On December 19, 2008, we signed an agreement with Sabre

Airline Solutions Inc.

® (Sabre) to provide us with a license

to access and use its reservation system SabreSonic®

. The

term of the agreement will continue for a period of fi ve

years. The minimum contract amounts associated with the

reservation system have been included in the above totals.

We currently have 24 aircraft under operating leases.

We have entered into agreements with independent third

parties to lease 15 additional 737-700 aircraft and fi ve

737-800 aircraft over eight- and 10-year terms in US

dollars, to be delivered throughout 2009 to 2012. Although

the current obligations related to our aircraft operating

lease agreements are not recognized on our balance sheet,

we include these commitments in assessing our overall

leverage through our adjusted debt-to-equity and net debt

to EBITDAR ratios.

Capital resources

During 2008, we took delivery of two leased 737-700s, three

owned 737-700s and one leased 737-800, increasing our

total registered fl eet to 76 aircraft with an average age

of 4.0 years. Additionally, we signed an agreement with

Boeing in the second quarter of 2008 to purchase four new

aircraft, bringing our total committed fl eet to 120 by 2013.

On September 6, 2008, Boeing’s largest labour union, the

International Association of Machinists and Aerospace

Workers (IAM), went on strike. The IAM ratifi ed a new

four-year labour contract with Boeing on November 2, 2008.

Based on previous disclosure, we expected one aircraft to

be delivered in the fourth quarter of 2008 and 10 aircraft

to be delivered throughout 2009. Because of the Boeing

strike, delivery dates for several of our future aircraft were